How to prepare BAS

Learn how to prepare and lodge your Business Activity Statement (BAS) and Instalment Activity Statement (IAS) in QuickBooks online.

Before you start:

We recommend that you perform pre-BAS checks before beginning any lodgements to ensure data accuracy.

Benefits include

Cutting out the stress

by auto tracking GST and calculating your obligations when preparing your activity statement.

Reviewing your BAS summary

and getting updates to any changes that need to be carried across to your next submission.

Preparing and e-lodging your BAS

directly from QuickBooks Online.

Step-by-step guide

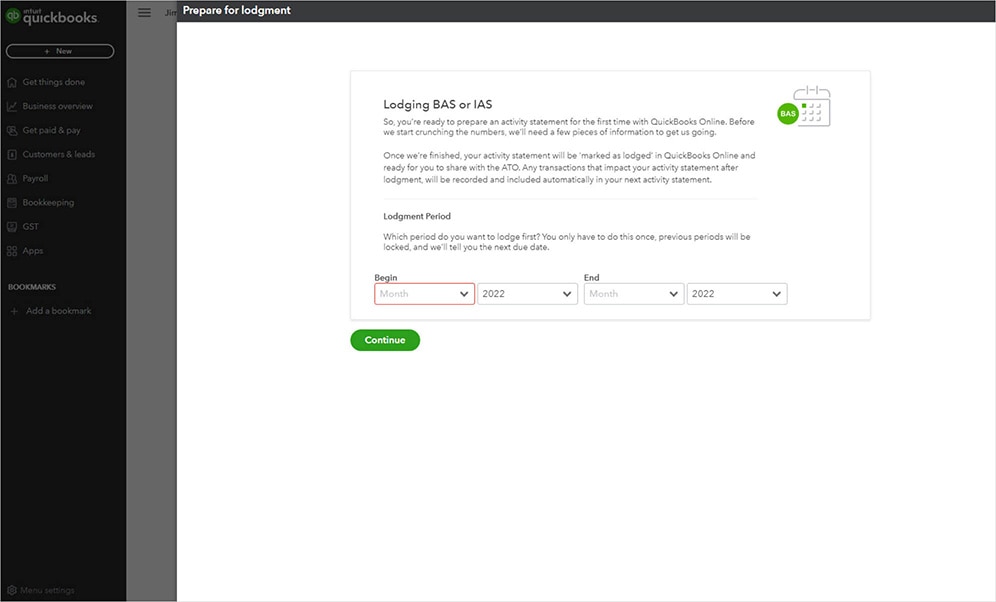

Step 1

- Finalise your reconciliation for the period that you are attempting to lodge.

- Go to GST and select Prepare BAS. If this is the first BAS to be lodged for this company in QuickBooks, select Get Started and enter the dates for your first period.

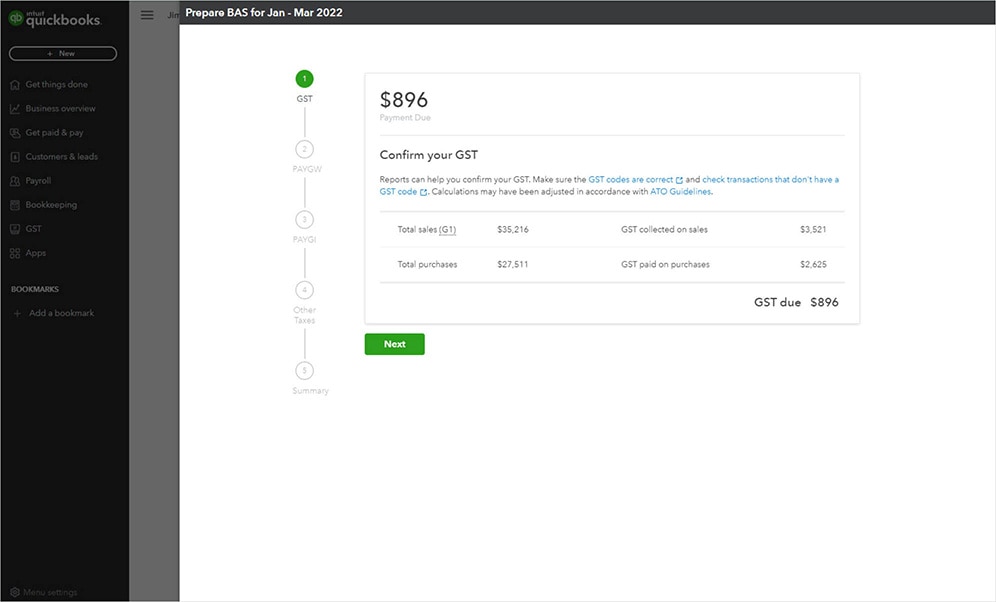

Step 2

You will see here that QuickBooks will display the below:

- Total sales (including GST)

- Total purchases

- GST collected on sales

- GST paid on purchases based on transactions in QuickBooks

Check your profit and loss reports, transactions by tax code reports, and review transactions that don’t have GST codes. If something doesn’t look right, check for discrepancies, learn how here.

