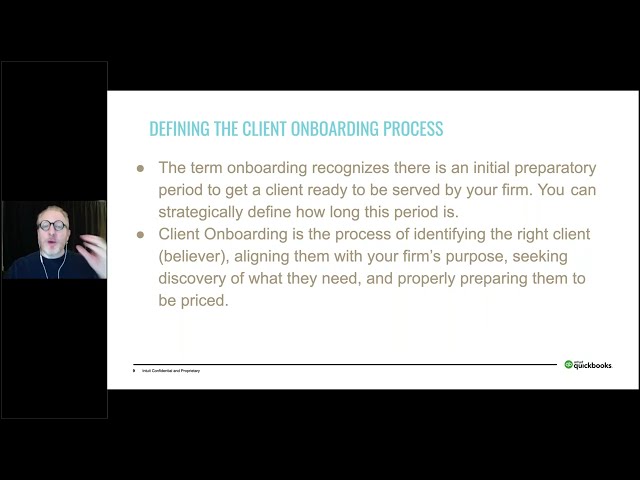

The onboarding process is a client’s first chance to get to know your business properly. First impressions matter, so the onboarding process is critical. Being onboarded with a standardised process from start to finish helps to build your clients’ confidence in your business, saves time and keeps things moving. For the purposes of this article, onboarding is defined as the process of bringing a new client on board, incorporating training and orientation.

When introducing your accounting and bookkeeping clients to QuickBooks Online it is important to have an effective onboarding process from start to finish. Follow these steps in our client onboarding checklist: