How to find operating profit margin

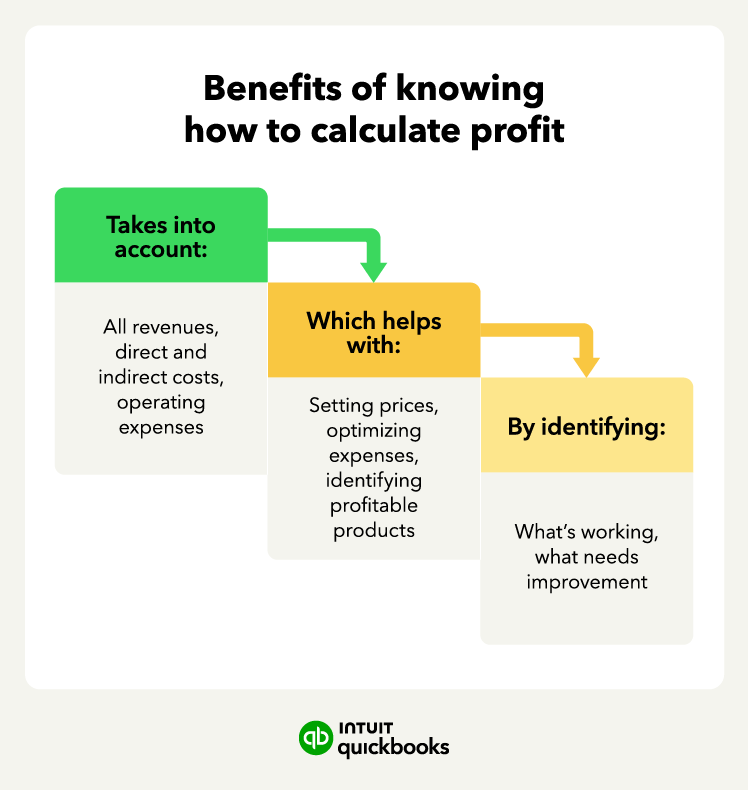

The operating profit indicates how much money the company makes from its core operations after accounting for all operating costs and expenses. The operating profit margin formula is:

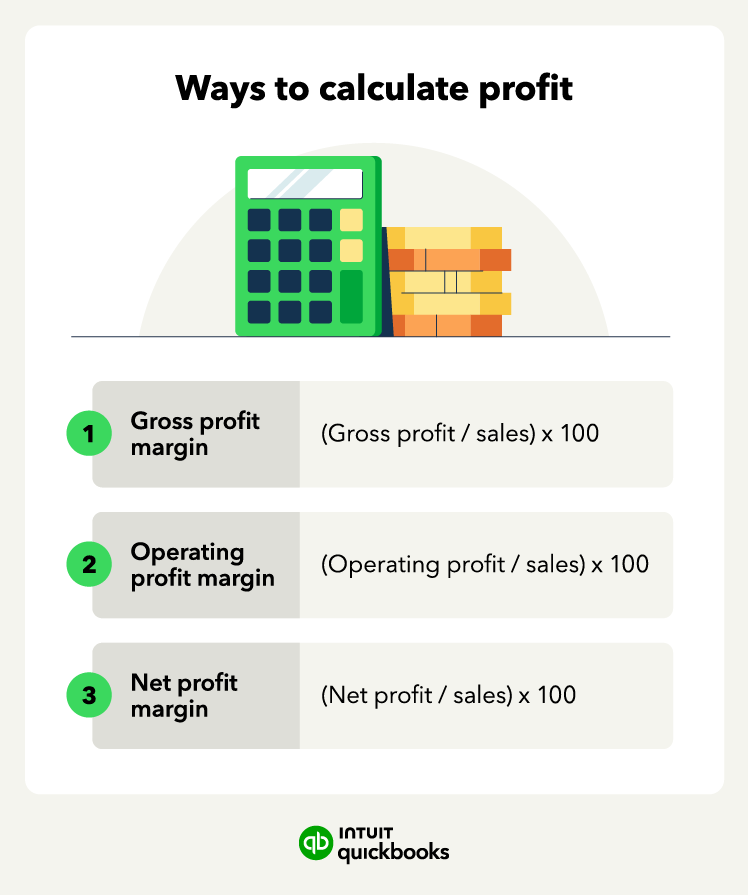

Operating profit margin = operating profit / revenue x 100

Steps to calculate operating profit margin

Step 1: Calculate gross profit

Start by determining your gross profit. This is your total revenue minus your cost of goods sold (COGS), which includes the direct costs of producing your products.

Step 2: Subtract operating expenses

Once you have your gross profit, subtract your operating expenses. Operating expenses include things like administrative costs, marketing expenses, and overhead.

Formula: Operating Profit = Gross Profit - Operating Expenses

Step 3: Divide operating profit by revenue

To find your operating profit margin, divide your operating profit by your total revenue. This shows what percentage of revenue is left after covering all operating costs.

Formula: Operating Profit Margin = Operating Profit / Revenue

Step 4: Multiply by 100

Multiply the result from Step 3 by 100 to convert it into a percentage.

Formula: Operating Profit Margin (%) = (Operating Profit / Revenue) x 100

H2: Operating profit margin example

If your boot wholesaler generates $10 million in sales and has $5 million in operating expenses, your operating profit is $5 million.

Operating profit margin = ($5 million / $10 million) x 100 = 50%. This means 50% of your revenue is retained as operating profit after covering all operating expenses.

How to find net profit margin

Net profit margin determines an entire company’s profit margin—it takes into account all revenue and expenses. The formula to find net profit margin is:

Net profit margin = net profit / revenue x 100

Steps to calculate net profit margin

Step 1: Start with operating profit

Begin with your operating profit—the profit remaining after subtracting all operating expenses from revenue. This figure gives you the income before considering taxes, interest, or other non-operating expenses.

Step 2: Subtract all other expenses

From your operating profit, subtract other expenses such as taxes, interest, and any one-time costs. These additional expenses are deducted to arrive at your net profit (aka net income).

Formula: Net Profit = Operating Profit - Taxes - Interest - Other Expenses

Step 3: Divide net profit by revenue

To determine the net profit margin, divide your net profit by your total revenue. This percentage reflects how much of your revenue is actual profit after covering all expenses.

Formula: Net Profit Margin = Net Profit / Revenue

Step 4: Multiply by 100

Multiply the result by 100 to convert it into a percentage.

Formula: Net Profit Margin (%) = (Net Profit / Revenue) x 100

Net profit margin example

If your operating profit is $5 million and you have $1 million in other expenses, your net profit is $4 million.

Net profit margin = ($4 million / $10 million) x 100 = 40%. This means 40% of your total revenue is left as net profit after all costs and expenses are accounted for.