If all looks well, select Next.

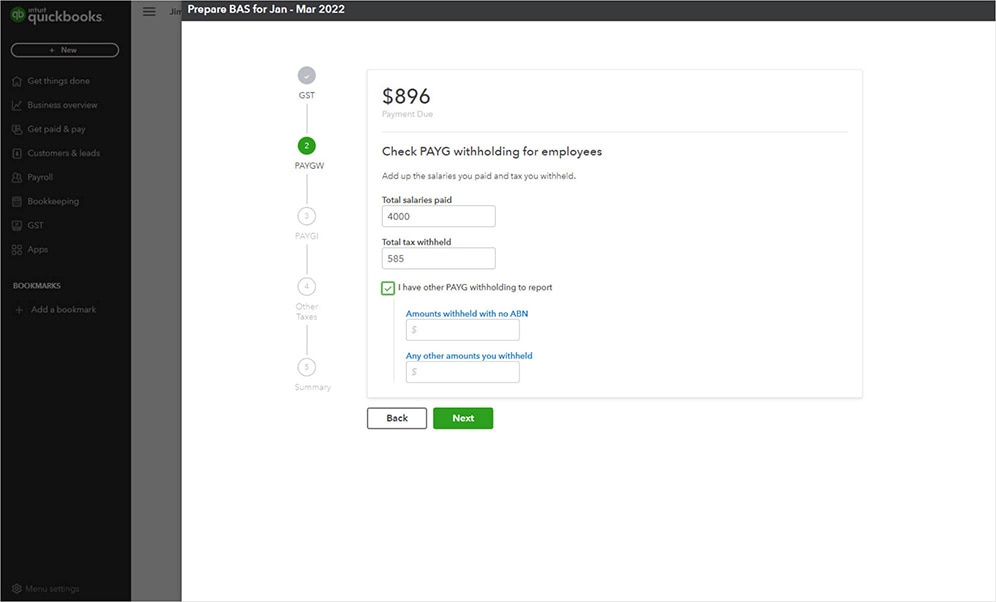

Step 3

- If you've enabled PAYG Withholding, review your total salaries paid and total tax withheld figures and select next.

- If you've enabled PAYG Instalments, enter your Income Tax instalment amount and select next.

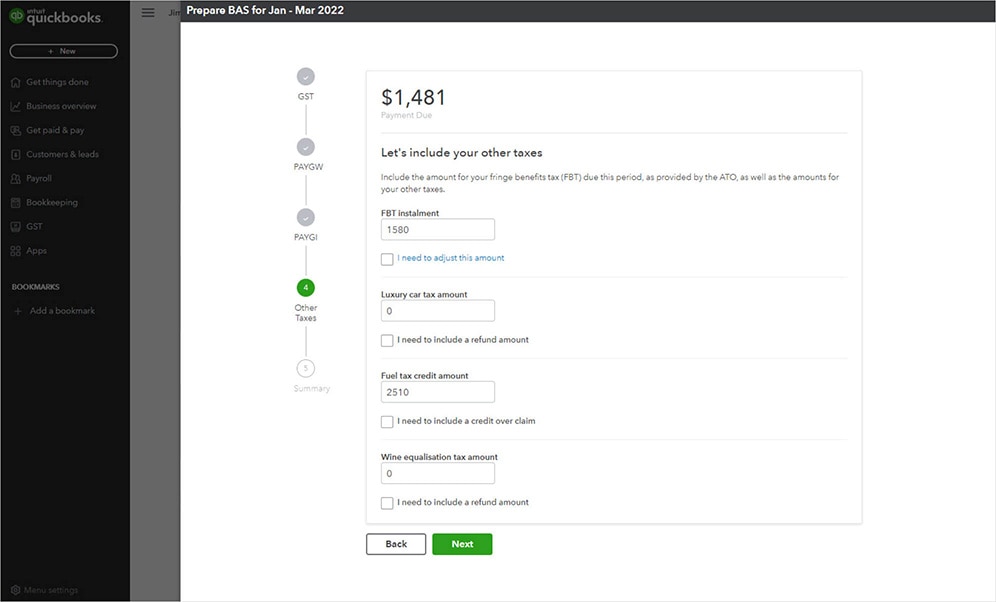

Step 4

- If you've enabled fringe benefits tax (FBT), luxury car tax, fuel tax credits or wine equalisation tax in QuickBooks, enter the amount due, then select Next.

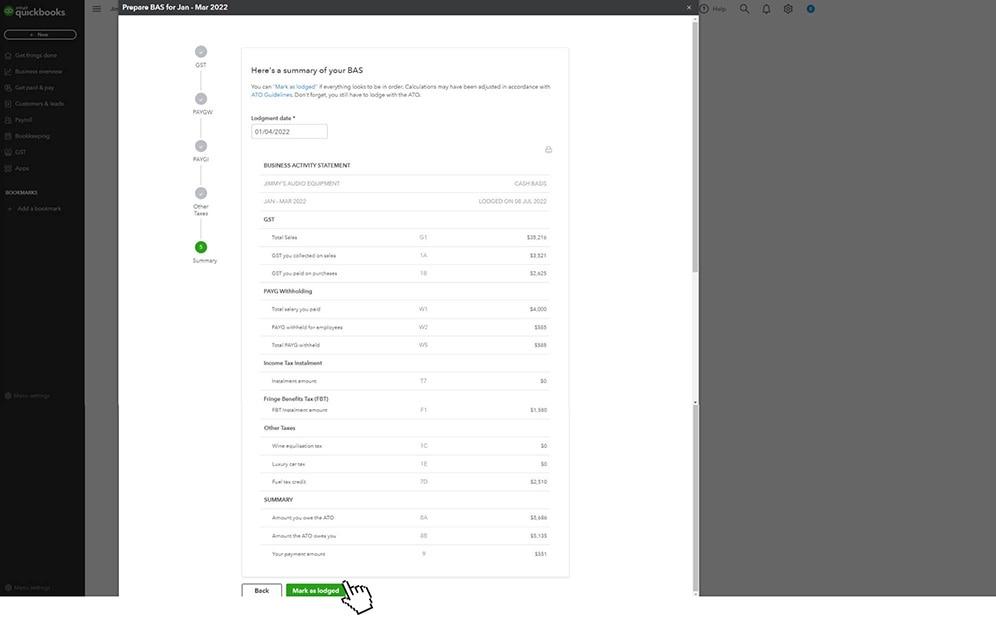

Step 5

- After reviewing the complete activity statement, select Mark as lodged to close the tax period in QuickBooks.

- Once you’ve marked this as lodged, you can lodge your BAS electronically from QuickBooks, or if you prefer you can do this directly with the ATO.

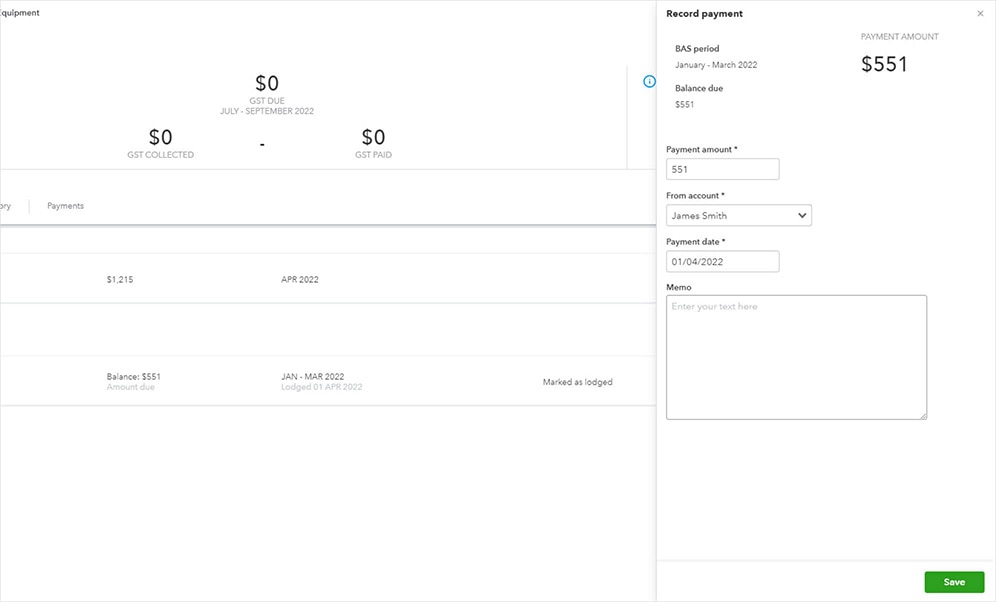

Step 6

- Once you've made the payment to the ATO, record this in QuickBooks. You can follow the steps in this article: Recording a GST payment (BAS Payment).

- If you've received a refund from the ATO, here's how to record it: Recording a GST refund.