For accounting professionals. Not an accountant?

Year-end Workpapers

Clear and concise data to help you fly through tax prep and filing. Learn how to streamline your year-end workflow right in QuickBooks.

Efficient year-end adjustments and analysis

Efficient workflow

Work directly in your client’s books without using extra tools. There’s no need to export, you’re only one click away from your workflow.

Reduce manual entry

GIFI Mapping pre-populates account balances to specific GIFI tax codes and you can make multiple adjustments in the books at once.

Preserve peace of mind

Your progress is automatically saved and backed up so your numbers are preserved while working in the client’s file.

Simplify your year-end

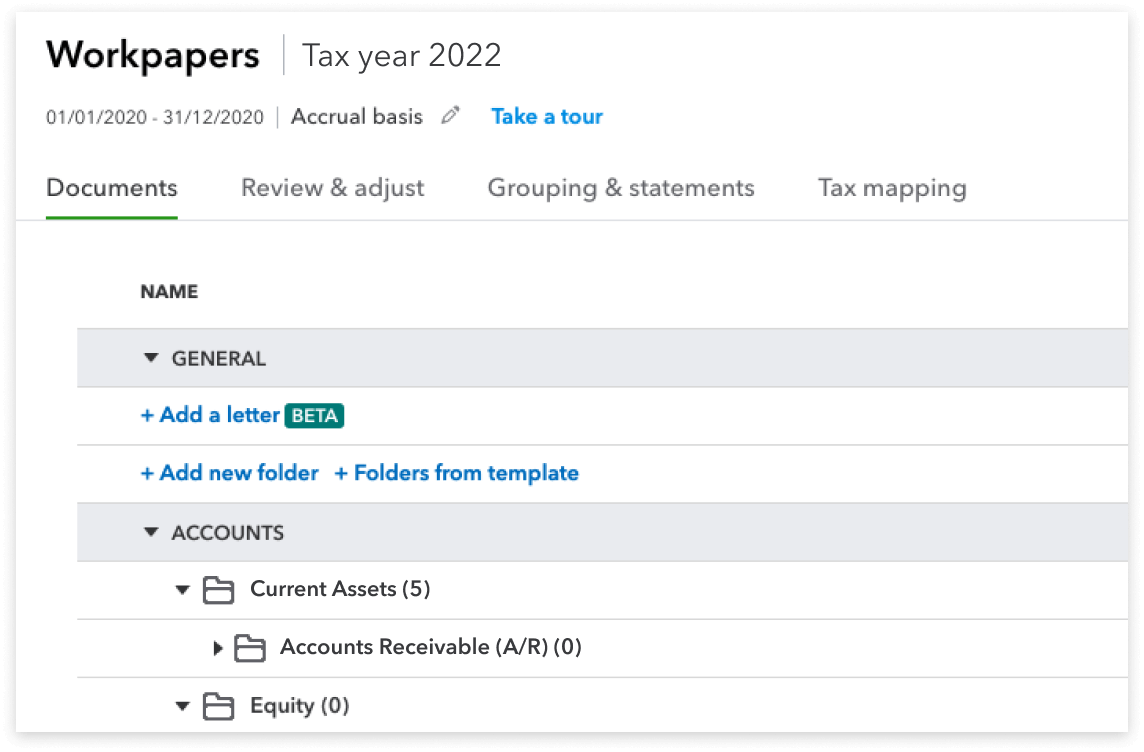

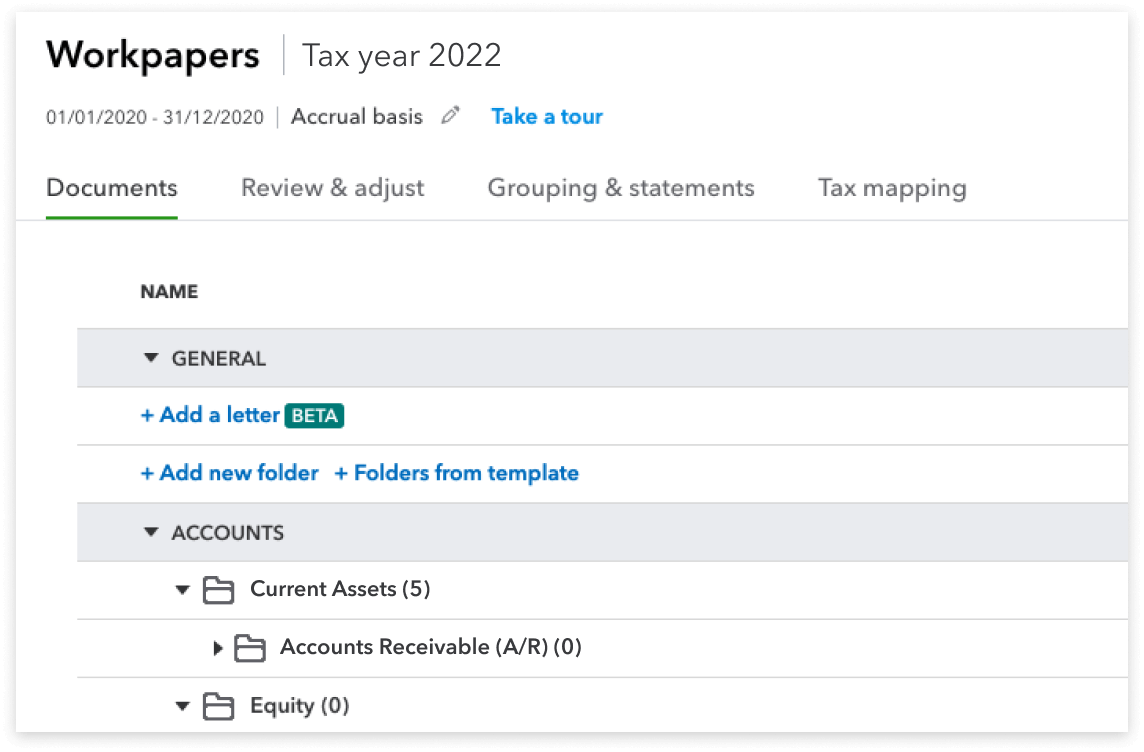

Document Manager

Get a single place to store and organize the documents you need to complete a client engagement. With everything in one spot, there’s no more transferring files between computers, hard drives, or other software.

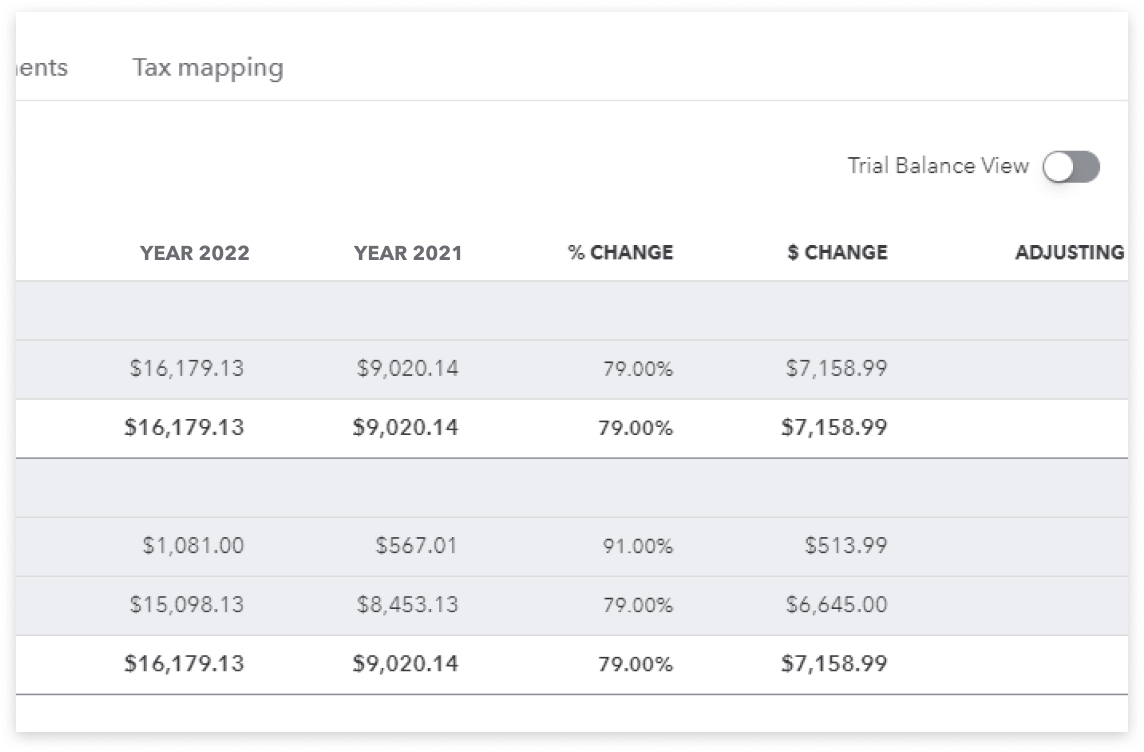

Adjusting entries

Eliminate the need to export data by comparing prior and current tax-year data side by side. Then record new activity in a separate Adjusting Entries field, which captures your changes directly to the books while preserving Workpapers data.

