Need help choosing?

Speak to a QuickBooks expert to find the right product for your business

Talk to sales: 0808 304 6205

9.00am - 5.30pm Monday - Friday

Get product support

Contact support Visit support pageAutomatic, hassle free

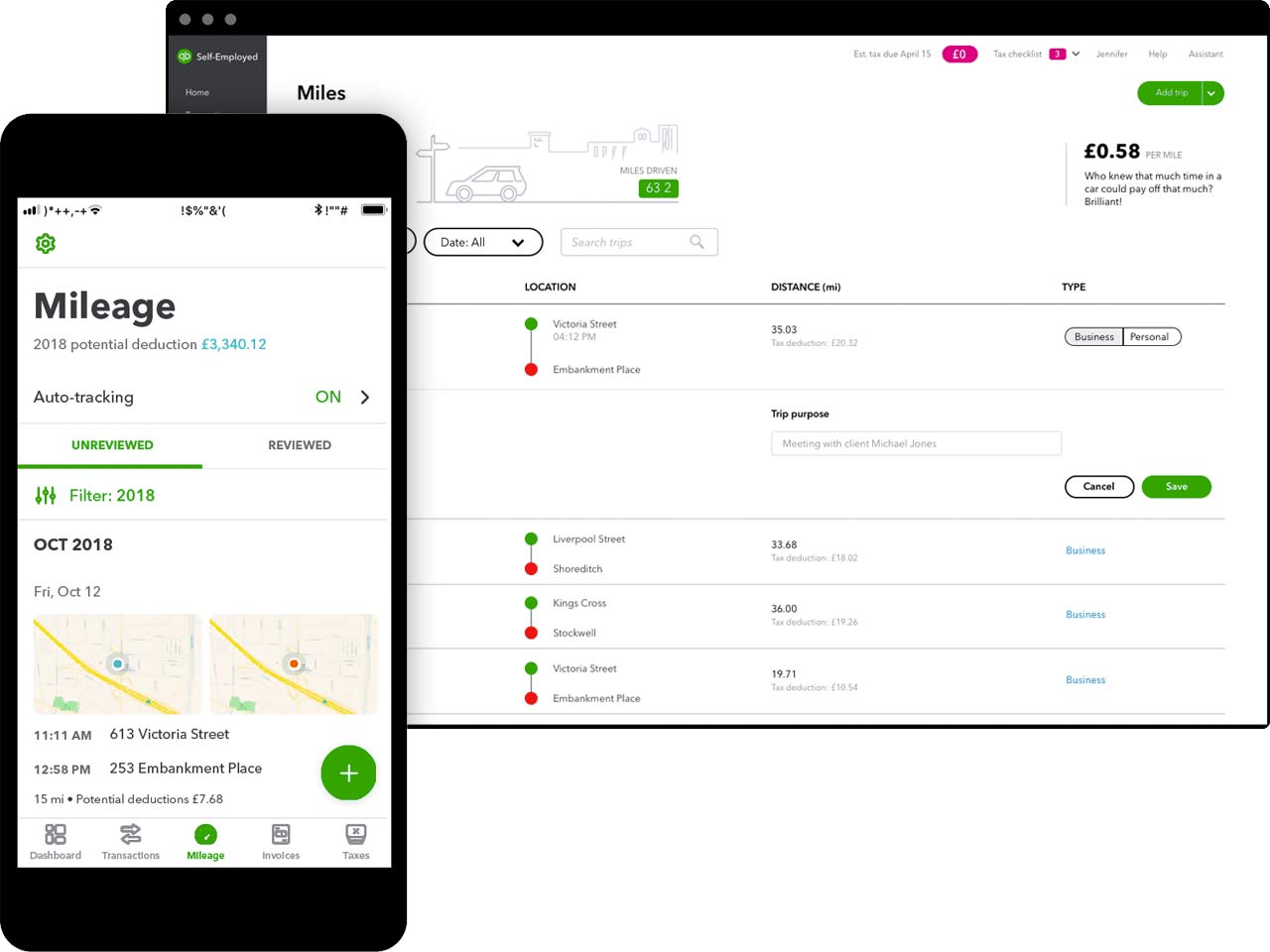

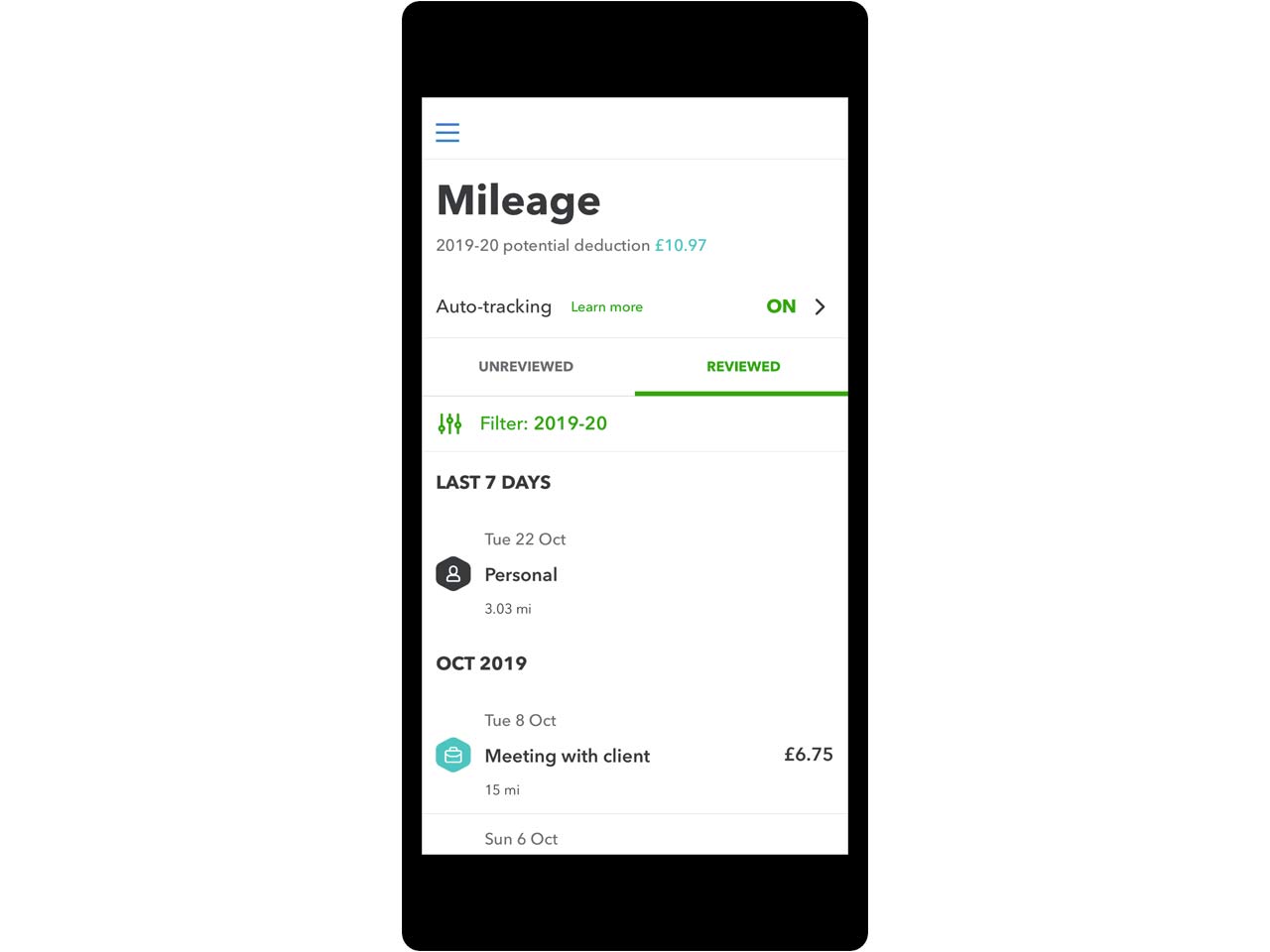

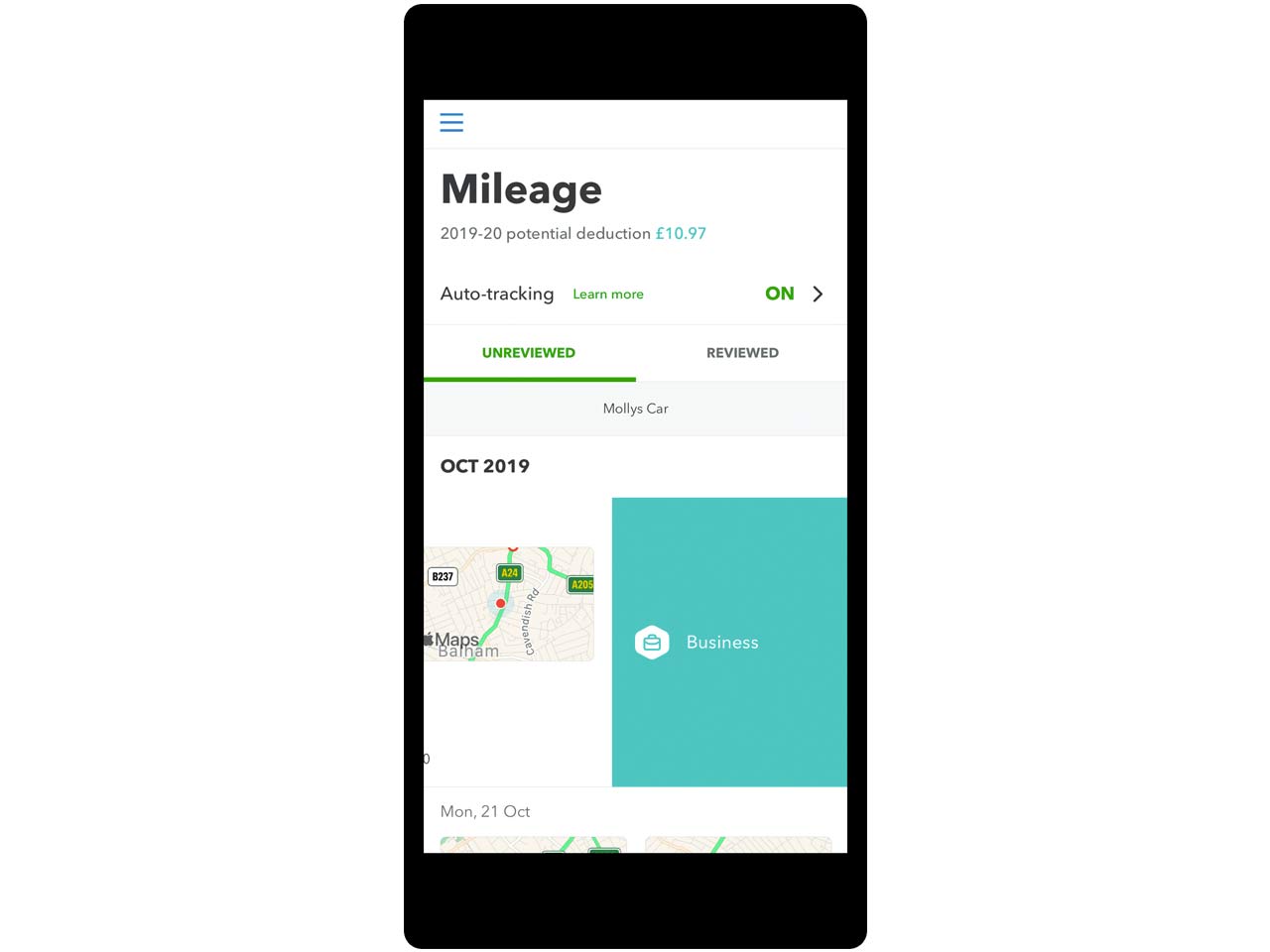

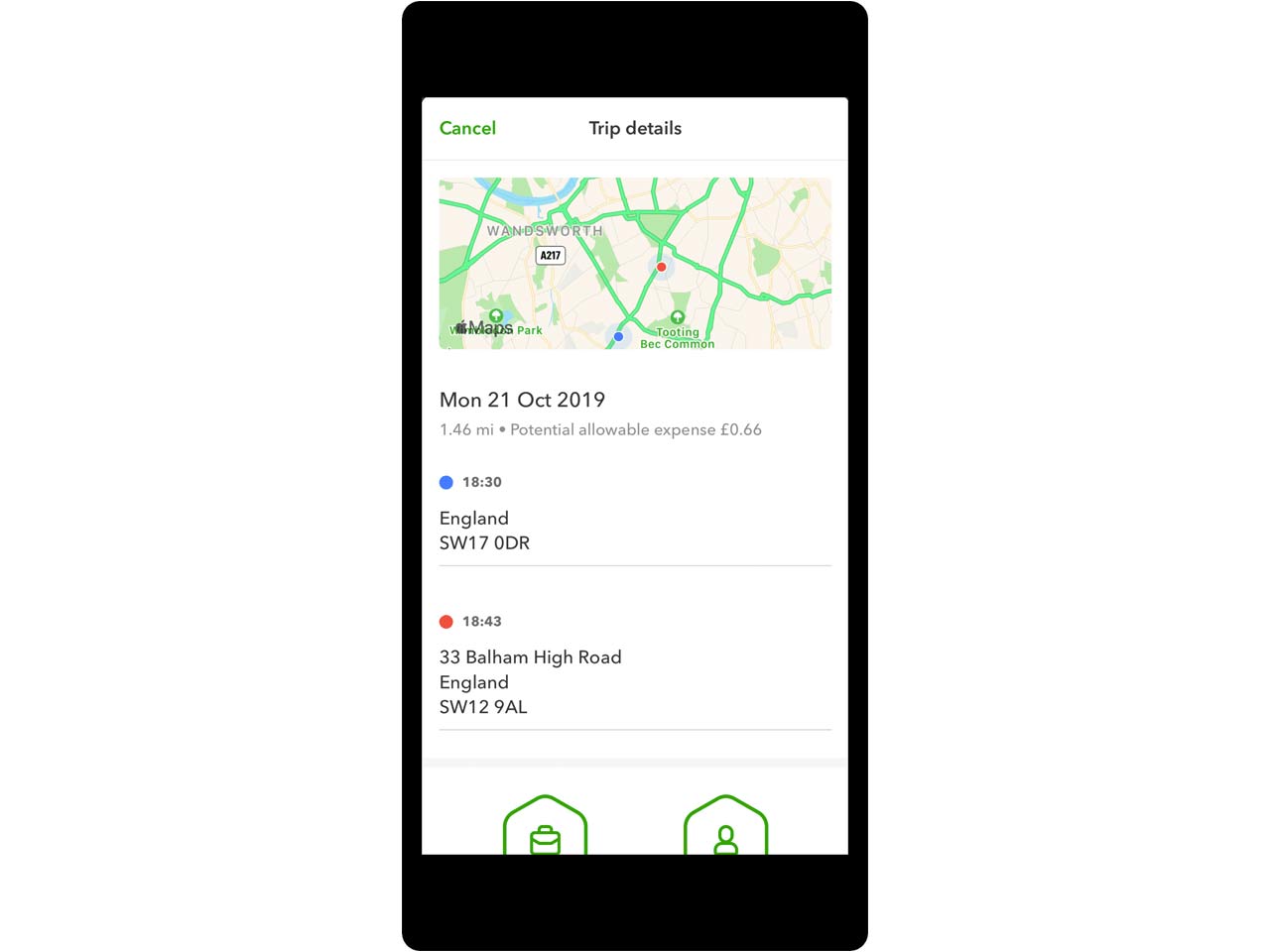

Just drive. QuickBooks does the rest. Every mile is logged using your phone’s location, so adding business trips to your other expenses is effortless.

Accurate deductions that put money in your pocket

Automatic tracking means your mileage is accurate and your deductions are maximised.

"I like that you can attach receipts. It takes the guessing out of taxes if you keep track with expenses."

QuickBooks Self-Employed - Google Play Review

Stay on track with all your expenses in one place

Always be ready for tax time. See how much mileage you can claim, without crunching the numbers, then run mileage log report for tracking, submitting to HMRC or sharing with your accountant.

"Before QuickBooks I dreaded the accounting side of my business. Now I can get everything done in minutes and spend time doing what I love."

Tammy Courtney - AccountAble Books

Let the QuickBooks app do the maths

With QuickBooks I love knowing what's happening financially with my business on a day-to-day basis, leaving me in complete control and able to focus on future growth.

"Works a treat across all my devices, keeps my accounts up to date and all invoices issued in a timely manner."

Sarah Riley - Inspired Courses and Inspired Camping

Frequently asked questions

Stay informed and inspired

Subscribe to get our latest insights, promotions, and product releases straight to your inbox.