- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Banking

- :

- Re: I Use Starling Bank for my Business Account. In the connected account box for bank balance, i...

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I Use Starling Bank for my Business Account. In the connected account box for bank balance, is it possible to show the 'Bank Spaces' too?

For Example, I have the One Business Account with one sort code and account number. Under that one account you can open what they call spaces. I have opened several, one to transfer money held back to pay my end of year self employment tax, one for transferring savings for van expenses and a few others. My questions is can I get these spaces to display in the bank accounts box on the dashboard as well as just the main account?

Solved! Go to Solution.

Labels:

Best answer November 24, 2022

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I Use Starling Bank for my Business Account. In the connected account box for bank balance, is it possible to show the 'Bank Spaces' too?

Hello Community Users, We just wanted to pop in and clarify, so there is a clear answer on this postabout how to show Bank Spaces/Money Pots. As one user has mentioned the best thing to do is create a completely separate cash on hand chart of account in Quickbooks. Then you can mark the money as a transfer to that cash on hand account (your pot) you can then move it back in via a transfer back or create the expense from the cash in hand chart of account for your Tax payment for example. Any questions please feel free to ask

0 Cheers

14 REPLIES 14

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I Use Starling Bank for my Business Account. In the connected account box for bank balance, is it possible to show the 'Bank Spaces' too?

You're unable to show the bank spaces, Psellick8.

When you connect your financial institution, it will let you select one type only. If these bank spaces are like multiple accounts with the same bank, you'll have to select the type for each one you're connecting.

I'll share the article about connecting bank and credit card accounts to QuickBooks Online for more information.

Let us know if you have other questions. We'll get back to you as soon as soon as we can.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I Use Starling Bank for my Business Account. In the connected account box for bank balance, is it possible to show the 'Bank Spaces' too?

The transactions in the Starling Bank spaces show up, as income or expenditure, how should they be recorded? For example, I have a 'space' to put money aside for paying tax in the future etc. but I don't know how that should be recorded.

Thanks

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I Use Starling Bank for my Business Account. In the connected account box for bank balance, is it possible to show the 'Bank Spaces' too?

Welcome to the thread, @Sqfoot.

QuickBooks Online (QBO) is a read-only app. Once you connect a bank account, it will bring in data based on the transactions posted into your bank account.

However, if you have imported transactions into your QBO account, please know that there are formats that need to be considered before importing transactions.

To help resolve the problem, kindly check the format of your file if it is one of the accepted formats when importing transactions in QBO. Here’s an article that you can check on with guidelines: Import bank transactions from Excel CSV file to QuickBooks Online.

Get back to me if you have further questions concerning QuickBooks. I'm always around to help. Have a great day!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I Use Starling Bank for my Business Account. In the connected account box for bank balance, is it possible to show the 'Bank Spaces' too?

I have this problem too:

I have created two different Spaces within Starling to put money aside for future tax and wages, I then created separate accounts for them in QBO along with the relevant transfers so the daily balances match, but the Starling monthly statement total includes all the money allocated to spaces so they when reconciling the bank balance is short the total value of the Spaces.

Are you saying that we QBO cannot cope with Spaces and therefore we can't use them?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I Use Starling Bank for my Business Account. In the connected account box for bank balance, is it possible to show the 'Bank Spaces' too?

Hi there, @BenleyCityStays.

I want to make sure this is taken care of right away. In QuickBooks Online you're unable to show the bank spaces as what my colleague mentioned above.

Regarding the reconciliation process, your bank statement and QuickBooks balance should match when reconciling. You'll need to review and categorize all of your downloaded transactions before reconciling. This is to ensure that you have accurate amounts.

Once done, find the transactions that aren't on your bank statement. If any transactions were on a previous bank statement but weren't on the reconciliation for those dates, you can add it manually. For more information, please browse through this article: Fix issues when you're reconciling accounts.

After that, you now finish reconciling your account without any short or discrepancy. You may check out this article: Reconcile an account in QuickBooks Online.

You can always access and print the reconciliation report by clicking the Report button on the left side. Simply click the drop-down arrow besides View report, then click Print. Also, you can customize it to see the specific details.

Let me know if you have any questions. I'm always here to help. Have a great day!.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I Use Starling Bank for my Business Account. In the connected account box for bank balance, is it possible to show the 'Bank Spaces' too?