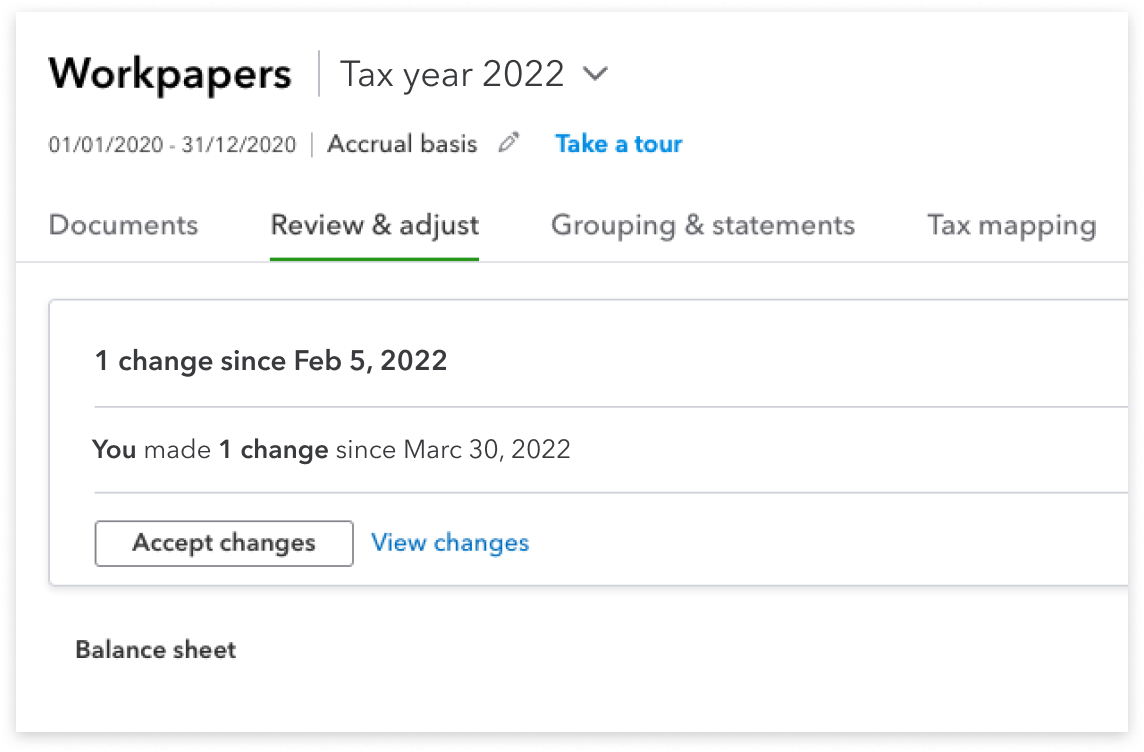

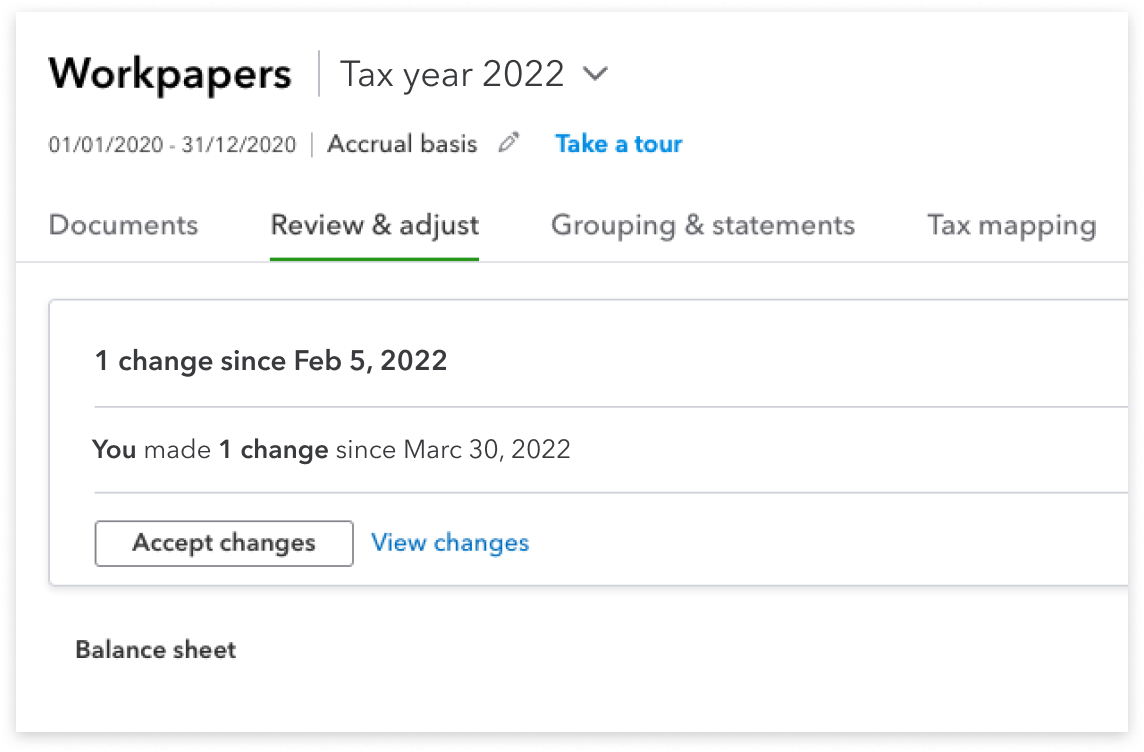

Change notifications

Get alerted of new changes to the books, then accept the changes into Workpapers.

