What about tax file declaration forms?

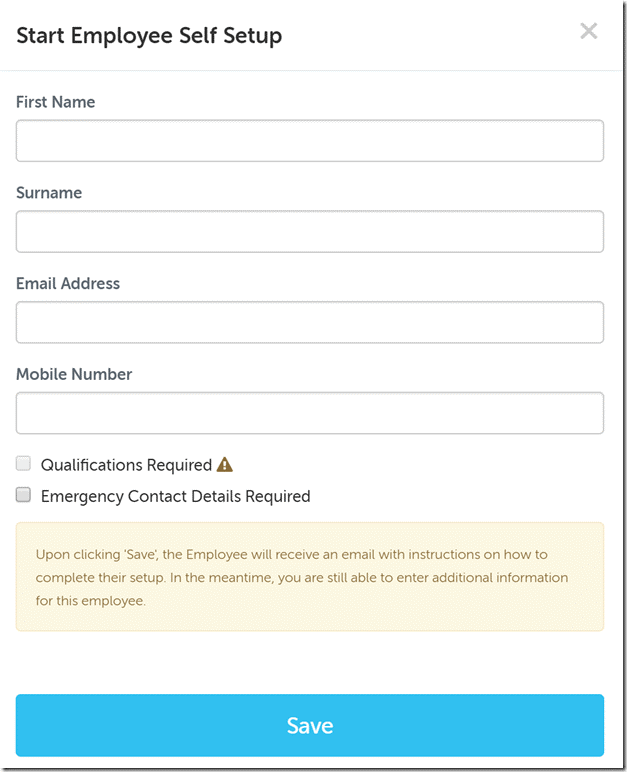

One of the best features about employee onboarding is that it eliminates the need for a paper tax file declaration form. If an employee supplies their mobile phone number, we’ll send them a verification code during the setup process to confirm their identity and once they’re verified, you can submit their details direct to the ATO using the inbuilt SBR lodgement and you’re done.

Employee onboarding is not only the simplest way to onboard new employees, but it also ensures you’ve met your reporting obligations. The best part is that employee onboarding is available right now to all Employment Hero users. As always, if you have any questions or feedback, please contact support@yourpayroll.com.au