Accounts receivable turnover ratio - what it is and how to calculate it

No small business can survive unless it can maintain a sufficient cash flow to cover the operations costs, and the turnover ratio measures how quickly a firm collects cash from credit sales of products and services. The higher the ratio, the better it is for the business. The ratio is defined as:

Net credit sales average accounts receivable

Net credit sales means that all returned items are removed from the sales total. An average accounts receivable is the (beginning balance + ending balance)/2. The period of time can be a month or a financial year.

The goal is to increase the numerator (credit sales), while minimising the denominator (accounts receivable). In an ideal situation, a business can increase credit sales to customers who pay faster, on average. As the ratio gets larger, the firm collects more cash over time.

A good turnover ratio depends on your industry. For example, a grocery store or restaurant serves customers who pay by debit card or credit card immediately. Businesses that sell “big-ticket items”, such as airplanes, may not receive payment for months. To assess your performance, it is important to compare your turnover ratio to other firms in your industry.

The accounts receivable ageing schedule separates receivable balances based on when the invoice was issued.

What is an accounts receivable ageing schedule?

This report groups your accounts receivable balances based on the age of each invoice. A typical ageing schedule will group outstanding invoices based on 0 to 30 days, 30 to 60 days, etc. The goal is to minimise the amount of receivables that are old, particularly those invoices that are over 60 days old.

Your ageing schedule also depends on your industry. Firms that are typically paid over a period of months will have a larger amount of receivables in the 60-day category. This is another report that should be compared to industry averages.

You can use a number of strategies to increase cash collections and reduce your receivable balance.

Tips for improving accounts receivable

Create a formal, written policy for collections, and enforce the policy.

For example, you may email every customer when an invoice is later than 30 days, and call each client when an invoice is over 60 days old. If you enforce a policy, people will either start to pay you on time, or stop doing business with you (which may be fine, if they always pay late). Some firms charge late fees after a specific due date, and include the terms of the fee on each invoice.

You may have some uncomfortable conversations, but it’s better to have them sooner than later. If you’re diligent in the collection process, you can avoid hiring a collection agency or an attorney to pursue collections on your behalf.

Offer your clients a discount (1% to 2%), if they pay within 10 days. You’ll lose some revenue with these payment terms, but you’ll collect some cash faster.

Automate the invoicing process. Using automation will reduce the risk of errors, and recurring invoices can be processed in far less time. Emailing invoices, and providing an online payment option, encourages customers to pay immediately, which speeds up the cash collections. Best of all, invoice automation makes the buying process easier, and improves the customer’s experience with your company.

Accounts receivable balances that will not be collected in cash should be reclassified to bad debt expense.

Managing bad debt

The easiest way to handle bad debts is to use the direct write-off method. When you know that a bill will not be paid, you reclassify the receivable balance to bad debt expense.

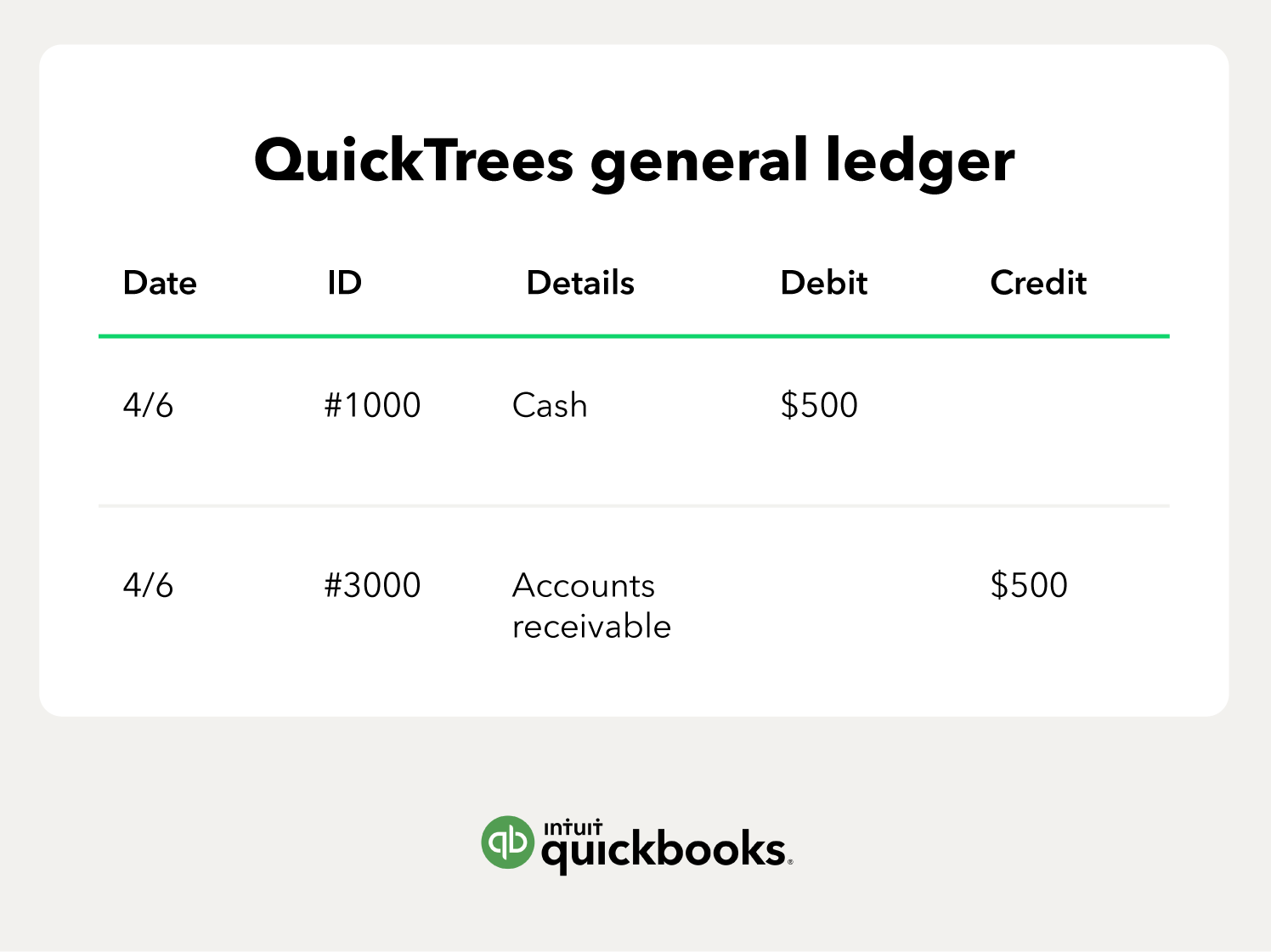

Let’s assume that your tree service company has a $2,000 balance owed by Jones Manufacturing. On April 30th, you find out that Jones has declared bankruptcy, and that your invoice will not be paid. You post this entry:

April 30th

Debit #6500 bad debt expense $2,000 (increase)

Credit #3000 accounts receivable $2,000 (increase)

(To recognise bad debt expense)

The allowance for doubtful accounts is a more complex method used to post bad debt expenses. Keep the process simple and use the direct write-off method.

The final step to managing accounts receivable is to write everything down.

Document your process

Every business should maintain a written procedures manual for the accounting system, and the manual should include specific procedures for managing accounts receivable. A procedures manual ensures that routine tasks are completed in the same manner each time, and the manual allows your staff to train new workers effectively and effortlessly.

Use a documented process to monitor accounts receivable, and to increase cash collections, so you can operate your business with confidence.