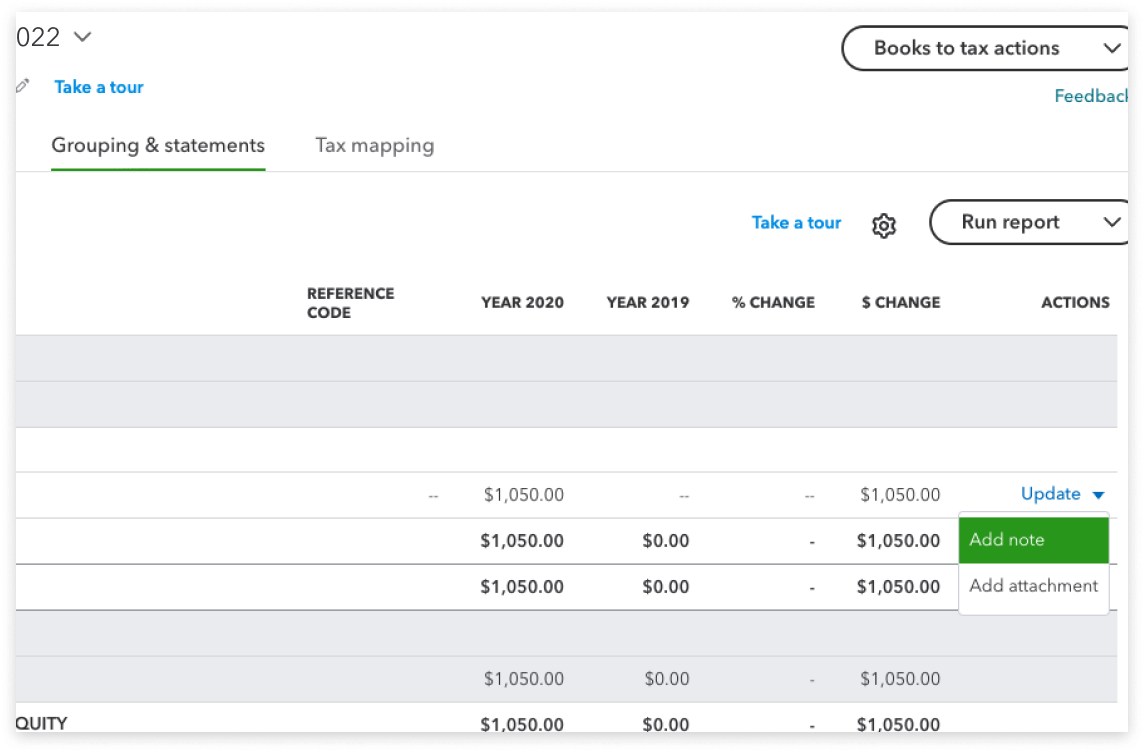

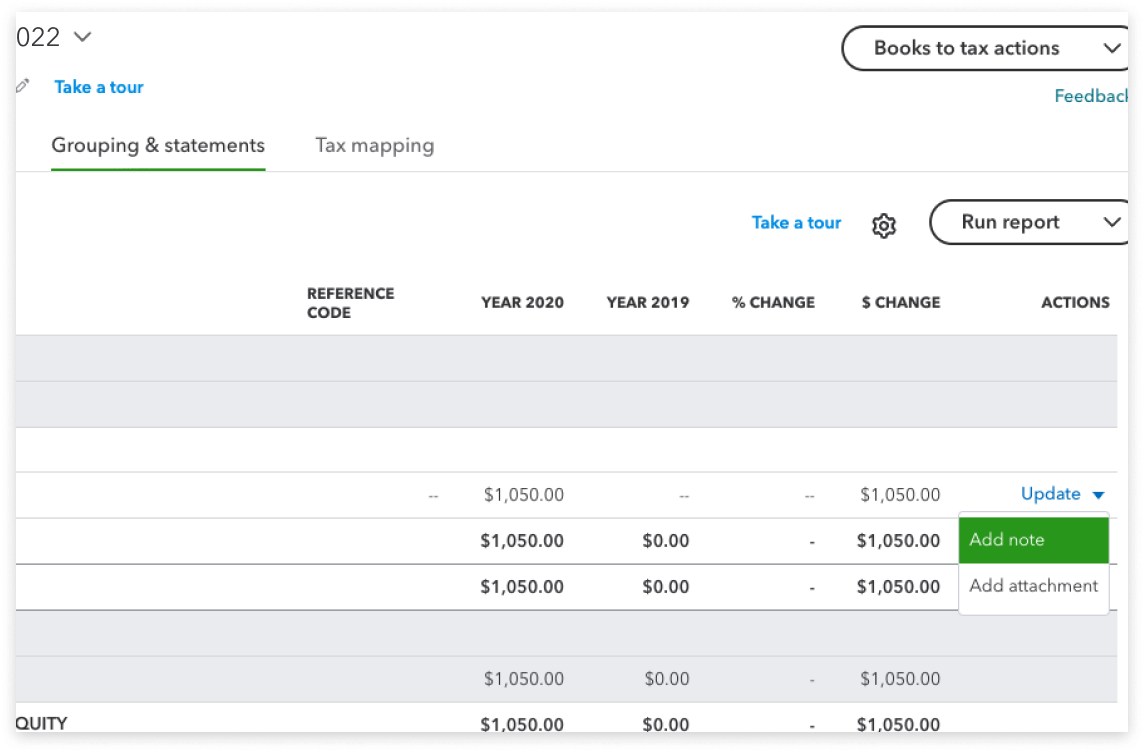

Organize financial statements

Arrange accounts into groups to get a simplified report when you prepare financial statements. Add notes, attachments and reference codes to customize your reports. Then, export the report into Excel.

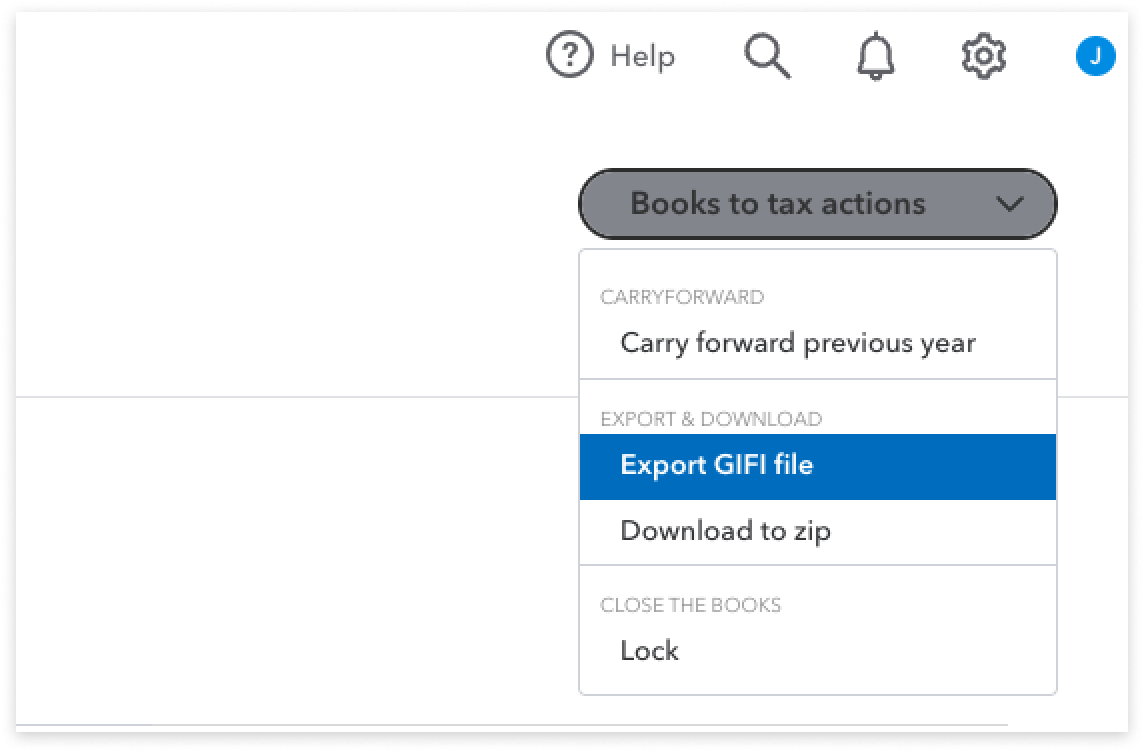

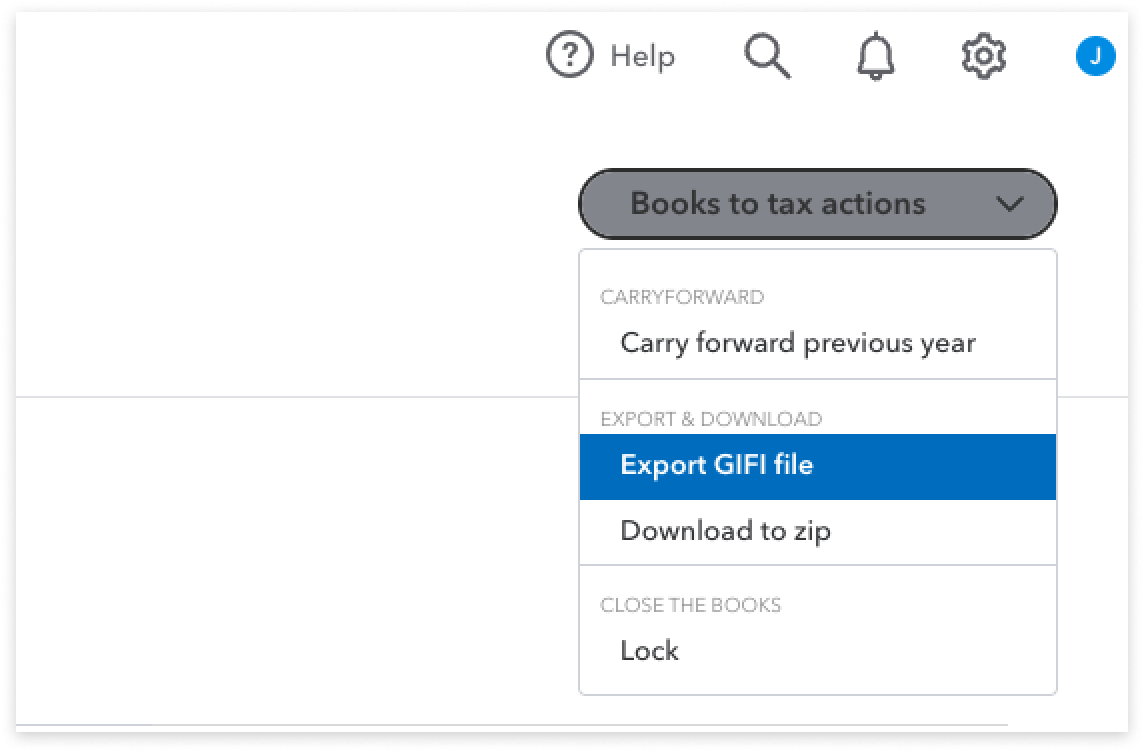

GIFI mapping & export

Easily review and re-assign GIFI tax codes. When you’re ready, you can export to ProFile, Excel, and other tax software. And export everything with one click for practice review or archival.

