Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We need to clear down the A/R and A/P as there are some very old transactions dating back many years. We wanted to do one journal entry for everything, but I believe QBO only allows payment to specific customers/suppliers – is there any way around this?

Solved! Go to Solution.

Clearing old Accounts Receivable (A/R) and Account Payable (A/P) balances can be a little tricky. We can give you the information you need to get these balances taken care of, however, it would still be best to consult with your accountant to make sure what's best for you and your business.

The most efficient way to clear any payables is to pay it off. Aside from making journal entries, this includes creating a clearing account. The steps are similar to setting up a bank account in your chart of accounts, but without an opening balance.

Once you're ready, you can follow the steps below to clear off those A/P balances:

Create the appropriate journal entry:

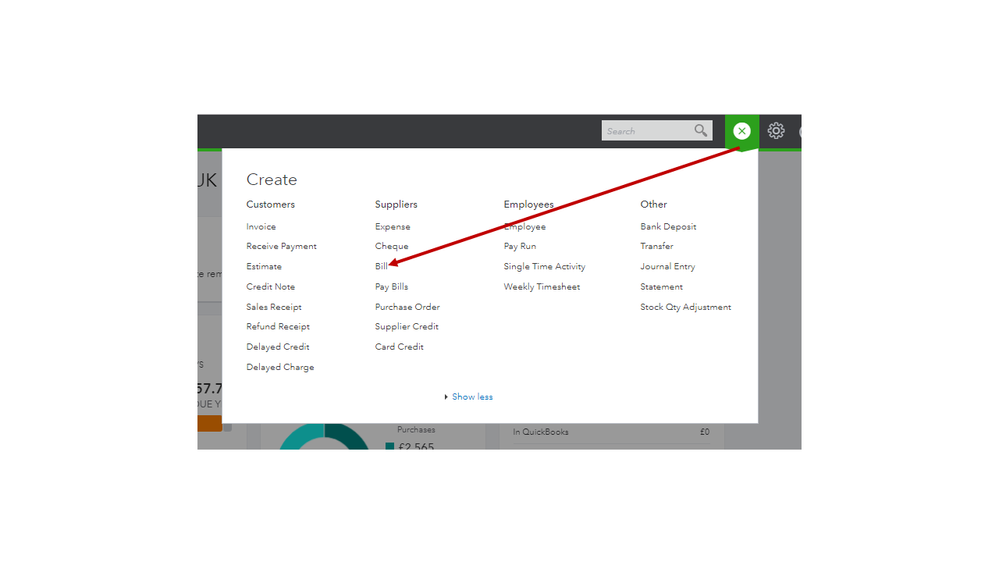

1) Click the Plus sign (+), then choose Journal Entry.

2) In the Journal Entry window, change the date if necessary.

3) In the Account Field, choose Creditors from the drop-down list.

4) Enter the amount in the Debit field.

5)Tab to the name field and select the Supplier from the drop-down list.

6) In the next row, choose the off-setting or the clearing account in the Account field.

7) The amount in the Credit field should be equal to the amount in the Debit field.

8) Click Save & Close.

Apply the general journal entry to the existing balance:

1) Go to Expenses, and then choose Suppliers at the top.

2) Click on the supplier name, and look for the Bill to pay it.

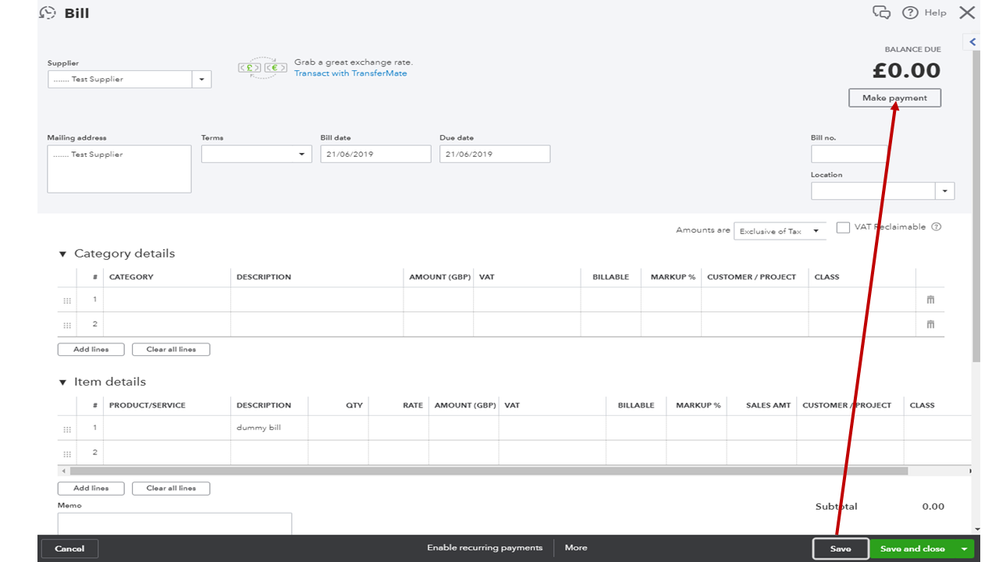

3) Click the Make Payment button in the top-right corner. When the Bill Payment window opens, the Journal Entrywill be under the Credits section.

