Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi,

So I have a liability account, that has a Bounce Back Loan in it.

Lets say for £10,000.

It's Negative £10,000. That's correct. Fine.

So I sync my bank transactions and apply the payment to that account. That's fine.

But my interest has started coming off as well, it comes off the Bounce Bank Loan account and adds onto the balance.

How do I reflect these interest payments in the BBL account and apply them to a expense P&L?

Solved! Go to Solution.

Thanks for your prompt reply, @email4.

I'll share some other ways to reflect those interest payments as expenses in your BBL account.

You'll want to manually add an expense transaction to your BBL account to show the interest payments as an expense. I'll show you how.

You can also check this link for more details about the process: Manually add transactions to accounts in QuickBooks Online.

Moreover, I still encourage you to check with your accountant or visit our ProAdvisor page to look for one from there. This way, you'll be guided accordingly in recording this. They can also provide you on other ways to record this.

Once you're all set, feel free to check out this article for reference. This can walk you through the process of flawlessly matching your book and bank accounts: Reconcile an account in QuickBooks Online.

I'll be here if you have any additional questions about recording your expenses in QBO. Keep safe!

I'll share insight on your query about a bounce-back loan repayment along with its interest, @email4.

You can create a cheque or an expense transaction to record the payment for this type of loan. To include interest payments, add them as another line item. Assign a specific expense account for these interest payments so you can have them show up in the Profit and Loss report.

Please be advised that it's best to consult an accountant for this matter. They can guide you with what accounts to use, so you can keep your books accurate.

Let me know in the comments below if you have other questions about bounce-back loans in QuickBooks Online. I'll be around to help you out. Have a pleasant day!

This does not help.

I need to add this into the BBL account and show it as an expense

Thanks for your prompt reply, @email4.

I'll share some other ways to reflect those interest payments as expenses in your BBL account.

You'll want to manually add an expense transaction to your BBL account to show the interest payments as an expense. I'll show you how.

You can also check this link for more details about the process: Manually add transactions to accounts in QuickBooks Online.

Moreover, I still encourage you to check with your accountant or visit our ProAdvisor page to look for one from there. This way, you'll be guided accordingly in recording this. They can also provide you on other ways to record this.

Once you're all set, feel free to check out this article for reference. This can walk you through the process of flawlessly matching your book and bank accounts: Reconcile an account in QuickBooks Online.

I'll be here if you have any additional questions about recording your expenses in QBO. Keep safe!

Were is the dropdown?