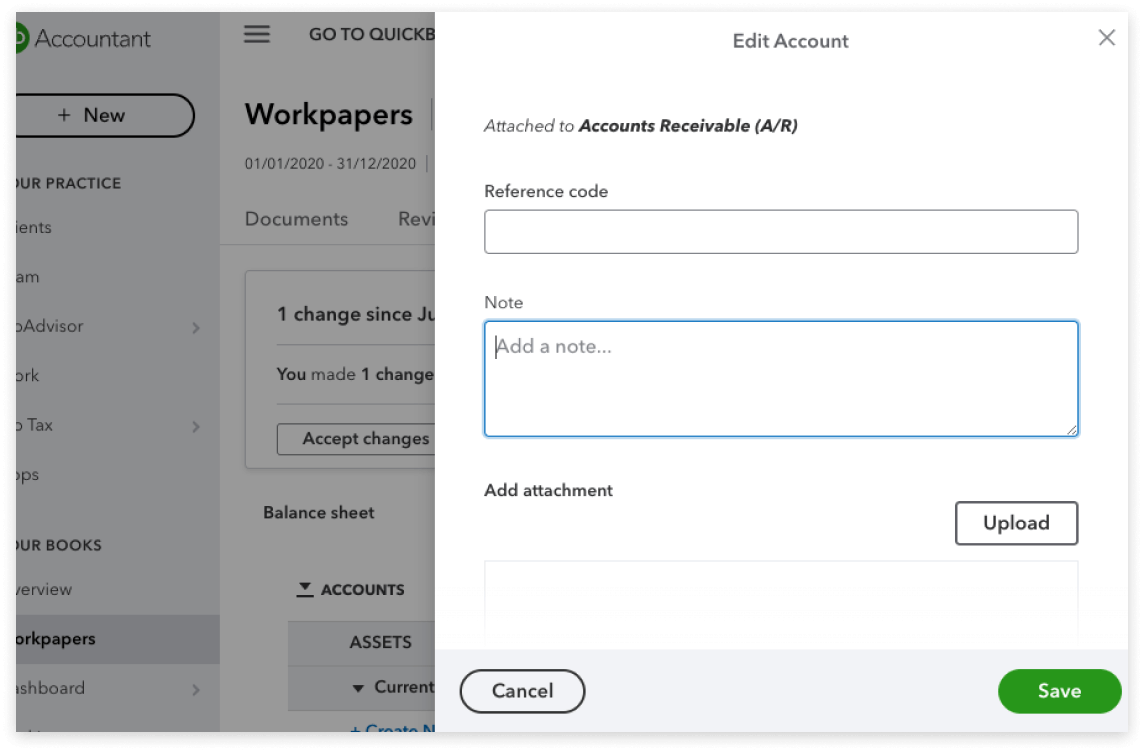

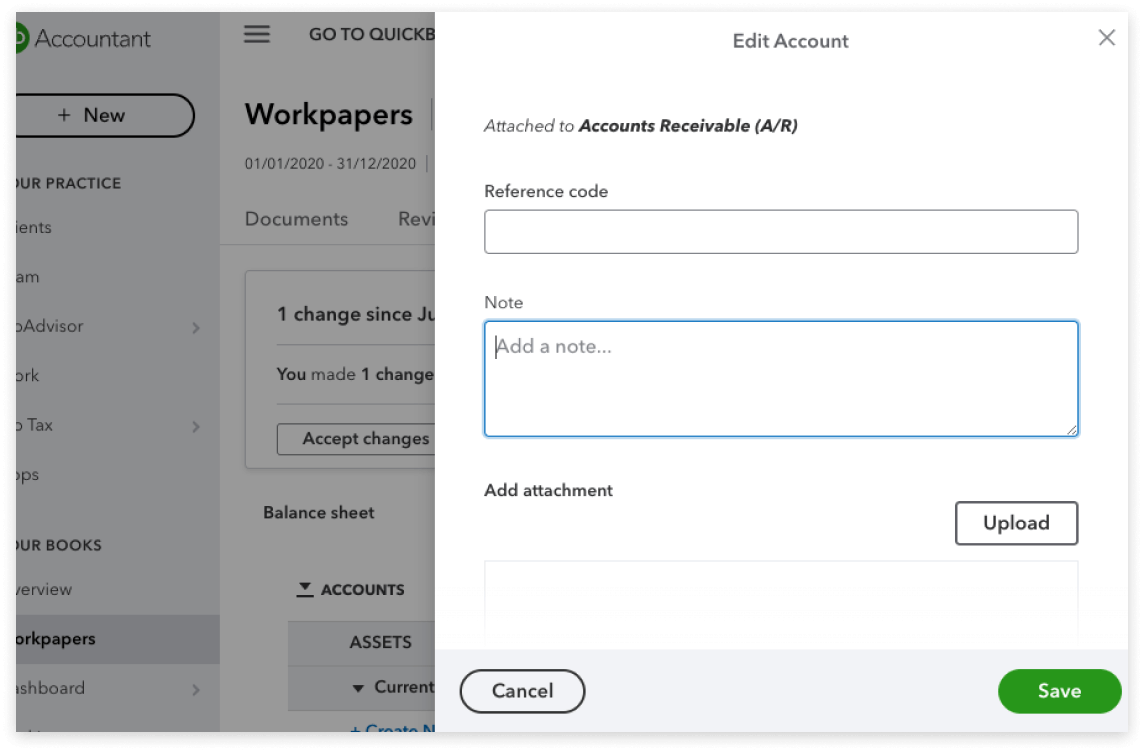

Add notes and attachments

Add accountant-level notes and attachments for each account directly in Workpapers. This gives you a clear record of changes and an easy-to-follow paper trail for future reference.

Document Manager

Get a single place to store and organize the documents you need to complete a client engagement. With everything in one spot, there’s no more transferring files between computers, hard drives, or other software.

