Thank you

Get your template here.

What is a profit and loss statement?

A profit and loss statement (P&L) is a snapshot of a company's sales and expenses over a period of time, such as a month, quarter, or year. It shows how much revenue was earned, what expenses were incurred, and the resulting net income. The final figure (called the “bottom line”) represents either a profit or a loss.

The basic profit and loss formula is:

Revenue – Expenses = Profit (or Loss)

Why a profit and loss statement is important

The profit and loss statement is important because it tells you if your business is turning a profit. It can also show where you’re spending your money.

As a business owner, you can use your profit and loss statement template to:

- Assess and evaluate profitability

- Track performance and costs over time

- Find strengths and weaknesses

- Price goods or services by assessing the cost of goods sold

- Make informed decisions about budgets and strategies

- Set goals for revenue generation ideas or cost cutting

What are the key components of a P&L statement?

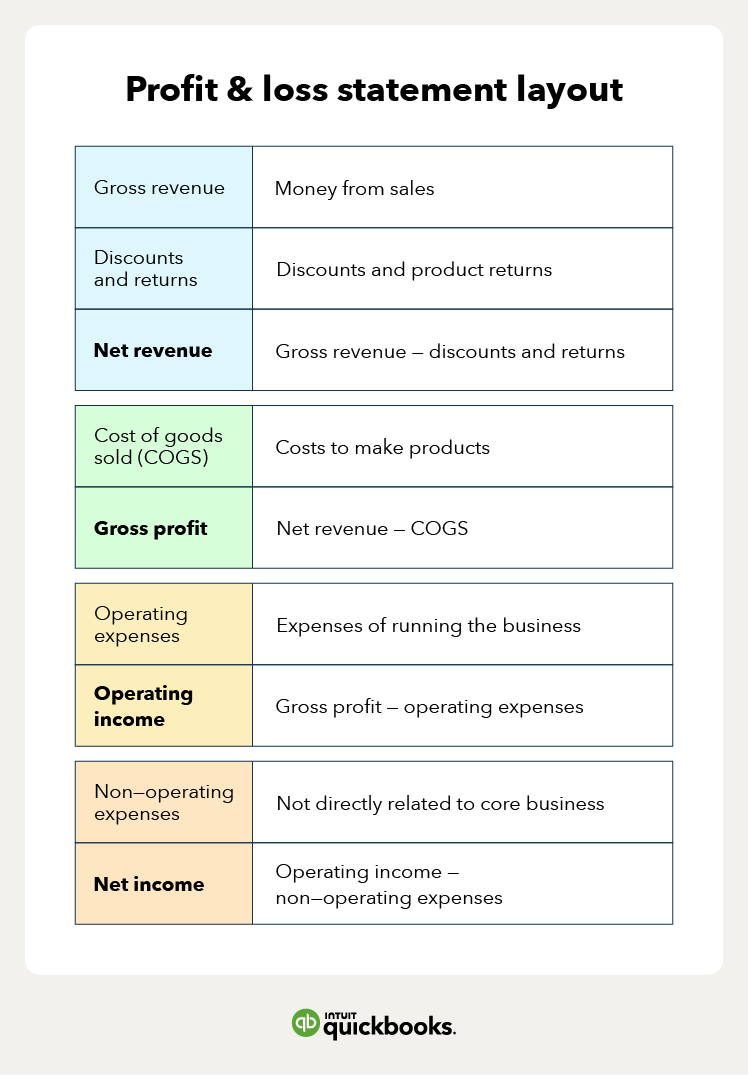

There are many ways to format a P&L statement, but all versions include the same basic information. Sales are at the top of the P&L statement, while expenses appear below. The bottom line shows the net profit or loss, calculated as total revenue minus total expenses.

The profit and loss sample layout below shows how this information should be structured:

How do you create a profit and loss statement?

