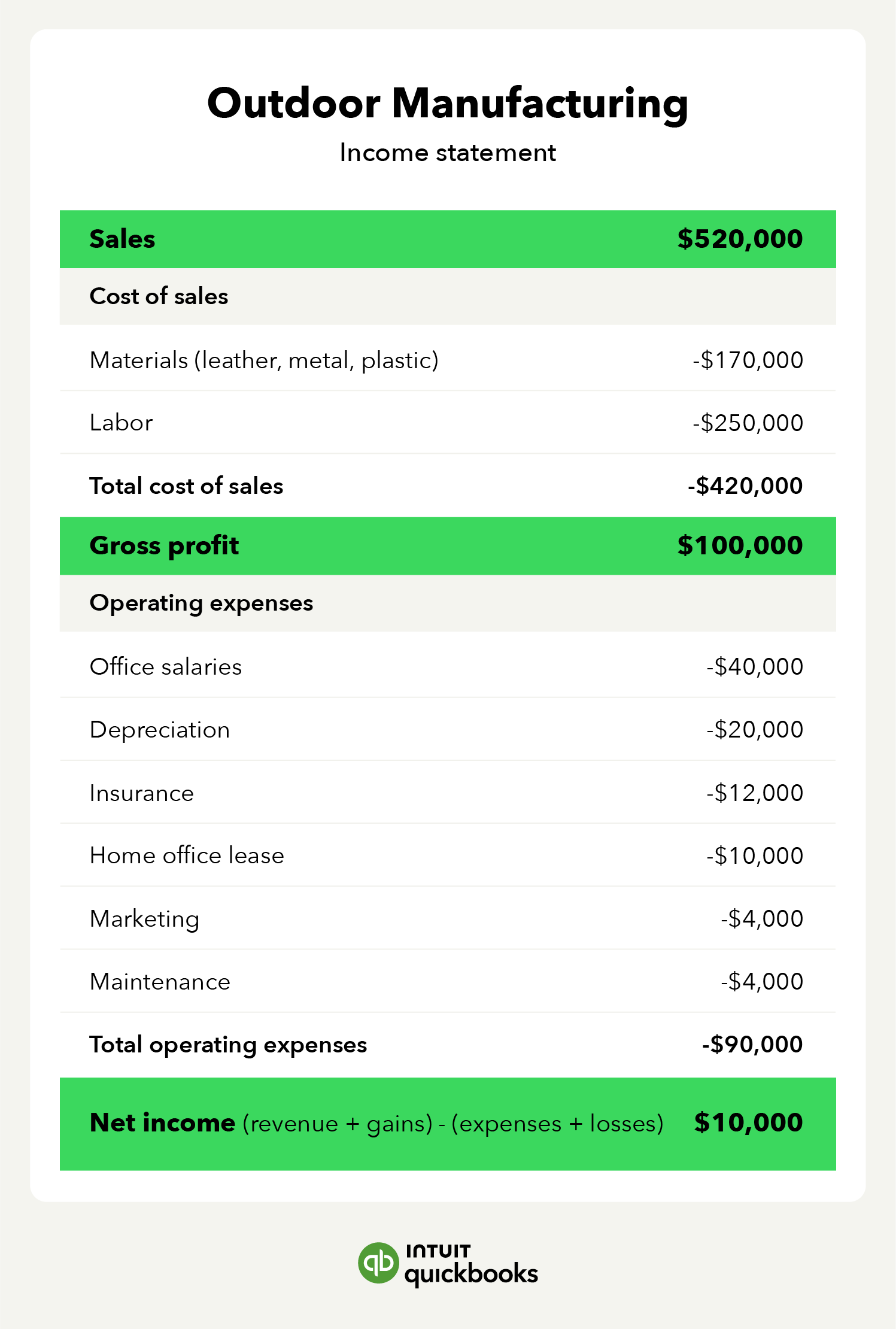

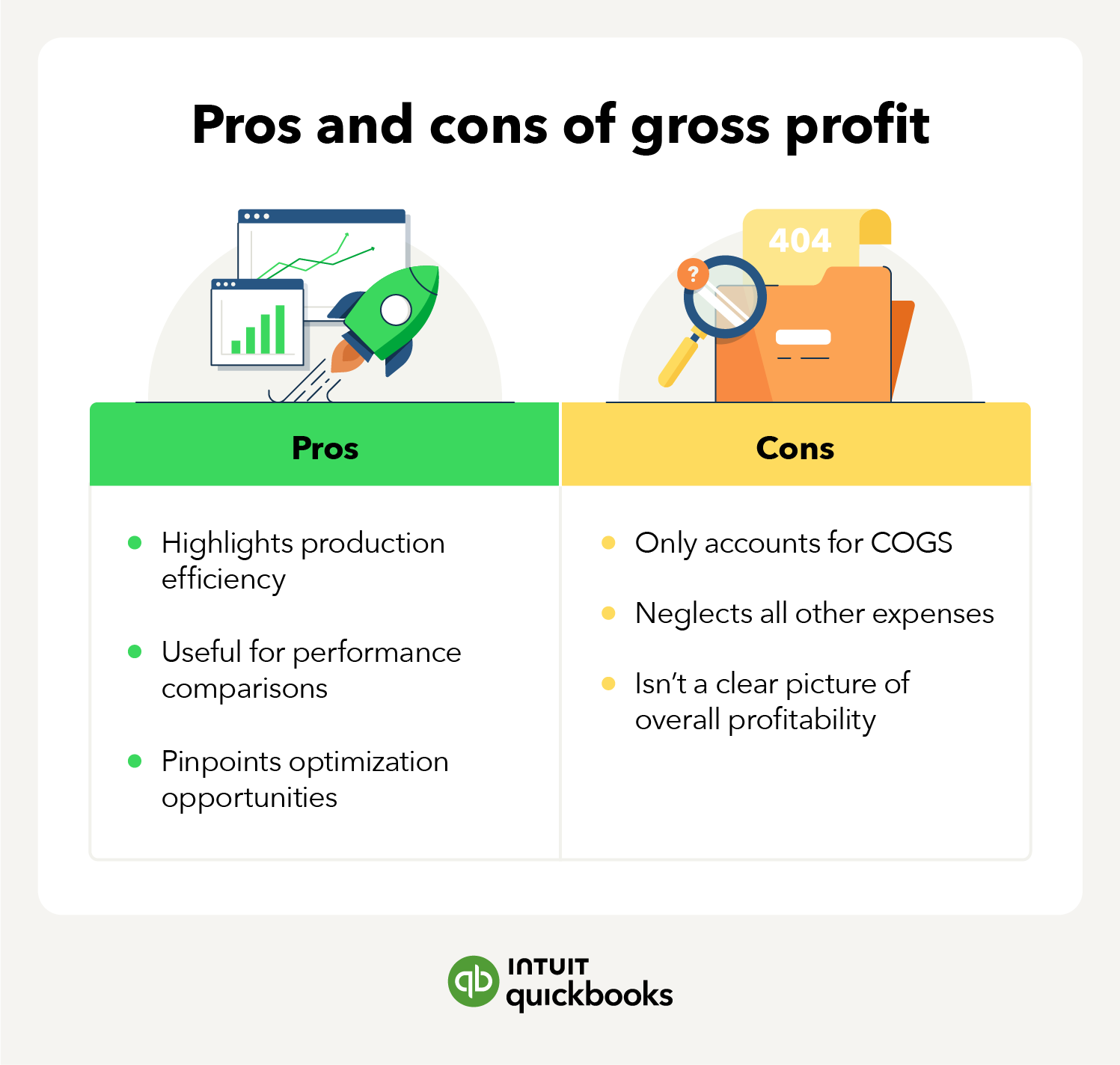

Revenue is the key to business success, right? Not quite. While forecasting revenue is an important piece of financial health, gross profit is an unsung hero when analyzing your production costs—especially since inflation is a top concern for business owners in 2024. But what is gross profit exactly and how does it differ from other popular reporting metrics?

Put simply, gross profit helps you get a more accurate picture of how well your business is maintaining its production profit margins. This, in turn, can impact everything from pricing to resource allocation.

Let’s take a closer look at how to calculate gross profit and its impact on financial reporting.

