Here’s a step-by-step breakdown of how to determine your operating costs:

Step 1: Choose a period

Select the time frame for which you want to calculate operating costs (e.g., monthly, quarterly, annually).

Step 2: Locate your income statement

Find the income statement for the chosen period.

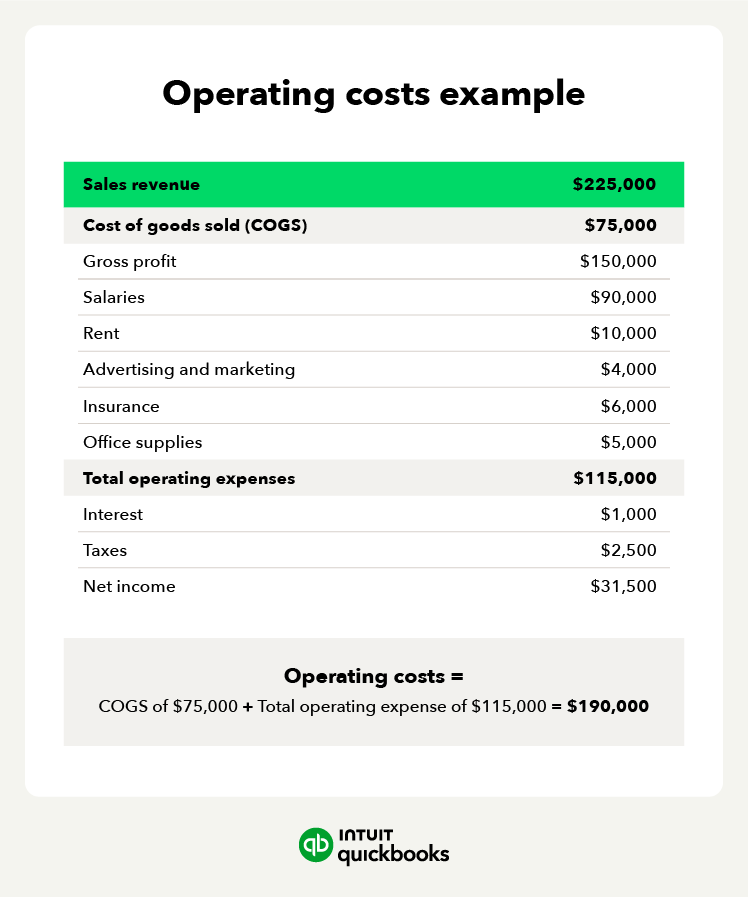

Step 3: Identify COGS

Find the total cost of goods sold (COGS) on the income statement. This represents the direct costs associated with producing or acquiring the goods or services you sell.

Step 4: Identify OPEX

Locate the total operating expenses (OPEX) on the income statement. These are the ongoing costs of running your business, such as rent, salaries, utilities, and marketing.

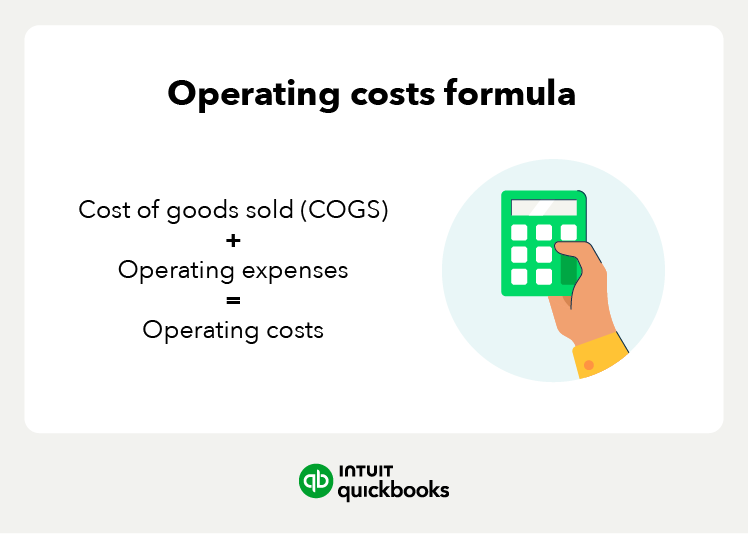

Step 5: Apply the formula

Use the following formula to calculate operating costs: Operating costs = COGS + OPEX

Step 6: Analyze the Result

Review your calculated operating costs to gain insights into your business's financial efficiency and identify potential areas for cost reduction.

