These reports give you the key data you need to create a forecast and recommend steps your clients can take to maximise their cash flow.

Customer balance detail report

Accounts receivable by customer. You can sort by due date to help prioritise which customers to contact.

- Go to Reports.

- Select Customer Balance Detail in the Who owes you section.

- Select Run report.

- Select Sort and choose to sort by due date in descending order Dues and subscriptions QuickReport

Transactions summary for the dues and subscriptions account.

- Go to Accounting and select Chart of Accounts.

- Filter by Dues & subscriptions.

- Select Run report.

Expenses by supplier summary

Total expenses for each vendor. You can sort by expense total to help prioritise which vendors to contact.

- Go to Reports.

- Select Expenses by Vendor Summary in the Expenses and vendors section.

- Select a report period from the dropdown.

- Select Run report.

- Select Sort and choose to sort by total in descending order.

Open invoices report

Unpaid invoices and statement charges, with totals for each customer.

- Go to Reports.

- Select Open Invoices in the Who owes you section.

- Select Run report.

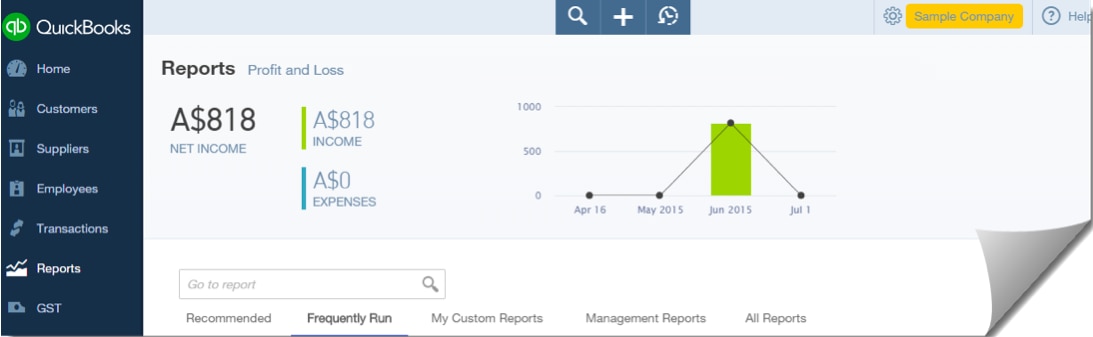

Profit and loss report

Income, expenses, and net income.

- Go to Reports.

- Select Profit and Loss.

- Select Since 90 days ago from the Report period dropdown. Or select Custom and enter a three-month date range.

- Select Run report.

Taxable sales detail report

Sales of taxable products and services.

- Go to Reports.

- Select Taxable Sales Detail in the Sales tax section.

- Select a time frame from the Report period dropdown.

- Select Month from the Group by dropdown.

- Select Run report.

- Go to Settings [add icon] on the report and select Show More.

- Choose Tax Amount and Tax Name to display the tax agency and how much the client owes by month.

Total payroll cost report

Costs associated with paying employees, including taxes.

- Go to Reports.

- Select Total Payroll Cost in the Payroll section.

- Select a time period from the Date Range dropdown.

- Select Run report.

Transaction detail by account report (insurance)

Transactions and totals for the accounts in your chart of accounts. Focus on the insurance accounts to see average monthly insurance expenses.

- Go to Reports.

- Select Transaction Detail by Account in the For my accountant section.

- Select Customise, and then select Filter.

- Choose Distribution Account, and then select the appropriate insurance accounts.

- Select Run report.

Transaction detail by account report (marketing and advertising)

Transactions and totals for the accounts in your chart of accounts. Focus on the marketing and accounts accounts to see related expenses.

- Go to Reports.

- Select Transaction Detail by Account in the For my accountant section.

- Select Customise, and then select Filter.

- Choose Distribution Account, and then select the accounts designated for marketing and advertising.

- Select Run report.

Transaction detail by account report (meals and entertainment)

Transactions and totals for the accounts in your chart of accounts. Focus on the meals and entertainment accounts to see related expenses.

- Go to Reports.

- Select Transaction Detail by Account in the For my accountant section.

- Select Customise, and then select Filter.

- Choose Distribution Account, and then select the accounts designated for travel, meals, and entertainment.

- Select Run report.

Transaction detail by account report (liabilities)

Transactions and totals for the accounts in your chart of accounts. Focus on the liability accounts to identify lenders.

- Go to Reports.

- Select Transaction Detail by Account in the For my accountant section.

- Select Customise, and then select Filter.

- Choose Distribution Account, and then select All Liability Accounts from the dropdown.

- Choose Vendor, and then select the appropriate vendors from the dropdown.

- Select Run report.

Unpaid bills report

Unpaid bills, with due dates and days past due.

- Go to Reports.

- Select Unpaid Bills in the What you owe section.

- Select a report period from the dropdown.

- Enter your due date.

- Select Run report.