Hi, I'm not sure if you've actually answered the question here. Starling bank uses spaces. It's the same account but you can separate your money to save for tax. In Quickbooks, when you connect the account, any money moved out of the main account into a 'space' does not appear in the account balance so it looks like you have spent money, when you have actually just moved it, within the same account.

How can we get quickbooks to see this money so that it recognises there is a balance there, in that space?

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I Use Starling Bank for my Business Account. In the connected account box for bank balance, is it possible to show the 'Bank Spaces' too?

Having the ability to show bank spaces in QuickBooks Online is a great idea,@Anattic.

While this isn't an option, you can create a sub-account instead to move the money out from your Sterling bank (main account) to that sub-account. This way, all transactions on that said sub-account will roll up into it. Here's how:

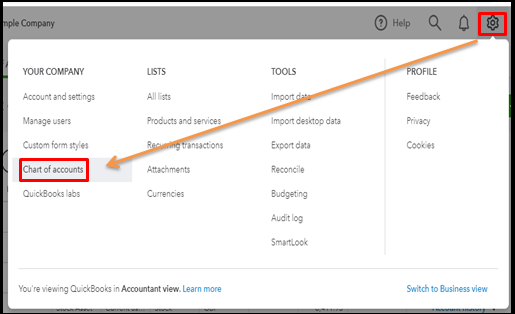

- Click the Gear icon :gear: at the top, and then choose Chart of Accounts.

- Select New at the top.

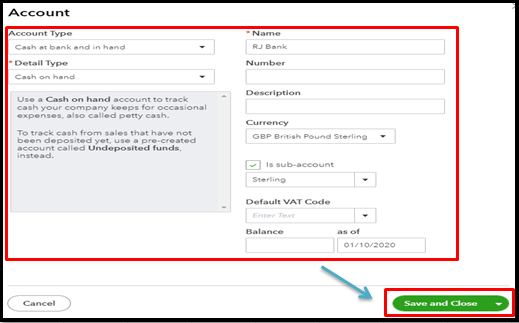

- In the Account Type drop-down ▼ , pick the account type.

- Choose the type of account you want to create in the Detail Type drop-down ▼ .

- Enter a name for the account in the Name field.

- Check the box for Is sub-account, and then select the parent account (Sterling).

- Input all the needed info you want, and then click Save and Close or Save and New if you want to enter another account right away.

Once done, you can now start connecting your bank accounts. Before doing so, please know how your bank sends the downloaded entries. If they download to one account, connect only the parent account.

If the transactions download to the individual accounts, connect the sub-accounts. This is to prevent duplicates and the system won't allow you if you try to do so. For more info, please check out this article: About bank or credit card subaccount setup.

Also, I recommend visiting our QuickBooks Blog site to keep up with the latest news and product updates.

You'll want to categorize and match your entries to ensure they're accounted for correctly and prevent duplicates. Then, you can reconcile them to make sure your books correct. This way, you can quickly access, print, or export a report to save a copy on hand.

I'd be glad to help you some more. Just click the Reply button and I'll get back to you. Thanks for dropping by.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I Use Starling Bank for my Business Account. In the connected account box for bank balance, is it possible to show the 'Bank Spaces' too?

I had actually forgot I done this thread as never saw any responses (too many mails). Having used Quickbooks with Starling Bank for the best part of a year now, all I do for my spaces which don't show as an account in connected banks, is created an expense that was extremely self explanatory (as I have an accountant that will look at this) so for example Tax taken from income for HMRC. I also set up a supplier and called it bank account for tax. Every time I have an invoice paid, I transfer the required amount for tax from my starling account to the 'spaces'. This then shows as an expense on the bank tab as it has been spent (left the account). I can then mark it as an expense (tax taken from income for HMRC) and also allocate where it has gone (supplier tax account).

Hopefully this should show the accountant where it has gone. Im hoping it doesn't cause an issue when I transfer it back as it will show as income, but then need to be paid straight back out as an expense to pay the tax to the relevant company. Only time it may cause an issue I guess is if you get a rebate, as you will be transferring money you have put aside for tax back into the account and it won't be going back out as an expense?