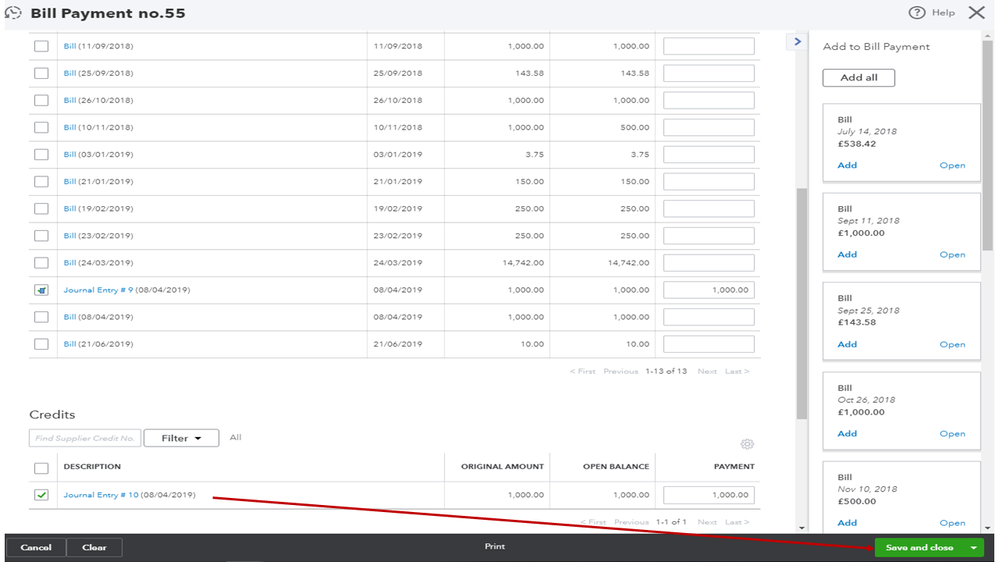

4) Select the Bill and the Journal Entry to link them.

5) Click Save & Close.

Clearing old Accounts Receivable (A/R) and Account Payable (A/P) balances can be a little tricky. We can give you the information you need to get these balances taken care of, however, it would still be best to consult with your accountant to make sure what's best for you and your business.

The most efficient way to clear any payables is to pay it off. Aside from making journal entries, this includes creating a clearing account. The steps are similar to setting up a bank account in your chart of accounts, but without an opening balance.

Once you're ready, you can follow the steps below to clear off those A/P balances:

Create the appropriate journal entry:

1) Click the Plus sign (+), then choose Journal Entry.

2) In the Journal Entry window, change the date if necessary.

3) In the Account Field, choose Creditors from the drop-down list.

4) Enter the amount in the Debit field.

5)Tab to the name field and select the Supplier from the drop-down list.

6) In the next row, choose the off-setting or the clearing account in the Account field.

7) The amount in the Credit field should be equal to the amount in the Debit field.

8) Click Save & Close.

Apply the general journal entry to the existing balance:

1) Go to Expenses, and then choose Suppliers at the top.

2) Click on the supplier name, and look for the Bill to pay it.

3) Click the Make Payment button in the top-right corner. When the Bill Payment window opens, the Journal Entrywill be under the Credits section.

4) Select the Bill and the Journal Entry to link them.

5) Click Save & Close.

How can I do it Desktop?

Good day, Bluewaterbookkeeping66.

Let me walk you through in the Desktop version.

First, we'll have to create a clearing account. Here's how:

Next, create a journal entry. Here's how:

Then, here's how to apply the entry to the existing balance:

Follow the steps for clearing out the A/R amount using the same clearing account.

As always, we recommend consulting with your accountant on the best way to handle this.

Feel free to reach out to us. While we can't provide an accounting advice, we want to make sure any technical questions you have about the system are answered.

What do you do with the balance remaining in the clearing account? Adjust it to retained earnings?

Hi there, MaryFerry.

Thank you for getting back to the Community. Allow me to step in and help provide additional information about clearing balances in QuickBooks Online.

You can still use the Journal Entry feature to clear balances on your Accounts Payable account in the system. While for the offset account, It would best to seek an expert's advice from an accountant to ensure your books will be correct.