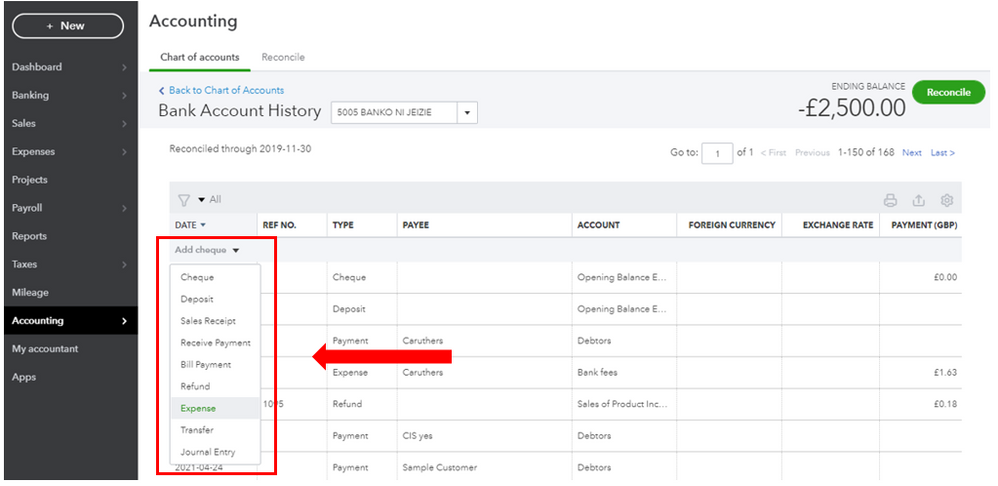

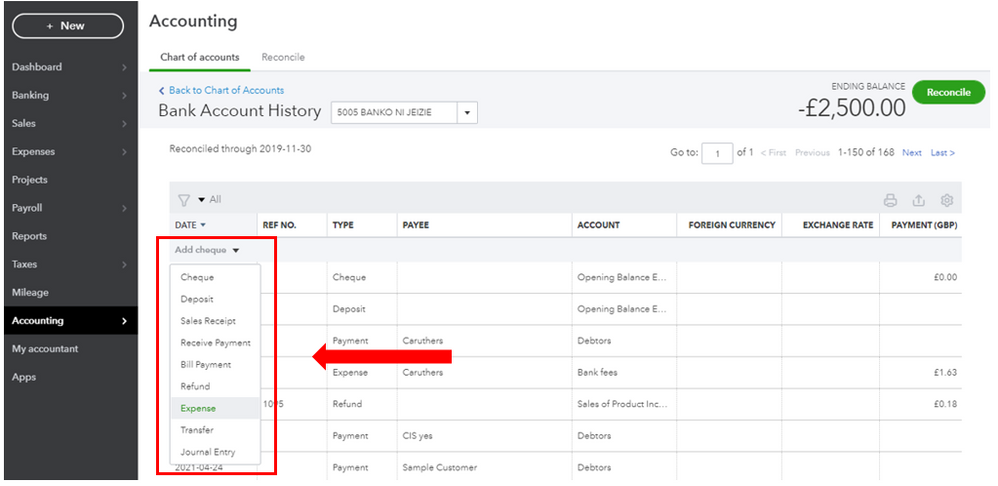

I appreciate you for getting back, email4. I'll show you where to locate the drop-down menu to add a check or an expense transaction under your account.

For more tips about handling your accounts in QuickBooks Online, you can open this article: What are account histories in QuickBooks Online?.

In case you want to find or modify a transaction in an account, you can also check out this link as your reference: Find, review, and edit transactions in account registers.

If there's anything else you need help with adding an expense entry to your BBL account, let me know by adding a comment below. It's my pleasure to help. Wishing you a good one!

I'm trying to do the exact same thing with a Bounce back loan. The drop down menu within the account just says add transfer and then gives me the options of transfer or journal entry. How do I record the interest as an expense for tax purposes?

Thanks for joining this conversation, JamesCParsons.

Allow me to jump in and help ensure you can record the interest as an expense in your QuickBooks Online (QBO).

You should be able to choose Expenses when clicking the drop-down option, as shown by my colleagues above. To isolate this, let's sign in to your QBO using a private browser (incognito). There are times that the browser is already full of frequently accessed page resources (cache and cookies), causing some unusual responses.

Here's how:

Once logged in, go back to your account register to double-check. You can follow the detailed steps shared by my colleagues above for further guidance.

If it works, return to your default browser and perform a clear cache to refresh the system. However, if the issue persists, try using other supported browsers.

To know more about managing and adding transactions to your account in QBO, consider checking out this article: Manually add transactions to accounts in QuickBooks Online.

Once everything looks good, you can proceed with reconciling your account to ensure your books are accurate: Reconcile an account in QuickBooks Online.

I also recommend visiting our website for more tips and other resources you can use in the future: Self-help articles.

Please post again or leave a comment in this thread if you have more questions about this or anything else QuickBooks. I'll be here to assist. Stay safe.

Hi James thanks for coming back to us and with a screenshot, what kind of account are you in on the chart of account? If you are in an liability account there is no expense option just the transfer and journal entry option, you can't create an expense from liability account because it's a transaction that takes a fund from the account. If you're in the bank account you should have all of them in the list.

So to record the interest element of a loan which is an expense, I cannot record it in the liability account related to that loan? What is the appropriate account to add this interest as an expense?

Hi James, we would advise that you speak to a trained and qualified accountant who will be able to help you on what account to put it to as we are just technical support and not trained accounts.

accountants*

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.