The accounting cycle

The accounting cycle has four steps:

1. Gather source documents: Transactions come from source documents like receipts and invoices. Each accounting document is used to post a journal entry.

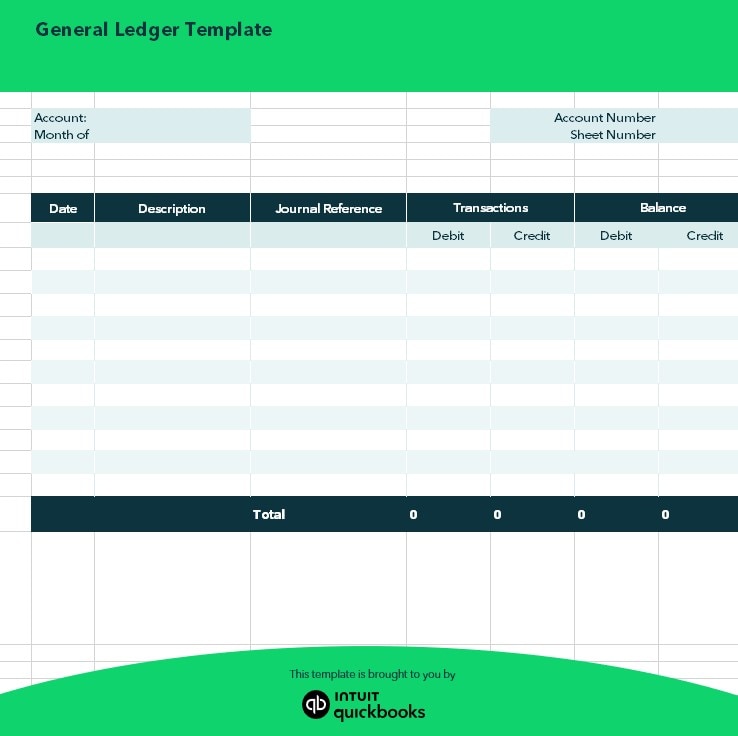

2. Post journal entries: A journal entry includes an account number, a date, a dollar amount, and a description of the entry. In some cases, accountants post information to control accounts and then transfer the data into a journal entry.

3. Record entries in the general ledger: The journal entries post to the general ledger. While some small businesses use Excel, accounting software — especially cloud-based software — is a more efficient way to maintain general ledger accounting records.

4. Generate financial reports: To produce the financial statements, an accountant generates a trial balance that lists each account and the current balance. You can use an adjusted trial balance to generate financial reports.

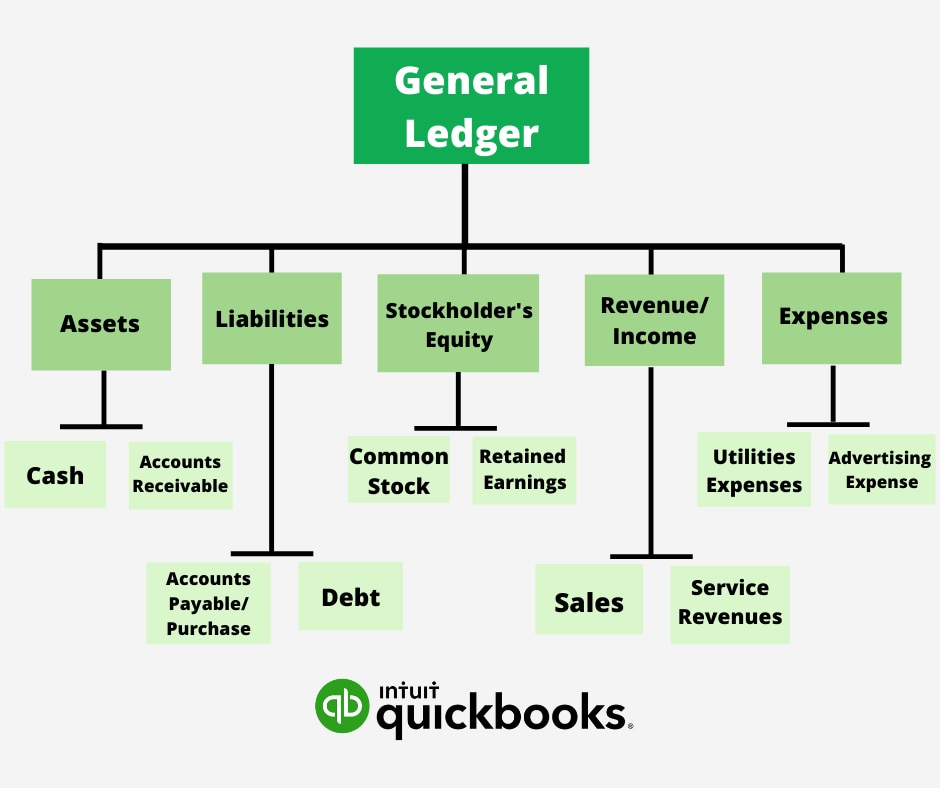

In financial accounting, a company’s main accounting record is its general ledger. Although there are tools that automatically categorise these transactions, like bank integrations, it’s still important to know the basic components of general ledger accounts. Knowing these components means you can spot potential issues in your financial data.