Factors for estimating depreciation

There are various factors that need to be considered in order to calculate the amount of depreciation to be charged in each accounting period. These include:

Cost of the asset

The cost of the asset is also known as the historical cost. It comprises the purchase price of the fixed asset and the other costs incurred to put the asset into working condition. These costs include freight and transportation, installation cost, commission, insurance, etc.

Salvage value

The salvage value is also known as the net residual value or scrap value. It is the estimated net realisable value of an asset at the end of its useful life. This value is determined as a result of the difference between the sale price and the expenses necessary to dispose of an asset.

Estimated useful life

The commercial or economic life of an asset is called the useful life of an asset. When the useful life of an asset is estimated, its physical life is not taken into consideration. This is because an asset might be in good physical condition after a few years but it may not be useful for production purposes.

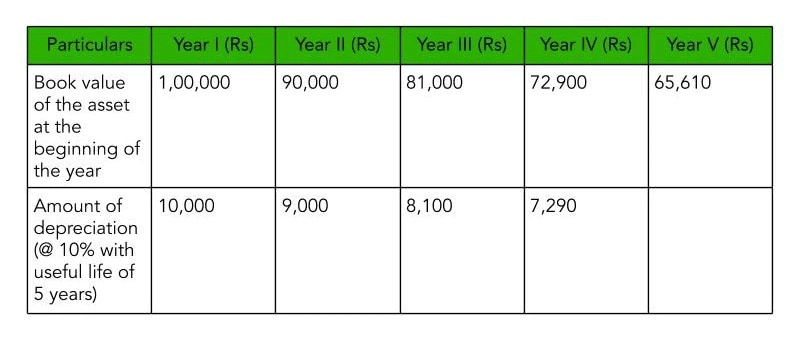

Method of depreciation

You need to determine a suitable way to allocate the cost of the asset over the periods during which the asset is used. Generally, the method of depreciation to be used depends upon the patterns of expected benefits obtainable from a given asset. This means that different methods will apply to different types of assets in a company.

However, in reality, companies do not think about the service benefit patterns when selecting a depreciation method. In general, only a single method is applied to all of the company’s depreciable assets.

_resized900x600.jpg)