You can manage your GST obligations to the ATO in QuickBooks Online if your small business is registered for GST. Your Accountant or Bookkeeper can help you register.

Setting up GST in QuickBooks Online

How to turn on GST tracking

As a default GST is not setup so you will need to switch this on. If you are not registered for GST you do not have to set this up. This makes entering your transactions easier as your sales and purchase forms will be GST code free.

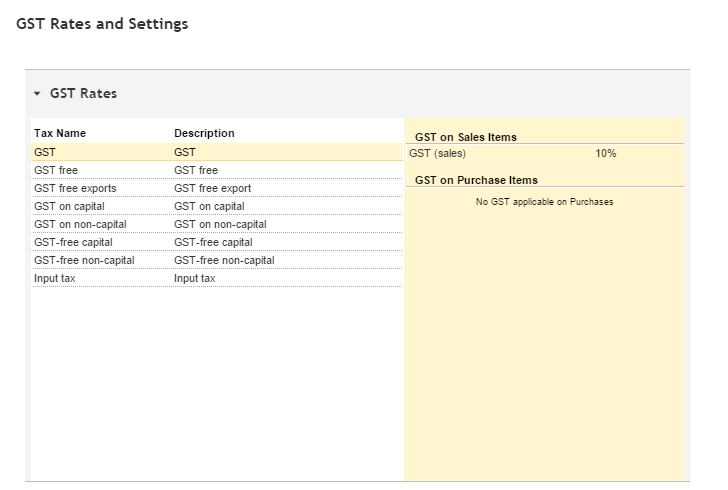

We will take a look at the default GST codes that are generated in the system once GST is set up. In QuickBooks Online the sales and purchases forms have separate codes. Make sure that the GST is setup prior to any transactions being entered.

Left hand side navigation bar GST > Click Set up GST.

Complete the information required. Ensure you choose the correct GST method that you are registered for:

- Cash or Accruals

- Lodging frequency: monthly, quarterly, half-yearly or yearly

- Any PAYG instalments

- Any other taxes such as WET, Luxury Car Tax, Fringe Benefit Tax or Fuel tax credit (QuickBooks Online will not generate codes for these additional taxes)

Click Rates & settings and the default tax codes are automatically generated. See the GST codes below.

