Whether you’re a freelancer or a small business owner, you can download one of QuickBooks’s free invoice templates for your specific needs.

Just find the invoice template that suits you, download one of our blank invoice templates in Excel, Word, or PDF, create your invoice and send it to your clients.

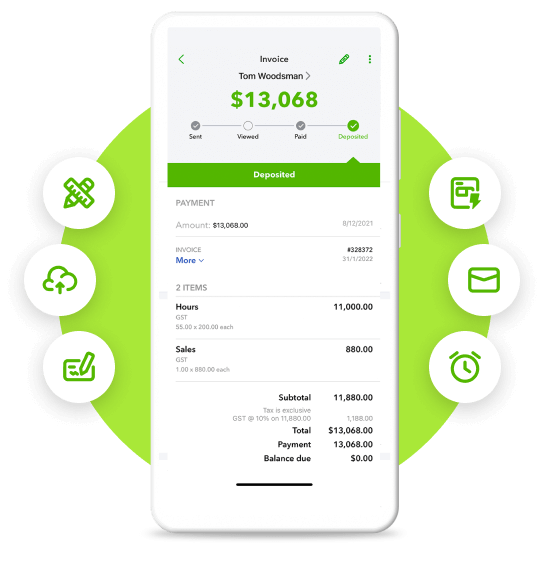

Get tips on what to include according to what you do and how to use professional Invoicing Software to get paid fast through online payments or credit cards.