If this is for vendors with overpayments, you can use the Credit column for the A/P account. You only use the Debit column instead for the account if this is for a vendor with underpayments.

To apply the journal entry to the existing debit/credit, you can use the Pay Bills feature.

I'm always here anytime you need additional help concerning the A/P account. The Community will be on a lookout on your response.

I'm curious about this too! What did you end up doing with the balance in the clearing account- adjusting to retained earnings?

I went back and adjusted to the original expense account.

How do you clear transactions that look like over payments?

The previous bookkeeper credit a payment larger than the bill amount, so it looks like a refund is due. It isn't, so I can only assume either other bills were paid by this check that were not entered in QB, or P&I were included in the payment. It's 5 years later, how to I clear AP and AR?

Hello there, FineCarp.

Thanks for joining this thread. Allow me to share some insights on how to clear old transactions from your accounts in QuickBooks Online (QBO).

If you wish to clear old transactions from your Accounts Payable (AP)/ Accounts Receivable (AR), you can create a clearing account in your QBO. This account is use to move money from one account to another account.

Here's how:

Once done, you can create a Journal Entry and apply the clearing account. You can follow the steps provided below:

Here's how to create a Journal Entry (JE):

Now you can apply the JE to the existing balance. Let me share again the steps provided by my colleague above:

However, I'd still recommend checking with an accountant about this for they can provide recommendations as to what account to use for debit and credit.

If there's anything else I can help you with or additional questions about the process of clearing transactions from your accounts, just let me know. I'd be more than happy to assist you further.

Thank you for such detail. I guess my question is, since there isn't a "bill" to pay, do I create a negative bill to account for the "over payments"? If so, if I use an expense account, it will make my current P&L expense account a negative.

Hello there, FineCarp.

You have to create a journal entry to offset your A/P account with your Clearing account, so you'll be able to clear the overpayment. Let me walk you through.

To create a clearing account, please refer to @Charies_M for the steps.

Then, create a journal entry. Here's how:

Feel free to read this article for your reference: How to record a barter transaction.

The Community is always here for you if you have questions. Stay in touch.

Hello,

I am trying to clear some small AP vendor balances and I need some help.

I originally created a journal entry and adjusted the balances to $0. But then I noticed that even if the amount was at $0 the bill still appeared as over 90 days on my aging. I reversed the entry as I thought there had to be another way. I also tried a vendor credit but again the amount keeps showing in 90 days and over. As I keep reading I find that I was doing it originally right and all I was needing was to check the credit on the pay bill section but now as I posted and reversed the entry It does not appear on the pay bill section to select the credit.

How can I write off these payables correctly and take them out of my AP Aging?

Also, what is the relationship on the Expense/vendor tab between the the total under the vendor name on the left column and the total when I see the detail transactions vendors on the right? Shouldn't these amounts be the same? If I took a vendor payment transaction directly from the bank and applied it to the vendor while coding it to the payable account it shows up as an increase in payable on the transactions to the right but the vendor balance is correct on the left column. Please help me understanding this relationship.

Thank you for the detailed information about your concern, @iankairos.

Yes, you’re correct. Creating the journal entry clears out the supplier’s balances. The likely reason why the amount is no longer showing on the Pay Bill section is that it was already zeroed out.

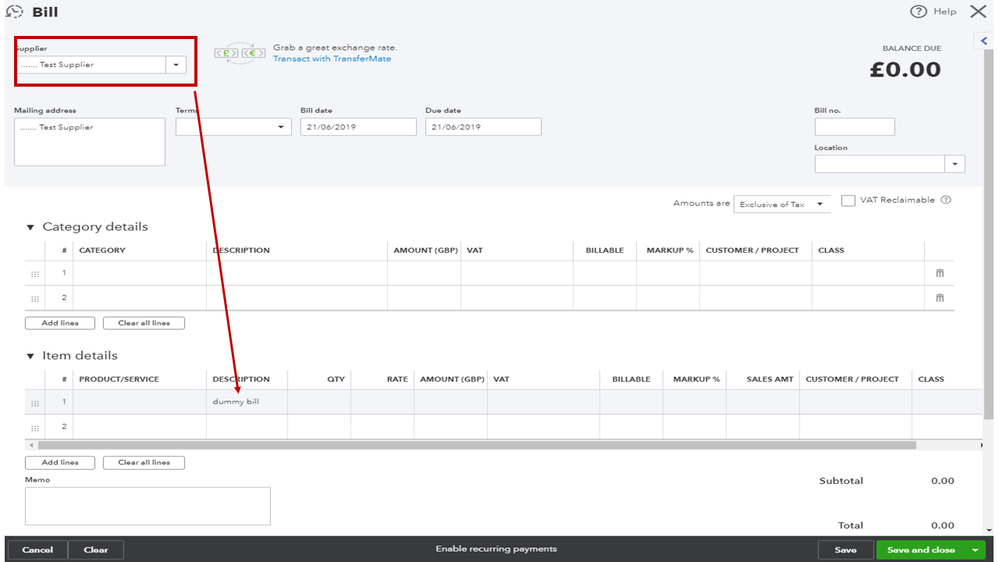

To keep your account payable's record correct, link the journal entry to the bill payment instead of creating a vendor credit. Since we’re unable to directly link the transaction to the bill payment, create a dummy bill first for the same supplier.