I have done the same for say a van account, I try to take a bit out of each invoice and put in a 'space' for van maintenance and repair - again, created an expense 'van maintenance' then created a supplier as van maintenance account, then any money that gets transferred from starling account into that space flags up as an expense to supplier (account / space) van maintenance.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I Use Starling Bank for my Business Account. In the connected account box for bank balance, is it possible to show the 'Bank Spaces' too?

Hi,

I followed your instruction and created sub-categories attached to my Starling account.

I then categorised transections from my main account to the space as transfer.

My bank balance is still off in QBO.

Can anyone help me to balance it out, please?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I Use Starling Bank for my Business Account. In the connected account box for bank balance, is it possible to show the 'Bank Spaces' too?

I'm here to help balance your Starling account in QuickBooks, fusé-Osaka.

Once your bank account is connected, the system automatically creates an opening balance. The amount is based on the real-life bank account. Thus, it causes the incorrect balance in QuickBooks.

No worries. You can either edit or delete this entry. Simply go to your Chart of Accounts and make changes from there. Here's how:

- Go to the Gear :gear: icon at the right top.

- Select Chart of Accounts under Your Company.

- Locate the account, then click Account history under Action.

- Find the opening balance.

- You can either delete or edit it.

- When you edit it, make sure to enter a zero amount to fix the opening balance.

- Click Save and close.

I've added this article for additional information: Fix opening balance issues in QuickBooks Online. This link will also help ensure QuickBooks will match your bank records.

Let me know if there's anything else you need with your bank account, and I'd be glad to help you.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I Use Starling Bank for my Business Account. In the connected account box for bank balance, is it possible to show the 'Bank Spaces' too?

Hi,

Thank you very much for your reply.

If I follow your instruction and delete my entries from bank feed, it will make my money disappear.

I followed the instruction from AlcaeusF in this post :

https://quickbooks.intuit.com/learn-support/en-uk/banking/re-starling-bank-pots/01/718048#M9566

I created new parent account under "Cash on hand" categories and transferred my transections for pots/space there.

Now my bank balance matches.

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I Use Starling Bank for my Business Account. In the connected account box for bank balance, is it possible to show the 'Bank Spaces' too?

Hello Community Users, We just wanted to pop in and clarify, so there is a clear answer on this postabout how to show Bank Spaces/Money Pots. As one user has mentioned the best thing to do is create a completely separate cash on hand chart of account in Quickbooks. Then you can mark the money as a transfer to that cash on hand account (your pot) you can then move it back in via a transfer back or create the expense from the cash in hand chart of account for your Tax payment for example. Any questions please feel free to ask

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I Use Starling Bank for my Business Account. In the connected account box for bank balance, is it possible to show the 'Bank Spaces' too?

I've created a separate cash on hand account as a sub account of the current account, but the bank transactions are all the wrong way round despite entering the transaction as a bank transfer that looks correct. The Starling statement doesn't show these transfer transactions at all but it seemed to all cancel each other out on the bank reconciliation for the current account. The sub accounts all show negative values when a deposit is made and positive values when a transfer is made back to the current account.

Any idea welcome please.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I Use Starling Bank for my Business Account. In the connected account box for bank balance, is it possible to show the 'Bank Spaces' too?

Thanks for joining this thread, bryonybs. I've come to help resolve bank deposits and transactions in your Starling account.

Before connecting to online banking, it's best to know how your bank sends the downloaded entries into your file. If they download to one account, you'll have to connect only to the parent account.

However, if the transactions download to the individual accounts, you need to connect the created sub-accounts and not the parent account. Doing so will help prevent duplicates on your banking feeds. I'm including this reference for more insight: About bank or credit card subaccount setup.

On another note, if deposit entries are downloaded to your file, it's best to verify the account category used when categorizing. If these are classified as income, then the deposits will result in a positive value.

If it's categorized under expense, it'll result in a negative total due to the amounts deducted from your account. With this, you can run a Deposit Detail report to check how your deposits are being categorized.

Additionally, if these transactions are manually recorded in QuickBooks, I recommend reviewing the account used and amounts entered to ensure the accuracy of these data.

Moreover, here's an article you can utilize to help reconcile your accounts so the actual values spent matches the amount shown leaving an account at the end of a fiscal period: Reconcile an account in QuickBooks Online.

I'll always be around in this forum if there's anything else you need additional assistance managing account balances in your file. Stay safe and have a good one.

0 Cheers

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...