Monday - Friday, 8:30 AM to 6:30 PM AEST

Join over

7 million

QuickBooks customers

Worldwide

Capterra

GetApp

Join over

7 million

QuickBooks customers

Worldwide

Google Play

App Store

Build the right plan for your business

Save an average of 29 hours per month using QuickBooks*

Smart features that help you save time

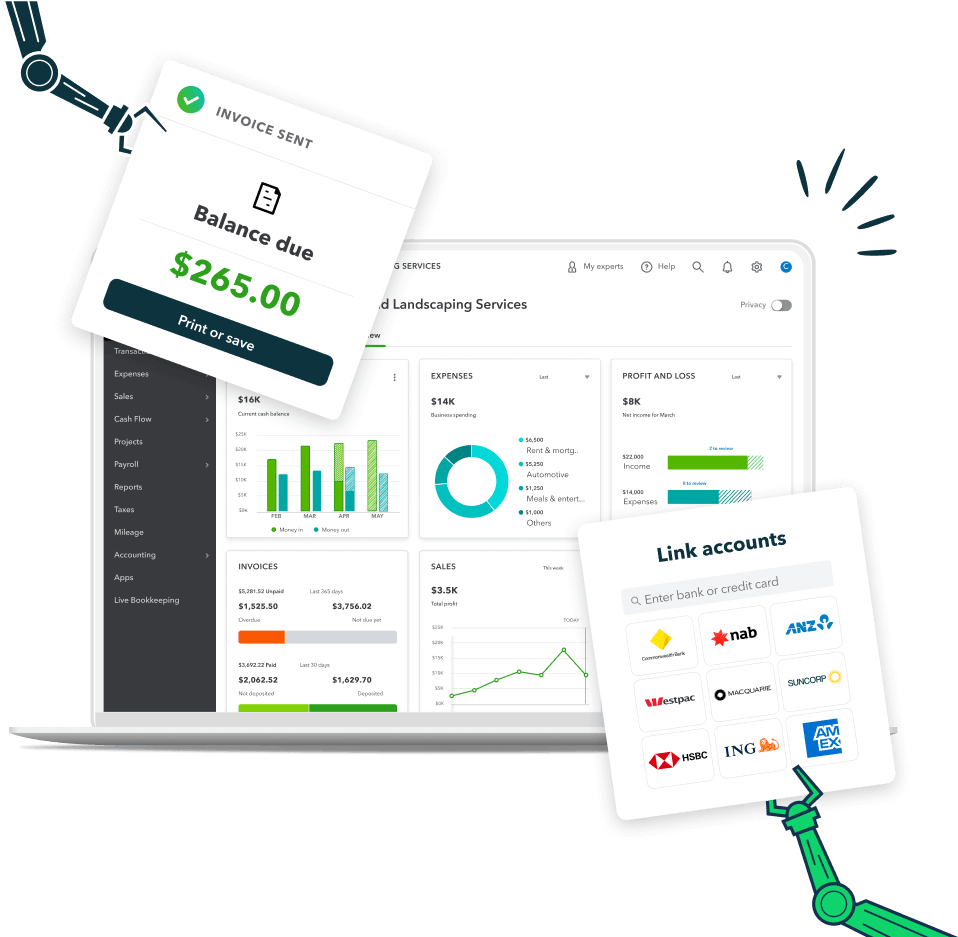

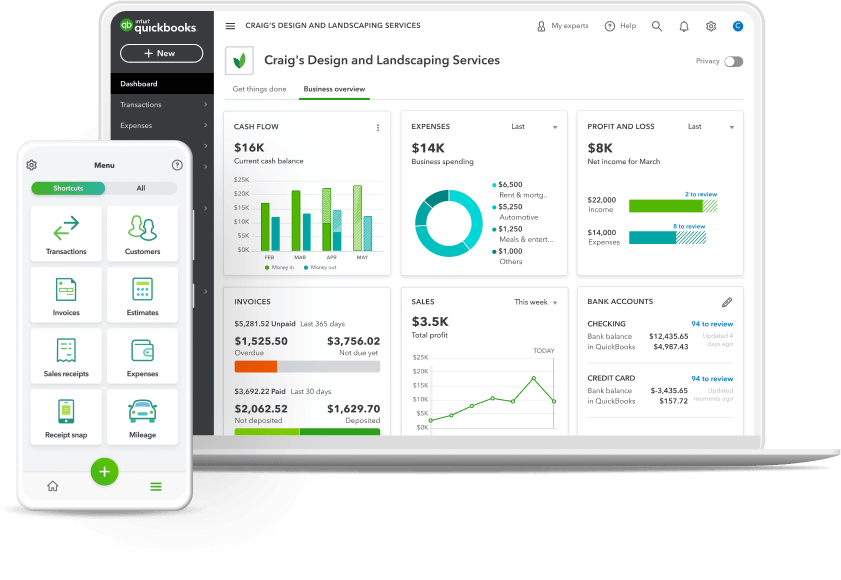

Whether you’re a small business owner or a self-employed sole trader, QuickBooks accounting software provides a complete view of how your business is performing in real-time, right from your dashboard.

Get paid 2x faster with automated invoices

Send custom invoices automatically with built-in payments and tracking. Schedule recurring invoices

and send personalised reminders. We’ll save the date for you.

Auto-track income and expenses

Connect your bank to track your business income and expenses automatically. Say goodbye to manual

data entry with smart automations.

GST & BAS tracking

Easily track the GST you pay and charge. Prepare and submit your BAS knowing exactly what you owe

and when

to pay it.

Painless payroll

Keep your payroll on time and compliant. Manage Single Touch Payroll, super and all other ATO

obligations in

one place.

Reports and insights

Generate fast and easy reports for valuable insights and better business decisions.

Cash Flow Confidence

Get custom cash flow tips and real-time balances from connected bank and credit

card

accounts.

Switch from your old accounting solution with ease.

Moving to QuickBooks Online is simple. Switch from Xero, Excel, MYOB or Reckon Desktop to QuickBooks Online. QuickBooks offers a free switching service on most plans so you can bring your data over today.

Customer success stories

Customer success stories

“QuickBooks helps a lot. It doesn’t matter where I am, I can keep an eye on what’s going on. We’ve integrated it with the ATO, which makes my life so much easier. It gives me so much confidence that now when I am overseas I can actually take time to rest”

Gabriela Da Silva Andrade, Lionfish Collective (Narrabeen)