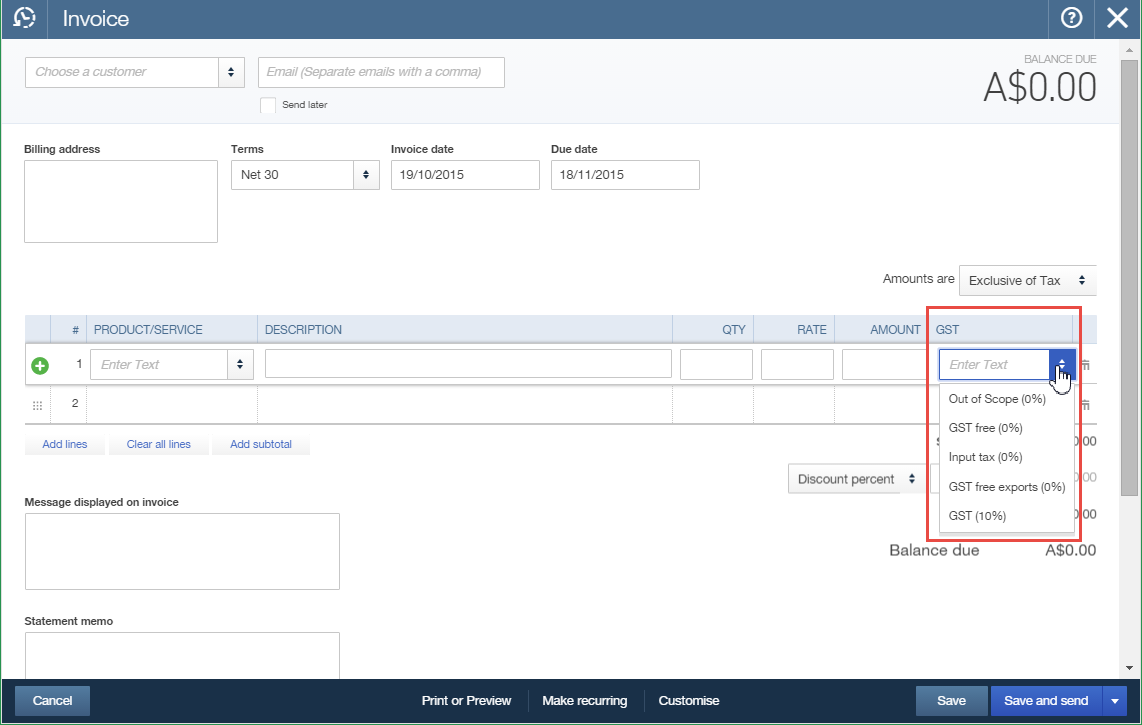

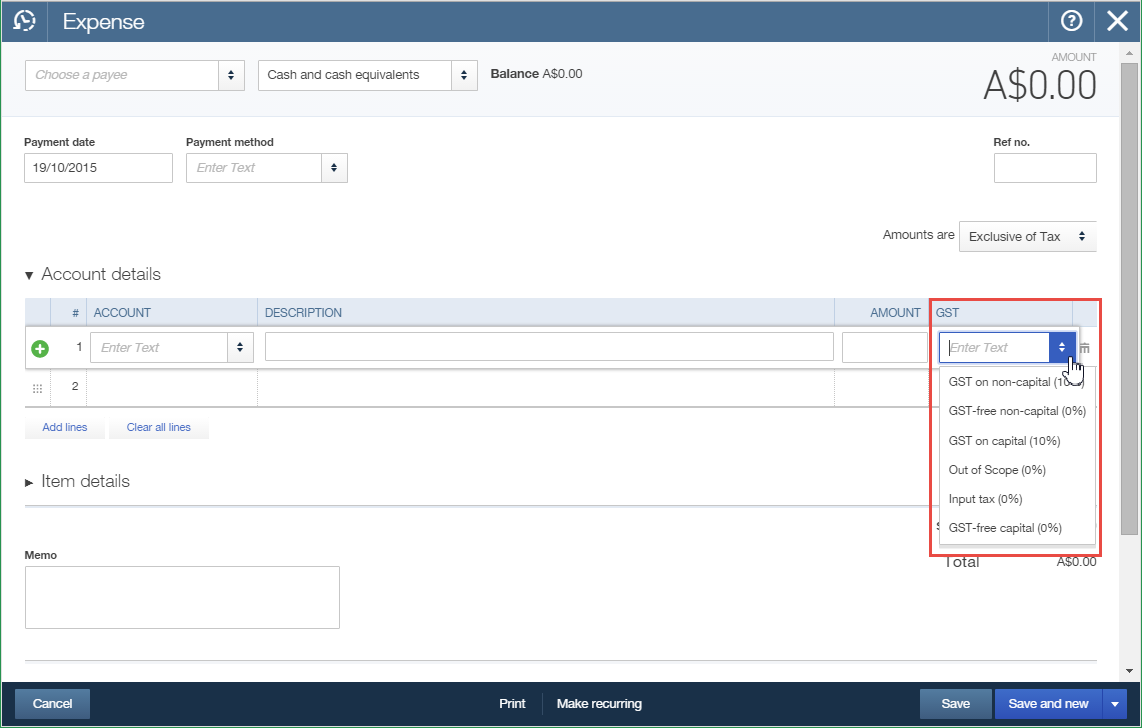

The GST codes are to be used for either sales or purchases, and are separated as shown.