Here's how:

The Total amount showing on the Suppliers panel is for all open transactions. While the figure displayed under the Total column in Transaction List is the sum of all transactions.

With these steps, you'll no longer see the transaction on the on the Accounts payable ageing Report.

Let me know if you need further assistance with any of these steps. Please know I’m always here to help.

Hi Rasa-LilaM,

Thanks for your response.

Unfortunately this did not correct my need, I still do not see the vendor on the pay my bills section.

I created again the JE, created the Dummy bill at $0 but cannot use the pay my bill section with him.

Let me know if there i another way I could fix this.

Thanks

Thank you for following the steps I provided and its result, @iankairos.

To rectify the issue, I’ll have to review how the transactions are entered in your account. However, I’m unable to perform this process here in the Community for the account’s safety.

I suggest contacting our QBO Care Team since they have tools to determine why you’re unable to see the vendor in the Pay Bills window. They can also perform a viewing session to ensure your vendor balance is in order.

To reach them:

If there’s anything else I can help you with, leave me a comment. I’ll be right here to assist further.

Hello. After clearing Wrong deposit by connecting Deposit/Credit to an Expense, I balanced Costumer Account to $0.

When I was checking Chart of Accounts, I could see an Expense for that amount sitting uncleared there.

How to cleared that expense and to keep costumer account on 0?

Thank you

Hello, @ZG10.

Good to see you here in the Community. I can help walk you through on how to cleared a transaction in QuickBooks Online (QBO).

Since the expense account still shows as uncleared in the Chart of Accounts (COA), you have an option to change the status to cleared, and it will remain the customer's account on 0.

Here's how:

You can check this article for additional reference on how to change the transaction status: How do I clear, unclear, reconcile or unreconcile transactions?.

For future reference, you can also visit this article to learn more on about reconciliation: How to reconcile accounts.

That should do it! Feel free to leave a comment below if you have additional questions about the transaction status. I'd be happy to answer them for you. Have a good one.

In QBO how would you manage this for Accounts Receivable?

We have some historic customers who paid in advance and then did not use up all their credit. Under our ToS they are not eligible for a refund if any unused credit is unclaimed after a year ... so we need to charge-off these small overpayments (without sending an invoice or refund to the customer!).

Charlie

Thanks for joining this forum, @Chester_Kay. I'm here to share a few insights about how QuickBooks clear old transactions from accounts receivable (A/R).

Ideally, you'll need to record a refund to your customer using Cheque expense. In your case, since your customers are not eligible for a refund, you'll need to create a journal entry. Then, set the journal entry to reverse so it will offset the credits. Here's how:

Create a journal entry for Accounts Receivable

Set the journal entry to reverse

To ensure your books are accurate, I'd highly recommend you speak with your accountant. He/She should be able to provide you more expert ways of handling this situation.

Let me know if you have any other questions. We're always glad to assist. Take care.

Thank you for the feedback & insights @katherinejoyceO

I do have a couple of questions...

Step 4 of the procedure states:

"Select the account affected by the invoice from the drop-down list in the Account column."

my question is: how can I find out which account that was?

My other question is, can I just make the customer Inactive instead?

Hey Chester_Kay,

The account here is the account on the product/service selected on the invoice, to see what this go to Sales > Product and Services > Edit to see where this posts to.

If you don't have any billable expenses posted against the customers you can make these inactive. When you make a customer with a non-zero balance inactive QuickBooks will create an adjusting transaction for the amount of the balance.

Thanks :)

I followed these steps, but when I click Save and Close, since the Journal entry brings the total transaction amount to zero, QuickBooks says:

Thanks for joining this thread, @Lairshallmark.

To isolate the error you're getting when creating journal entry, you need to enter amounts on the Debit and Credit column to be recorded to the accounts selected.

You may consult with your accountant if you're not familiar with the process and to ensure your books are accurate.

Don't hesitate to leave a comment below if you have any other questions. Have a good day!

i think i,ve done everything correctly created the clearing account and made the nessary journal but from the go to Expenses i have a problem not seeing Make payment and also problem with linking. Please i,m spending the whole day on this exercise..........i,ve more than 40 accounts to clear.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.