Smart job tracking and scheduling software

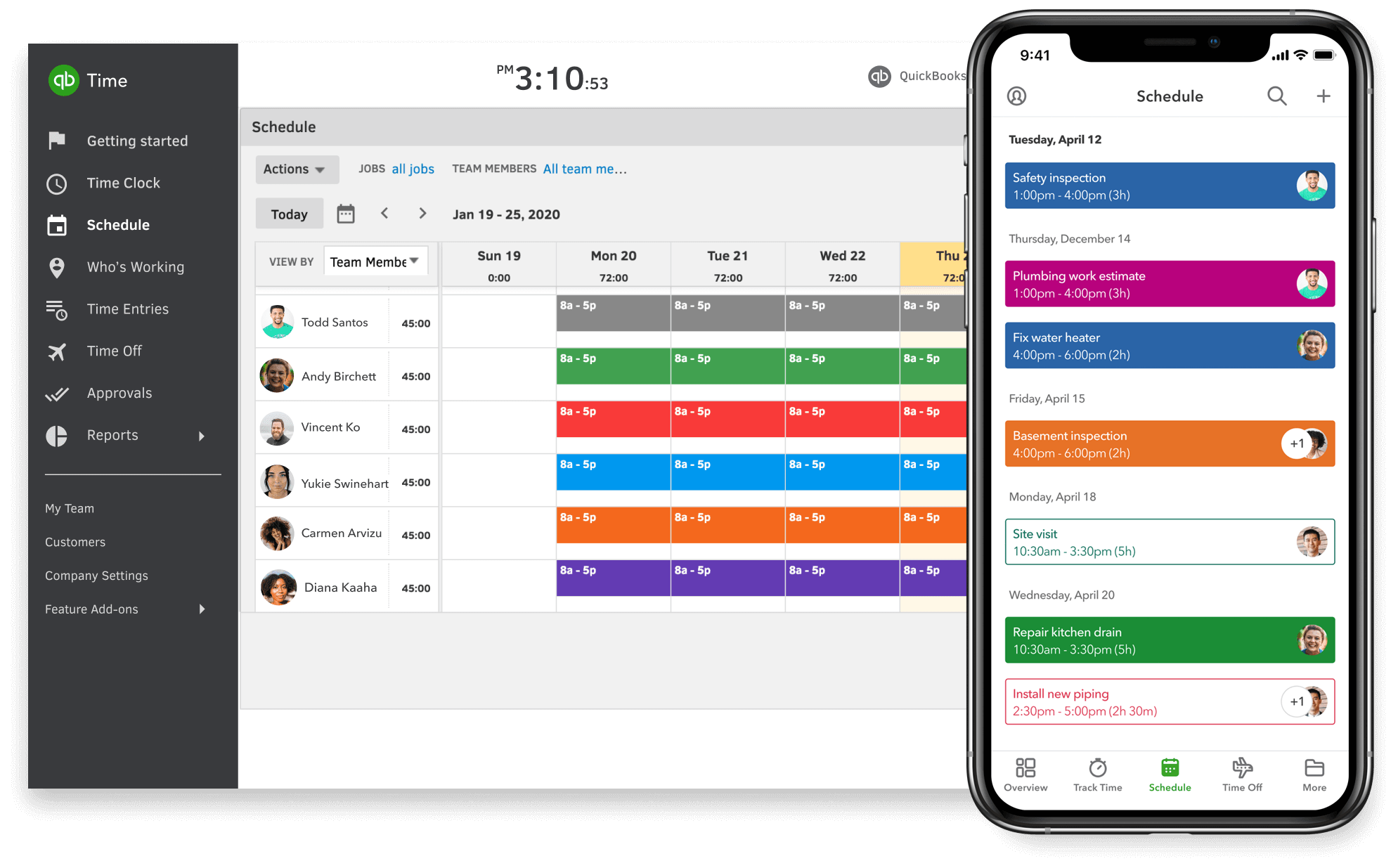

Schedule by shift

With our time tracking and rostering software, quickly build shifts and share with your whole team in minutes. It only takes a few simple details to set up, assign and launch a new shift.

- Create or modify schedules.

- Add, edit, or delete scheduled shifts from your phone, using QuickBooks Workforce, the QuickBooks Time mobile app.

- Alert employees of new schedules and shift changes.

- Copy, edit and repeat a previous week’s schedule.

Schedule by job

Our time tracking software for small businesses allows you to reduce the time it takes to create rosters down to a few minutes. Just choose the day, time and client, and assign your employees. Find unassigned jobs and easily repeat last week’s job schedule with just one click.

- Drag and drop into open employee time slots.

- Save time by creating jobs to assign later.

- The Who’s Working window shows who’s available.

- Alert employees of new schedules and job changes.

- Reports can help with job costing.

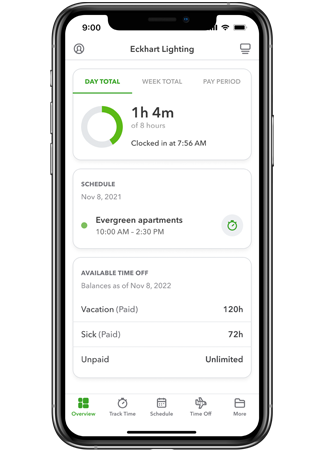

Manage remotely

When you need to manage rosters, know your team is receiving new shift changes and job assignments, QuickBooks Workforce, the QuickBooks Time mobile app can help.

- Alert employees when schedules change.

- Push out new schedules to your employees’ phones.

- Make changes on the fly—wherever you are.

- Stay ahead of the game when urgent jobs come your way.

QuickBooks Time Plans and Pricing

QuickBooks Time Plans and Pricing

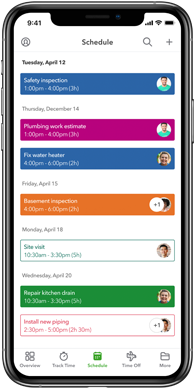

How to schedule jobs with QuickBooks Time

- Sign up for a free 30-day free trial.

- Invite your team to QuickBooks Workforce, the mobile app for QuickBooks Time.

- Go to Schedule. Select a calendar cell, select Add and Add Shift.

- Choose start and end times.

- Enter a shift title, select a job or customer, and add notes.

- Enter a location, or select one from the dropdown.

- Add team members.

- Save the job shift as a draft or publish it.