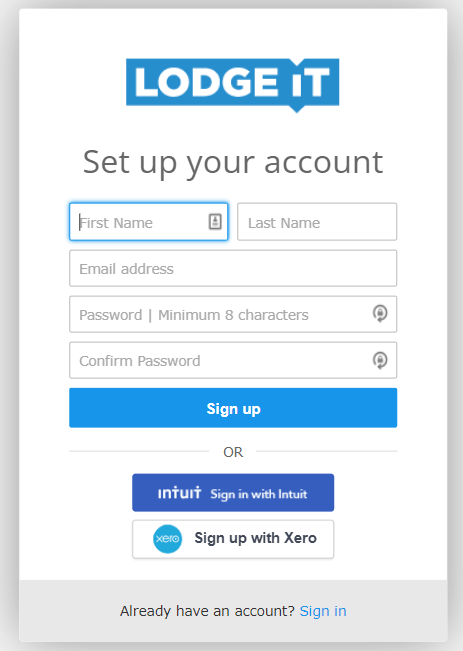

To set up LodgeiT you’ll need your Tax agent number or BAS agent number to complete the setup process and lodge a return.

QUICKBOOKS TAX

CHECKLIST FOR QUICKBOOKS TAX | GET STARTED TUTORIAL

Getting started checklist for QuickBooks Tax powered by LodgeiT

Get started with QuickBooks Tax - boost your team’s productivity and power through tax and BAS preparation and lodgements. Check out more tips & guides in our EOFY Hub, to help turn EOFY workload into workflow.

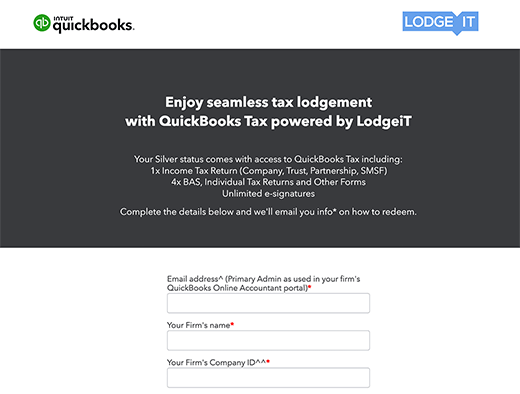

Step 2: Activate your token

To take advantage of your free LodgeiT access, you will need to claim and input your unique token.

Watch how to claim a token.

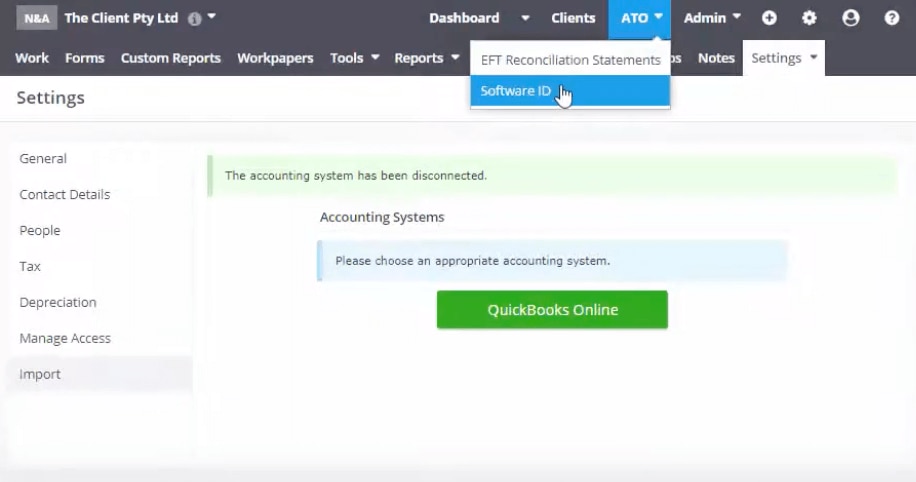

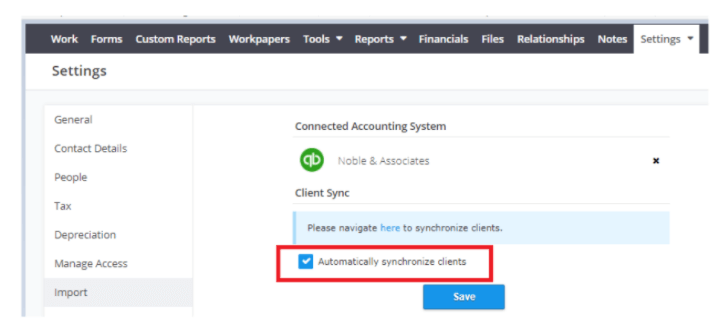

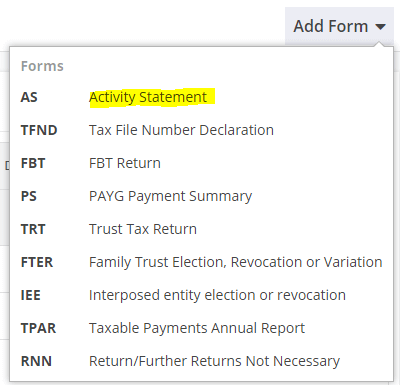

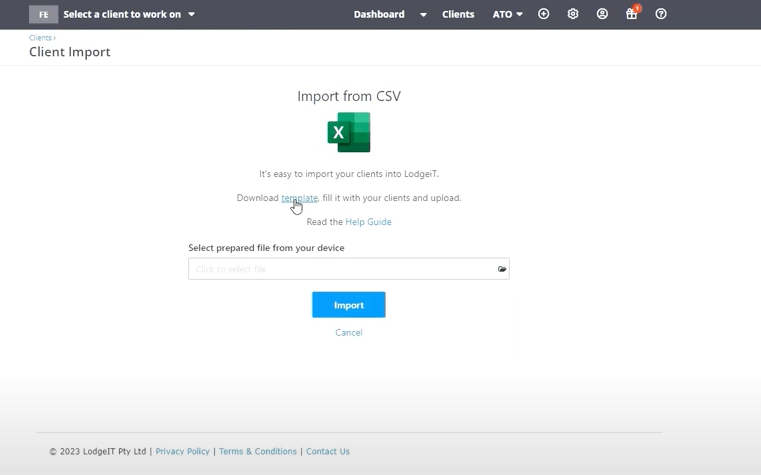

Step 4 - Adding Clients into LodgeiT

You can add clients to LodgeiT one by one or import them via a bulk upload.

Watch how to individually & bulk import clients.

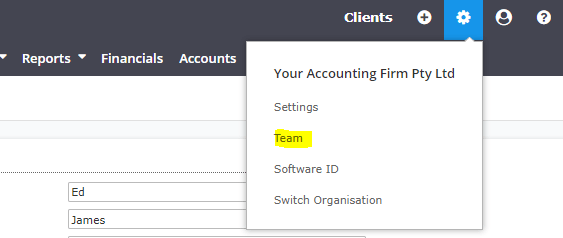

Step 6 - Inviting and managing team member access

You can have unlimited team members access LodgeiT. Learn how to set up your team and manage what areas they can access.

Inviting team members into LodgeiT

Managing team access to specific clients or access levels within the firm

Upskill in QuickBooks Tax

Build on your learning by completing our on-demand QuickBooks Tax training or, join an upcoming training webinar.