Understanding operating cost ratios

Operating cost ratios are financial metrics that can help you assess your business’s operational efficiency and profitability. They provide insights into how well your company manages expenses relative to revenue. By understanding and analyzing operating cost ratios, you can identify areas for improvement and make informed decisions to optimize financial performance.

Key operating cost ratios

Key operating cost ratios are invaluable to measuring a company’s efficiency and profitability. Utilizing and understanding these ratios can help businesses make informed decisions to optimize operations and enhance overall performance.

Operating Expense Ratio (OER)

This ratio measures the percentage of a company's revenue that is consumed by operating expenses. It is calculated by dividing operating expenses (excluding depreciation and amortization) by total revenue. A lower OER indicates greater efficiency, as it means the company is spending less to generate each dollar of revenue.

Formula: OER = (Operating Expenses (excluding depreciation and amortization)) / Total Revenue

- Operating Expenses: The total expenses incurred during normal business operations, excluding depreciation and amortization.

- Total Revenue: The total income generated from the company's core business operations.

Example Calculation:

If a company has operating expenses of $500,000 (excluding depreciation and amortization) and total revenue of $2,000,000, the OER would be calculated as follows:

OER = $500,000 / $2,000,000 = 0.25 or 25%

This means that 25% of the company's revenue is consumed by its operating expenses. A lower OER indicates greater efficiency, as it signifies the company is spending less to generate each dollar of revenue.

Gross Profit Margin

This ratio reveals the percentage of revenue that remains after deducting the cost of goods sold (COGS). It is calculated by dividing gross profit (revenue minus COGS) by total revenue. A higher gross profit margin suggests that the company is effectively managing its direct production costs.

Formula: Gross Profit Margin = (Gross Profit / Total Revenue) * 100

- Gross Profit: Total Revenue - Cost of Goods Sold (COGS)

- Total Revenue: The total income generated from the company's core business operations.

Example calculation: If a company has total revenue of $2,000,000 and the cost of goods sold (COGS) is $1,200,000, the gross profit would be calculated as follows:

Gross Profit = Total Revenue - COGS Gross Profit = $2,000,000 - $1,200,000 = $800,000

Then, the Gross Profit Margin would be calculated as follows:

Gross Profit Margin = (Gross Profit / Total Revenue) * 100 Gross Profit Margin = ($800,000 / $2,000,000) * 100 = 0.4 * 100 = 40%

This means that 40% of the company's revenue remains after deducting the cost of goods sold, indicating that the company is effectively managing its direct production costs.

Net Profit Margin

This ratio represents the percentage of revenue that remains as profit after deducting all expenses, including operating expenses, taxes, and interest. It is calculated by dividing net profit by total revenue. A higher net profit margin indicates greater profitability.

Formula: Net Profit Margin = (Net Profit / Total Revenue) * 100

- Net Profit: Total Revenue - Total Expenses (including operating expenses, taxes, and interest)

- Total Revenue: The total income generated from the company's core business operations.

Example calculation: If a company has total revenue of $2,000,000 and total expenses (including operating expenses, taxes, and interest) of $1,600,000, the net profit would be calculated as follows:

Net Profit = Total Revenue - Total Expenses Net Profit = $2,000,000 - $1,600,000 = $400,000

Then, the Net Profit Margin would be calculated as follows:

Net Profit Margin = (Net Profit / Total Revenue) * 100 Net Profit Margin = ($400,000 / $2,000,000) * 100 = 0.2 * 100 = 20%

This means that 20% of the company's revenue remains as profit after deducting all expenses, indicating greater profitability.

Non-operating expenses are necessary costs that are part of the operations but are indirectly tied to them. Some examples include interest charges and loss on the sale of assets.

Non-operating expenses are necessary costs that are part of the operations but are indirectly tied to them. Some examples include interest charges and loss on the sale of assets.