After you’ve downloaded your profit and loss statement sample, watch this video to learn more about how it works:

The P&L will include three key components: revenue, expenses, and income. There are three key steps to making a profit and loss statement:

1. Start with revenue

Begin by choosing the time period your profit and loss statement will cover. This could be monthly, quarterly, or annually, but monthly P&Ls are often best for spotting trends and staying on top of your finances.

Next, calculate your gross revenue for that period (all income from sales before any expenses are deducted) and enter it on the top line of your P&L statement.

2. Calculate your costs

After accounting for all your revenues, group your expenses into one of three categories:

- Cost of goods sold (COGS)

- Operating expenses

- Non-operating expenses

COGS are all the costs of making a product. For a service business, which doesn’t make a physical product, COGS can include labor for employees performing the service. For example, a hair stylist’s COGS would include the time spent styling hair.

You'll group all the other costs of running your business as operating expenses. Non-operating expenses should be everything that's left. This will be the money you spend on things like taxes and interest.

A hair stylist would have operating expenses like cosmetic supplies, insurance, and marketing. Non-operating expenses may include interest on business debt, or writing off unsellable inventory.

3. Figure out your net income

This is the final step, subtract your total expenses from your total revenue. The result is your net income, which will show whether your business made a profit, incurred a loss, or—rarely—broke even.

Example of a profit and loss statement

Here’s what a simple profit and loss statement would look like using the multi-step method, which is what many businesses use. This sample profit and loss template categorises revenues and expenses:

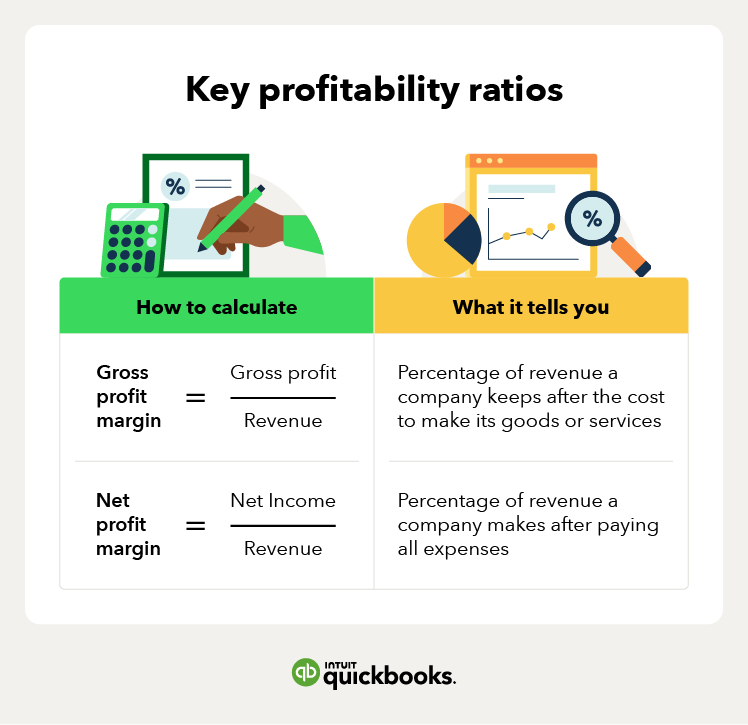

Profitability ratios

Profitability ratios help assess how efficiently a business is turning revenue into profit. In other words, they measure how much a business earns relative to its expenses. Profitability ratios are useful for understanding financial health over time, or comparing performance with other businesses.

There are several types of profitability ratios, but two of the most common are:

- Gross profit margin: This shows how much money is left after subtracting the cost of goods sold (COGS) from revenue. It reflects how efficiently you’re producing or sourcing what you sell.

- Net profit margin: This shows how much profit remains after all expenses are deducted—including operating costs, interest, and tax. It gives a clearer picture of overall profitability.

By tracking these ratios, you can track how well your business is doing and identify areas for improvement.

Put your bookkeeping on auto-pilot

With QuickBooks invoicing and expense management you can feel confident about your business finances and focus on doing more of what you love.

Save an average of 29 hours per month using QuickBooks*

Profit and loss statement FAQs