Jump to:

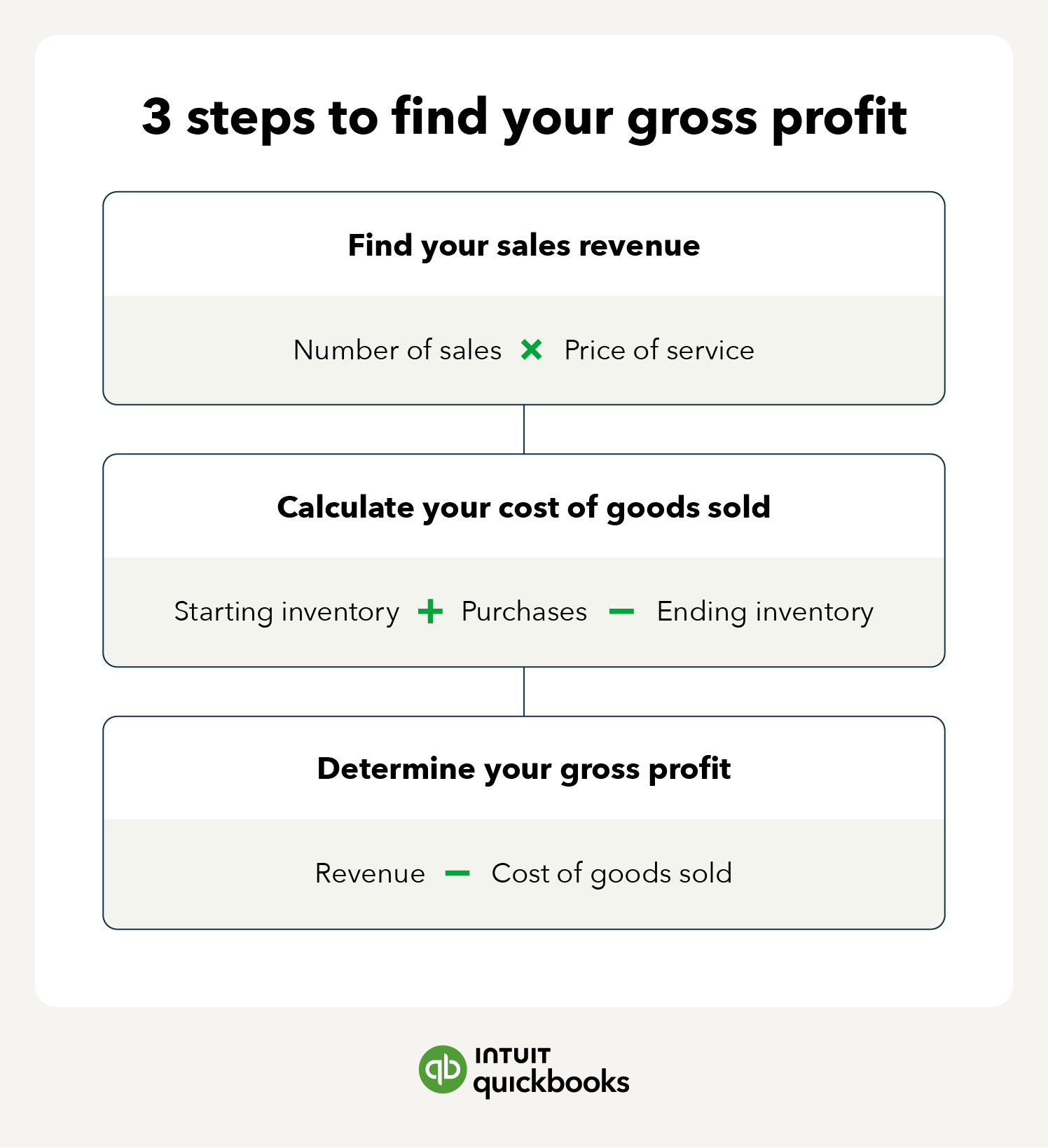

You’ll need to know your total revenue and cost of goods sold before determining your gross profit.

You’ll need to know your total revenue and cost of goods sold before determining your gross profit.