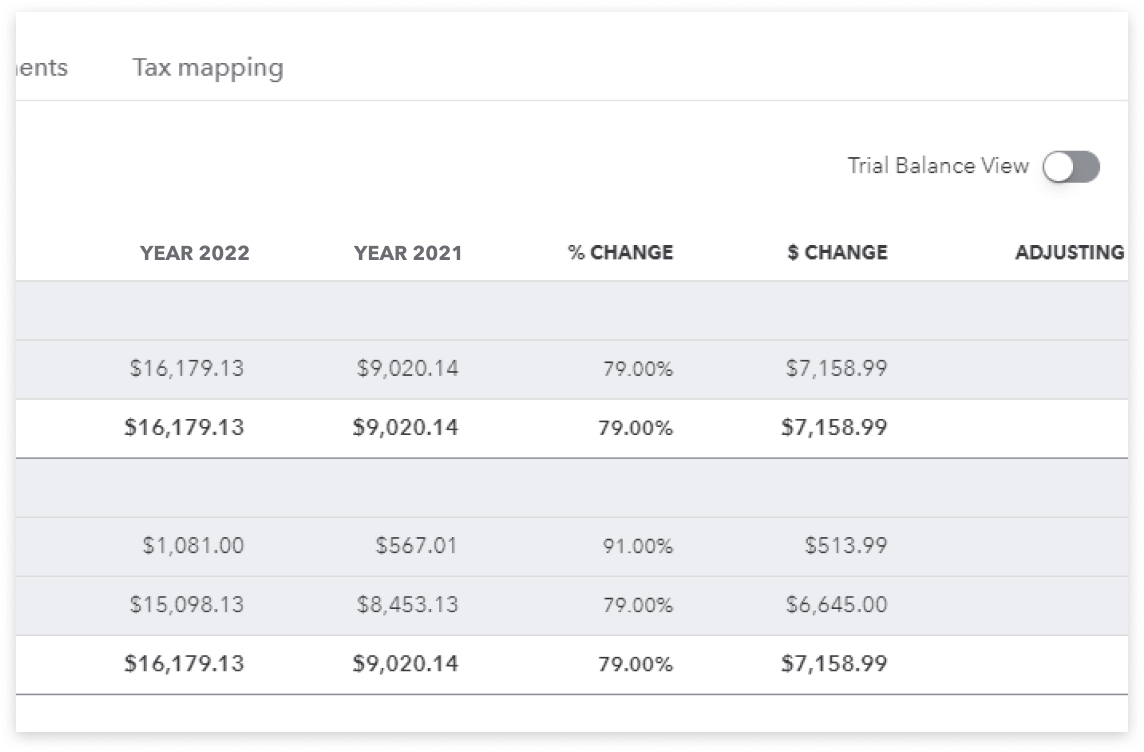

Adjusting entries

Eliminate the need to export data by comparing prior and current tax-year data side by side. Then record new activity in a separate Adjusting Entries field, which captures your changes directly to the books while preserving Workpapers data.

Change notifications

Get alerted of new changes to the books, then accept the changes into Workpapers.

Organize financial statements

Arrange accounts into groups to get a simplified report when you prepare financial statements. Add notes, attachments and reference codes to customize your reports. Then, export the report into Excel.

GIFI mapping & export

Easily review and re-assign GIFI tax codes. When you’re ready, you can export to ProFile, Excel, and other tax software. And export everything with one click for practice review or archival.

Add notes and attachments

Add accountant-level notes and attachments for each account directly in Workpapers. This gives you a clear record of changes and an easy-to-follow paper trail for future reference.

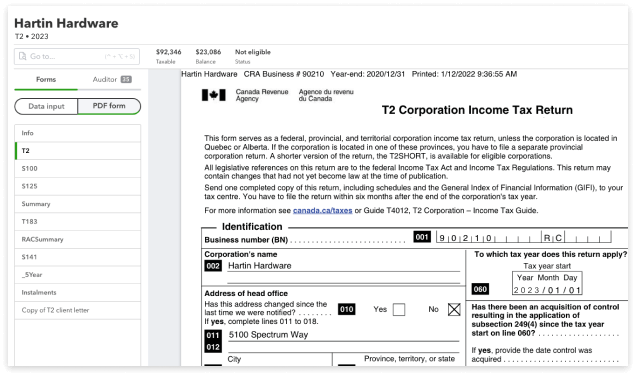

Pro Tax T2: File corporate returns from QuickBooks

File tax returns with the tried and true: ProFile

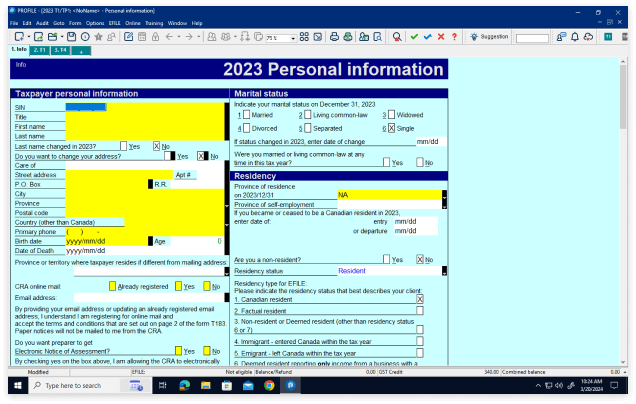

You can export the GIFI codes in Workpapers to ProFile, saving you manual entry and simplifying your workflow. A single install of ProFile gives you access to all years and modules and the real-time auditor highlights potential errors as you work. Other features include:

- File a group of corporations easily with Corporate Linking

- CRA tools built in like AFR and ReFILE

- Switch ProFile between computers using one license

- Forms for all of Canada