Sales Items Codes

- GST: GST on sales 10%

- GST free: GST free on sales 0%

- Input tax: input taxes on Sales 0%

- GST free export: GST free on Exports 0%

- Out of Scope: sales items that are not related to GST 0%

Purchase Items Codes

- GST on capital: GST if you have purchased any capital items 10%

- GST on non-capital: GST on any purchases 10%

- GST-free capital: GST free on capital items 0%

- GST-free non-capital: GST free on any purchases 0%

- Input tax: input tax on purchases 0%

- Out of Scope: purchase items that are not related to GST 0%

Setting Up Codes That Are Not Generated

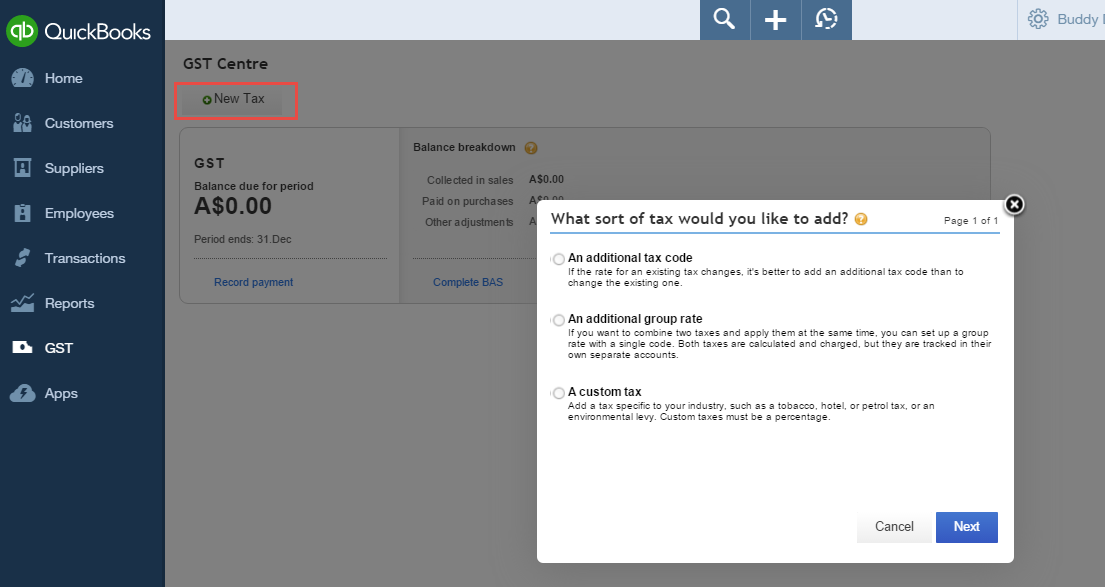

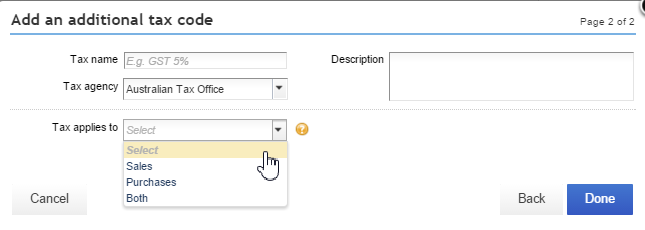

GST codes that are not system generated can be set up in the GST Centre.

Left hand side navigation bar GST > Click New Tax.

Choose from the following codes to be added:

- An additional tax code

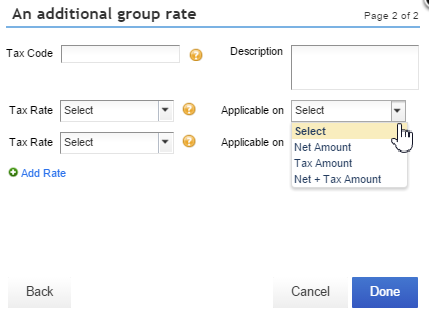

- An additional group rate

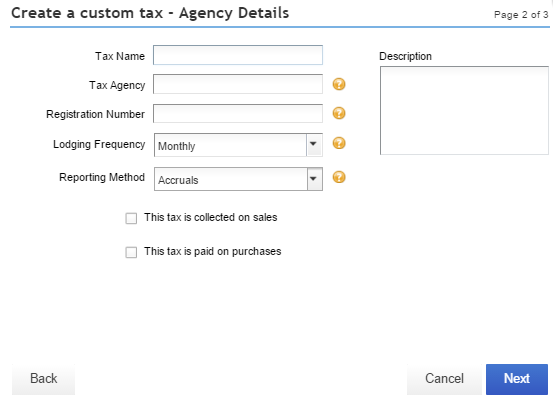

- A custom tax

Additional Information

Goods and services tax (GST) is a broad-based tax of 10% on most goods, services and other items sold or consumed in Australia. Check out the links below for more information in relation to GST and different reporting requirements:

Related Articles

Looking for something else?

Stay up-to-date with the latest small business insights and trends!

Sign up for our quarterly newsletter and receive educational and interesting content straight to your inbox.

Want more? Visit our tools and templates!