Bringing in revenue should be one of your top priorities as a small business owner. However, to fully understand the profitability of your business, you need to know how to calculate your net income.

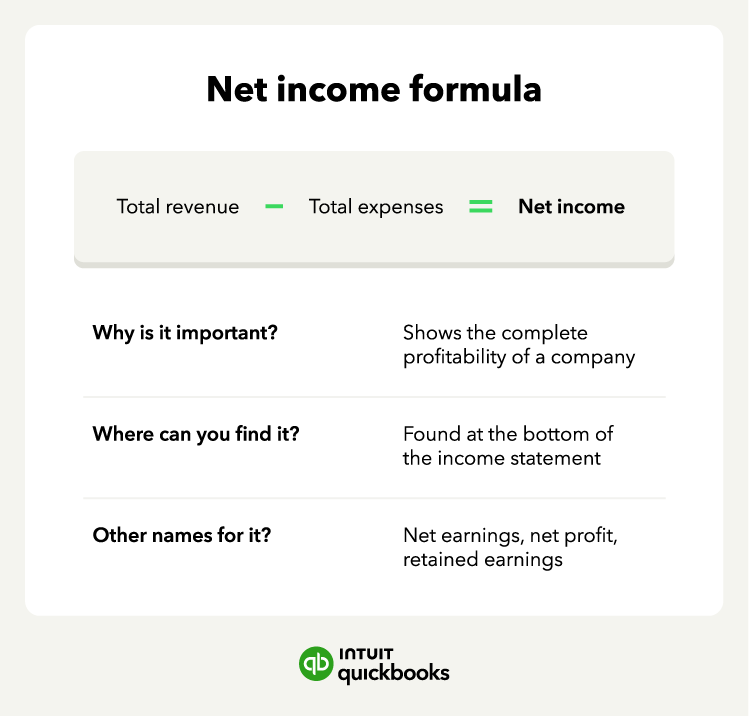

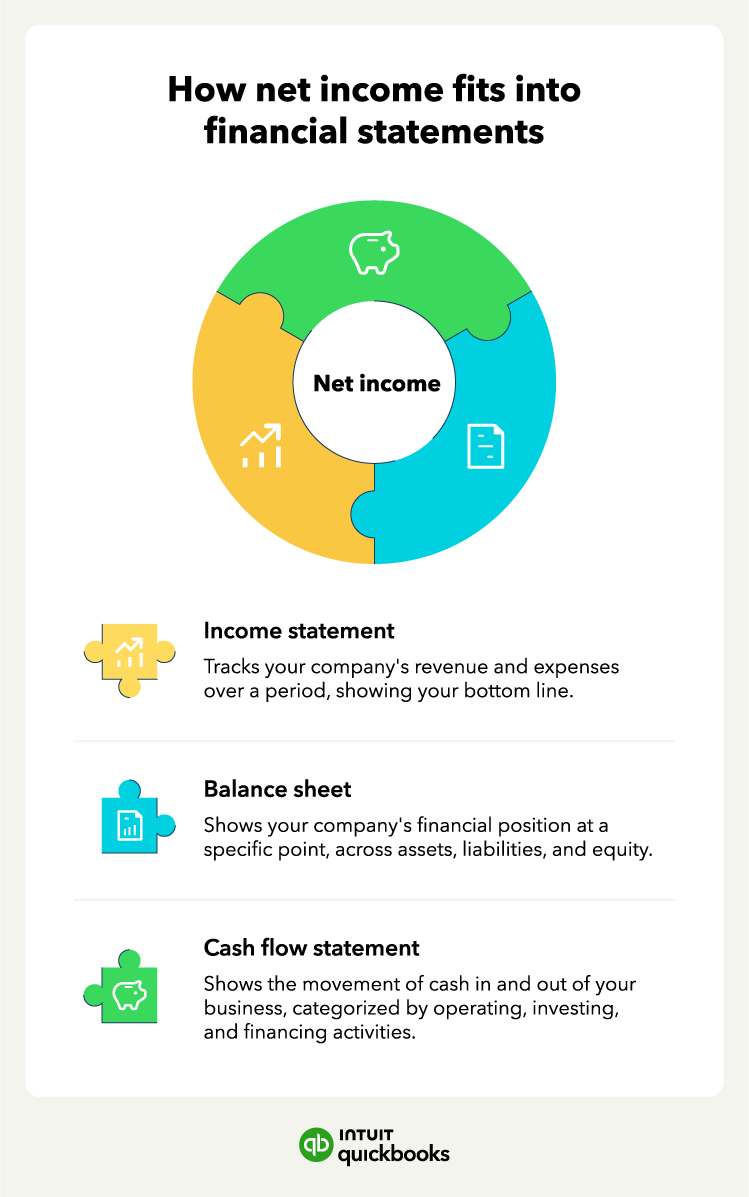

Net income, also known as the "bottom line," is the profit remaining after subtracting all business expenses from your total revenue. It reveals how much money your business makes after accounting for operational costs.

To help you get started, we’ve created this net income formula guide that you can use to calculate your profitability. Below, we’ll define net income, explore how to calculate it, and delve into why it's a necessary metric for understanding your business's financial health.

Jump to: