Monday - Friday, 9 AM to 6:30 PM ET

Introducing QuickBooks Ledger, a cost-effective plan for your year-end clients. Designed exclusively for accounting professionals this solution is ideal for tax-only, or multi-company clients with non-operating entities.

Powered by AI, QuickBooks will automatically suggest account categories for each imported transaction making it faster for you to match them to the right account.

Experience a more efficient budgeting process with QuickBooks Online Plus and Advanced by importing your budgets divided by class, customer, or location with ease using custom Excel templates.

Accomplish your work with ease using the new task icon in the QuickBooks Online Advanced navigation bar. It enables you to access your tasks directly from wherever you are in QuickBooks Online, eliminating the need to switch between pages to complete tasks.

The Revenue Recognition feature in QuickBooks Online Advanced now offers you the flexibility to customize revenue recognition schedules tailored to your specific business needs. This feature significantly reduces the time spent on complex manual calculations, making it ideal for subscription-based revenue recognition and more.

Stay on top of sales tax deadlines. Set up custom email reminders in QuickBooks and receive notifications for upcoming sales tax submissions.

The new Bookkeeper role provides you with more flexibility to manage user access when handling your accounting tasks. Plus, we've simplified and renamed three existing roles to provide more appropriate access to features and data, giving you a more personalized user experience.

You can now customize your accounting settings to suit your business needs. Choose between cash or accrual accounting methods, and set up your chart of accounts as per your business structure.

Create custom chart of accounts templates to match your business structure and accounting needs. You can also customize your chart of accounts by adding or removing accounts.

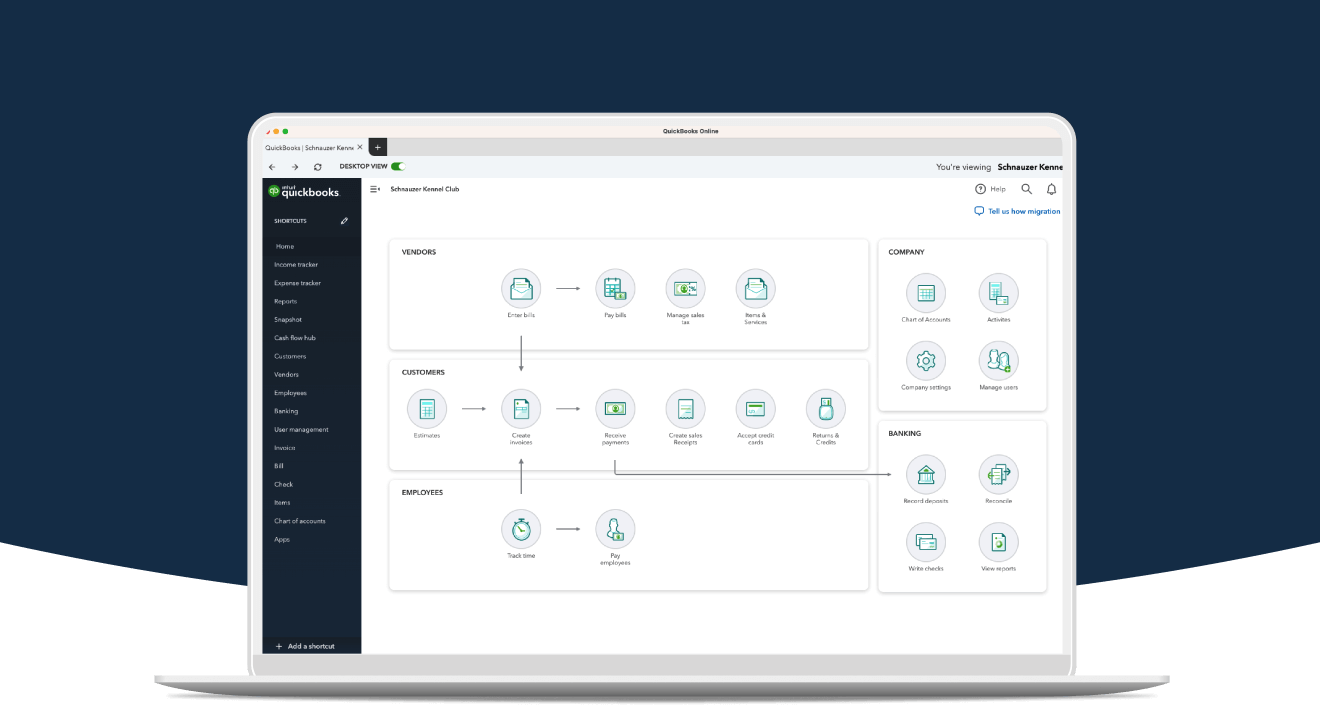

The latest QuickBooks Online menu removes the Business View navigation and brings all QuickBooks Online users back to one navigation. This gives you quick access to your most important job centres like invoicing, banking, employee management, and more.

Add statutory holiday pay for your employees across Canada on QuickBooks Payroll.

In QuickBooks Online Advanced, you can now add and manage fixed assets with ease. With this feature, you can easily track your fixed assets, including equipment, vehicles, and property, and manage their depreciation over time.

Streamline budget creation and editing, saving you time and simplifying your budget planning process. Our user-friendly feature lets you create a budget plan matching your business goals, track the progress over time, and customize settings for accurate financial reporting. Synchronize your budget with a spreadsheet for even more efficient financial management.

Managing employee documents just got easier. Upload documents easily, ranging from resumes to contracts, and store them all in one location. QuickBooks Online automates employee document management, saving you time and relieving you of manual document management hassle.

Keep up with government regulations with our new feature that simplifies dental code management.

Looking for personalized recommendations on how to get the most out of QuickBooks Online? The new Get Things Done page suggests actions, to-dos, and tips relevant to you. View your bank balances directly on this page, quickly set up customers, check on your payroll health, and more.

QuickBooks Online's employee document upload feature stores and manages employee documents in one place. Upload and manage contracts, resumes, and performance reviews. Streamline document management processes and improve employee satisfaction.

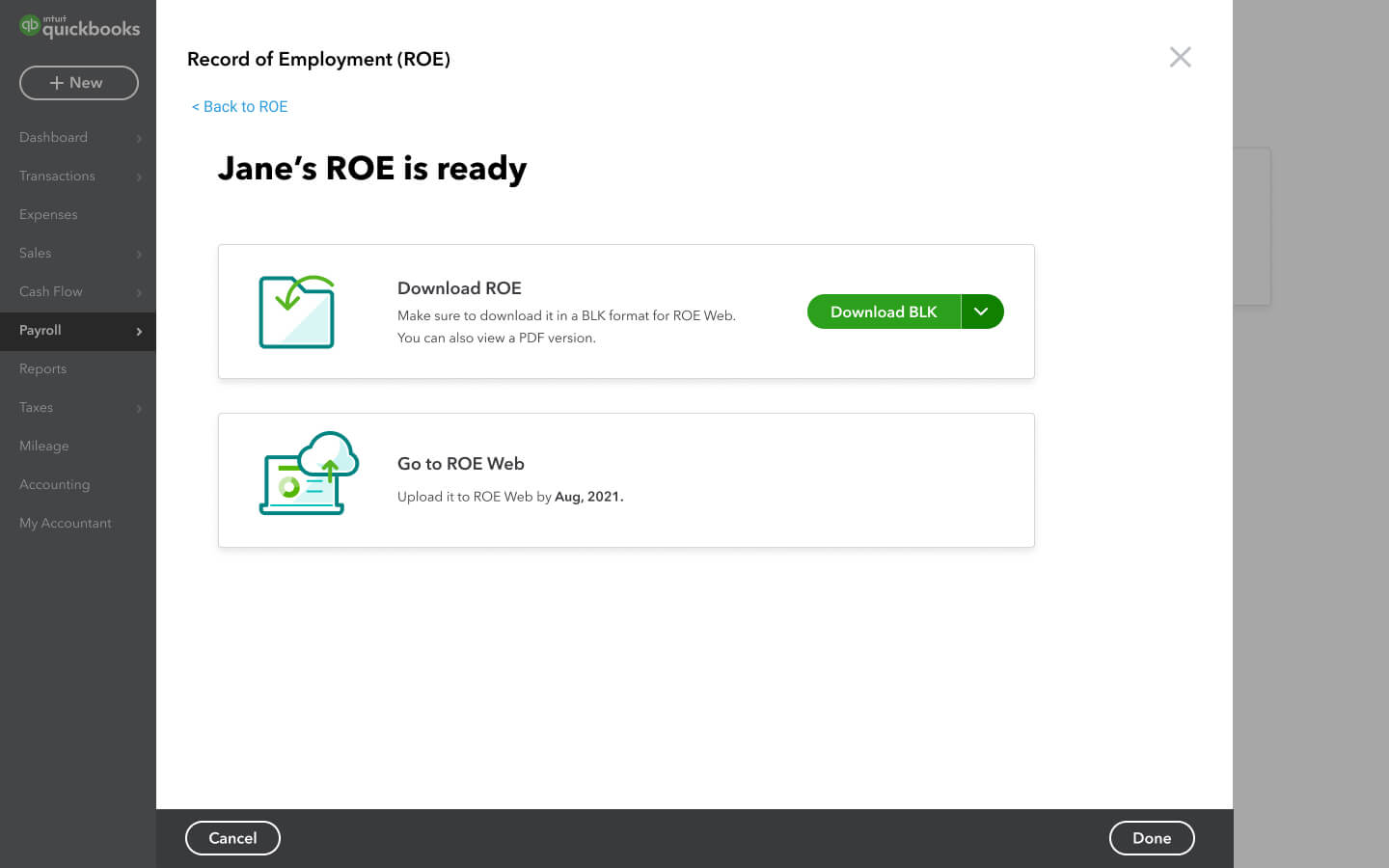

The QuickBooks Workforce mobile app allows employees to view pay stubs and tax slips like the T4 and RL-1 online. Additionally, with QuickBooks Payroll Premium or Elite employees

Instead of manually matching each credit card transaction, QuickBooks can do this work for you by automatically matching bank deposits (invoice payments and sales deposits) that correspond to QuickBooks Payments transactions.

QuickBooks Payroll’s new tax centre enhancements provide easier navigation, visibility, and clarity to help complete T4/RL-1 filings. This includes a simplified process of managing employees, and you can now file year-end forms for the current tax year if a customer closes their business.

QuickBooks Payroll simplifies your payroll processes with a new feature that helps you manage employee payroll and deductions. Automate your payroll processes, ensure accuracy and compliance, and focus on growing your business.

Get a clear view of your finances and reduce manual errors by automatically recording deferred revenue in QuickBooks.

The QuickBooks Online desktop app lets you work more efficiently by staying signed in and easily flipping between multiple tabs and companies.

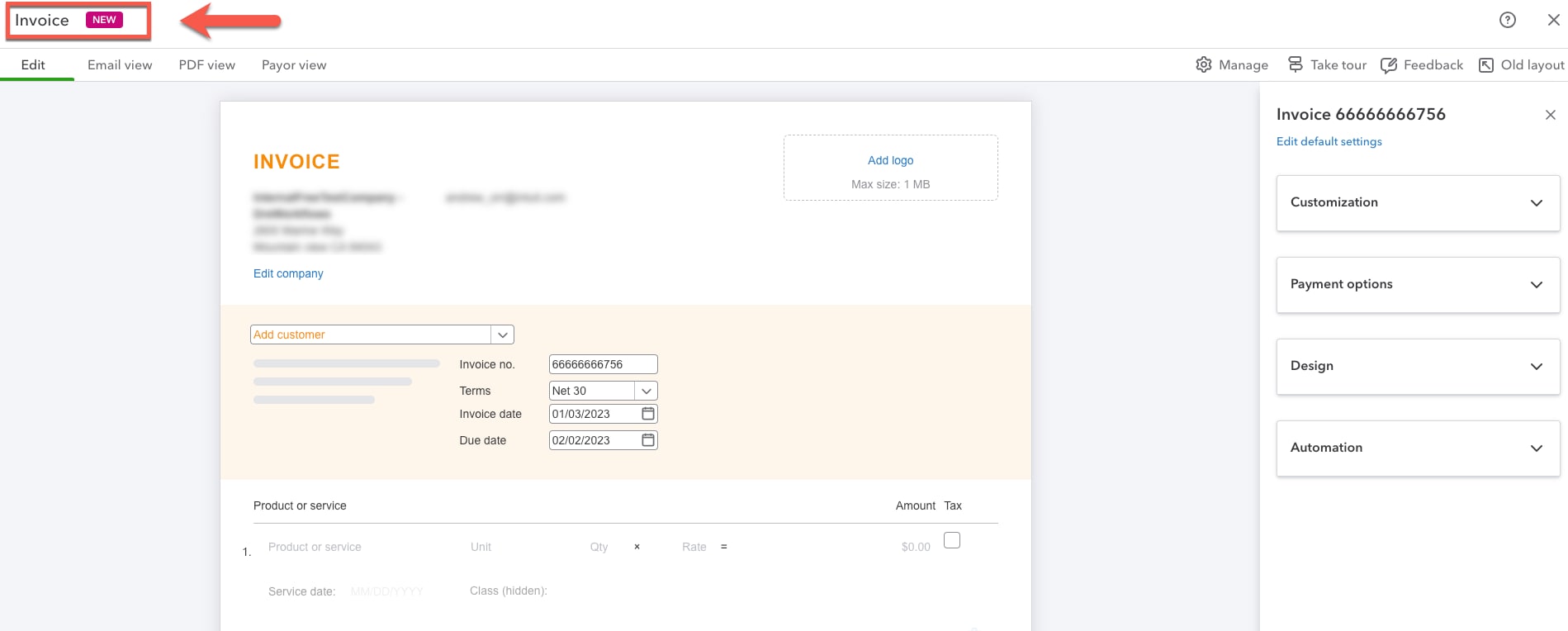

The new estimates and invoices experience makes it easier to send invoices in your custom template. You can now adjust your forms right on the estimate or invoice you are about to send, making it faster to customize what you send to customers. Seamlessly start new projects with professional-looking templates and option to copy existing estimates and invoices.

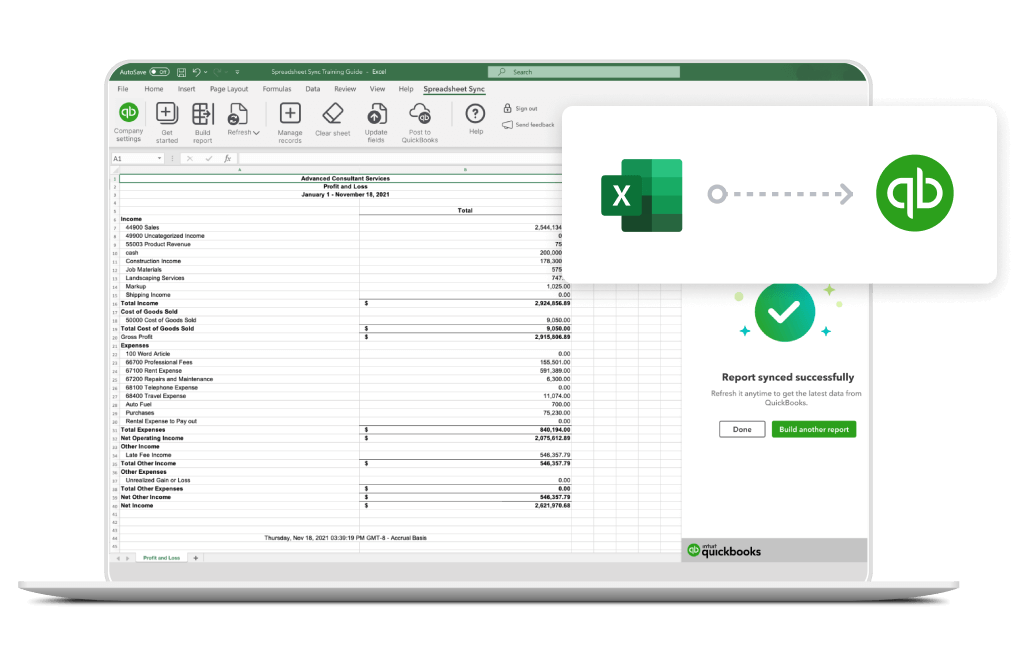

QuickBooks Online now offers the ability to combine select reports from multiple companies using SpreadSheet Sync. Easily view and analyze financial data from multiple companies in one place.

Accountants can utilize the “Documents” tab to collect, store, and collaborate with firm members on important documents that lead up to the clients’ fiscal year-end.

Seamlessly send data back and forth between QuickBooks Online Advanced and Excel for more accurate business data and custom insights.

With the custom report builder in QuickBooks Online Advanced, you can now visualize company performance by making graphs, charts and tables with your data.

Save time when you create and edit multiple invoices in QuickBooks Online Advanced.

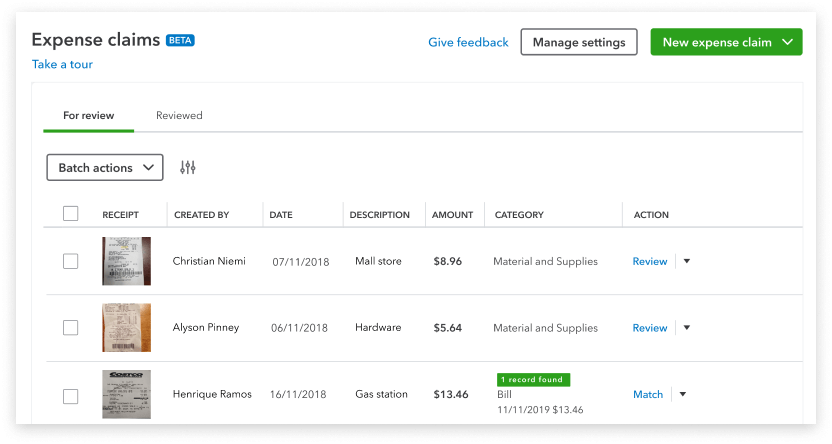

You can now invite employees to submit expenses and receipts to QuickBooks Online Advanced so you can review and add them straight to the books.

Create custom reports from scratch with the custom report builder in QuickBooks Online Advanced.

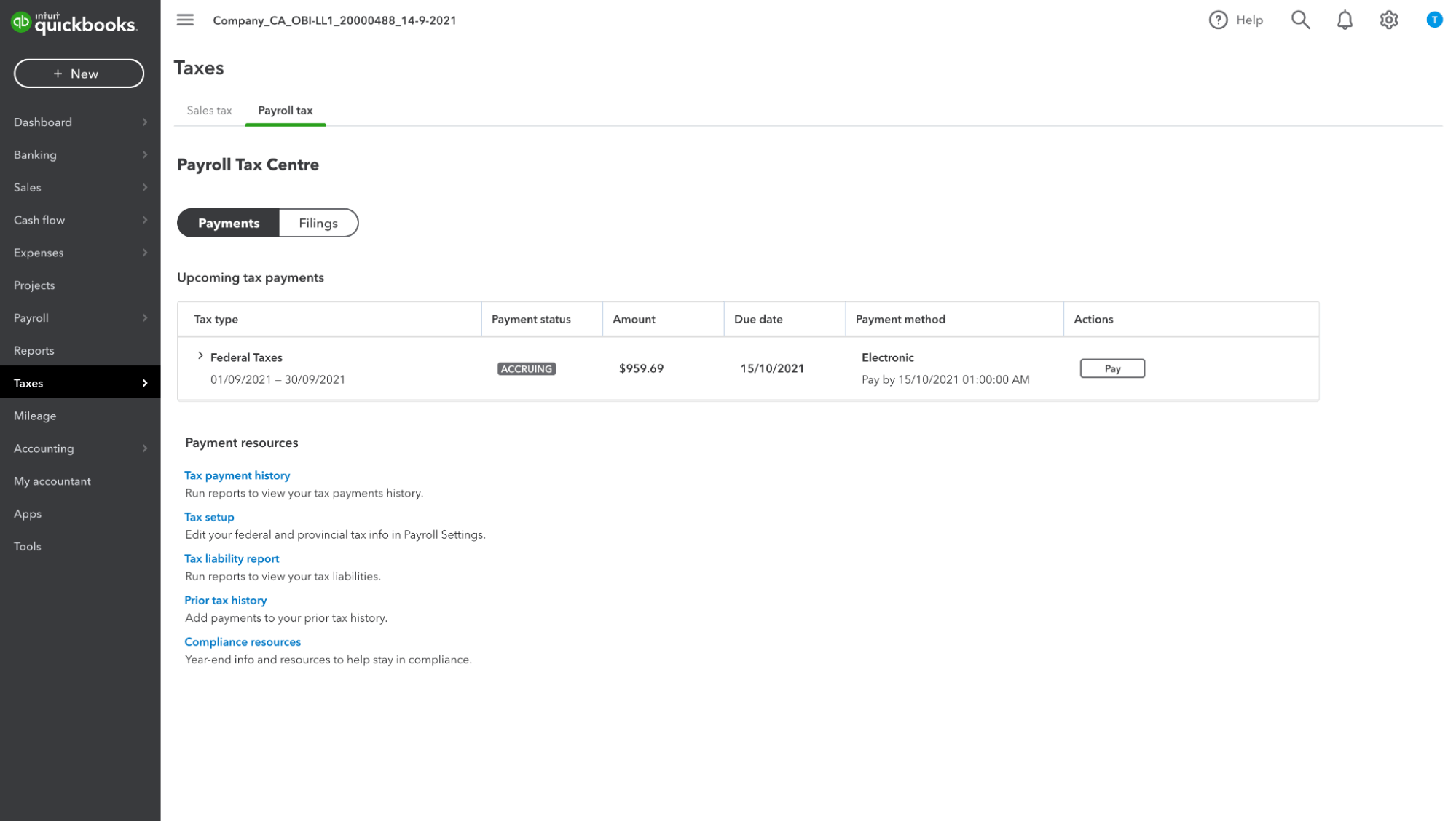

You can submit your payroll tax payments electronically to the CRA or Revenu Québec, right from QuickBooks. With E-Pay, there's no more need for manual payments each month. Simply make your payment directly within the Payroll Tax Centre in QuickBooks.

You can now pay your wholesale billing subscriptions using PayPal. Update your payment information to be able to use.

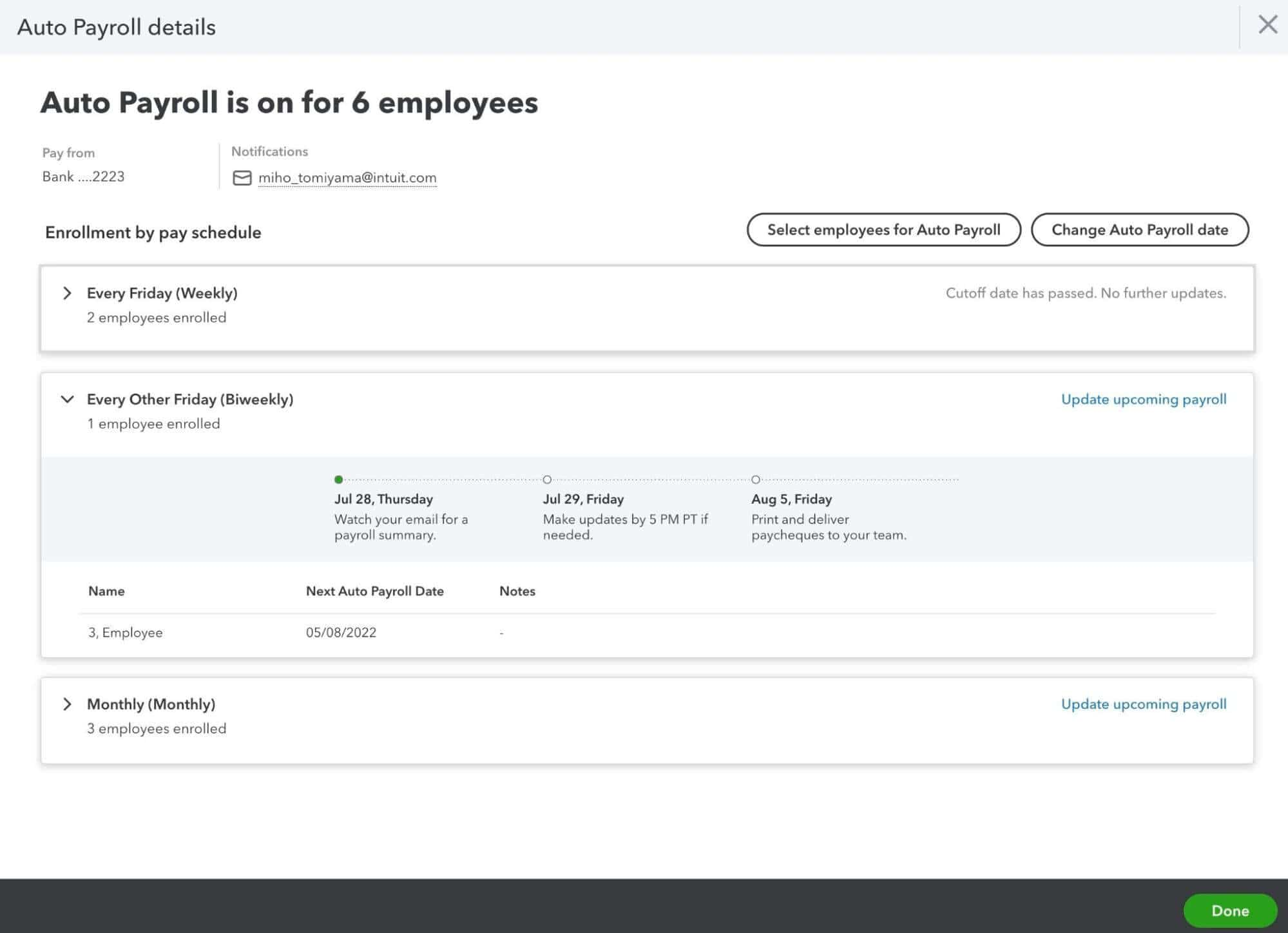

Save time running payroll each payday with Auto Payroll. Set employees up on direct deposit or cheques, and easily review and make changes, like adding commission or bonuses.

QuickBooks Online Advanced is the most powerful QuickBooks Online solution designed to accelerate the success of your growing business with deeper automation, customization and room to grow.

The Books review feature keeps track of outstanding tasks in your client’s books so you know exactly what needs to be done for month-end. Use it to easily tie up loose ends like incomplete transactions, reconciliations, account balances, and more.

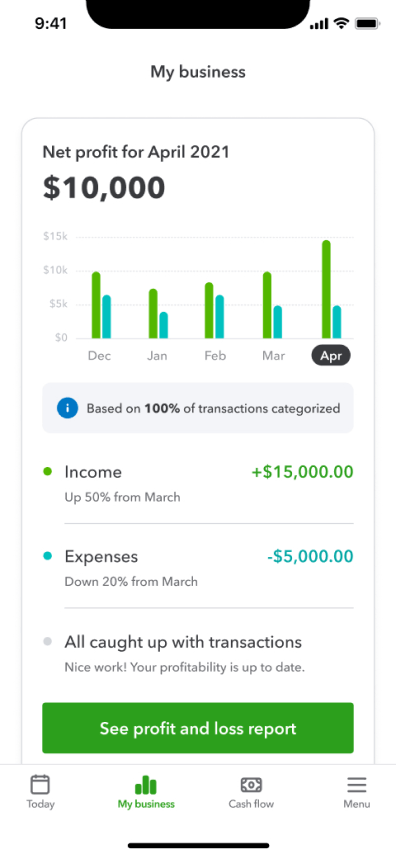

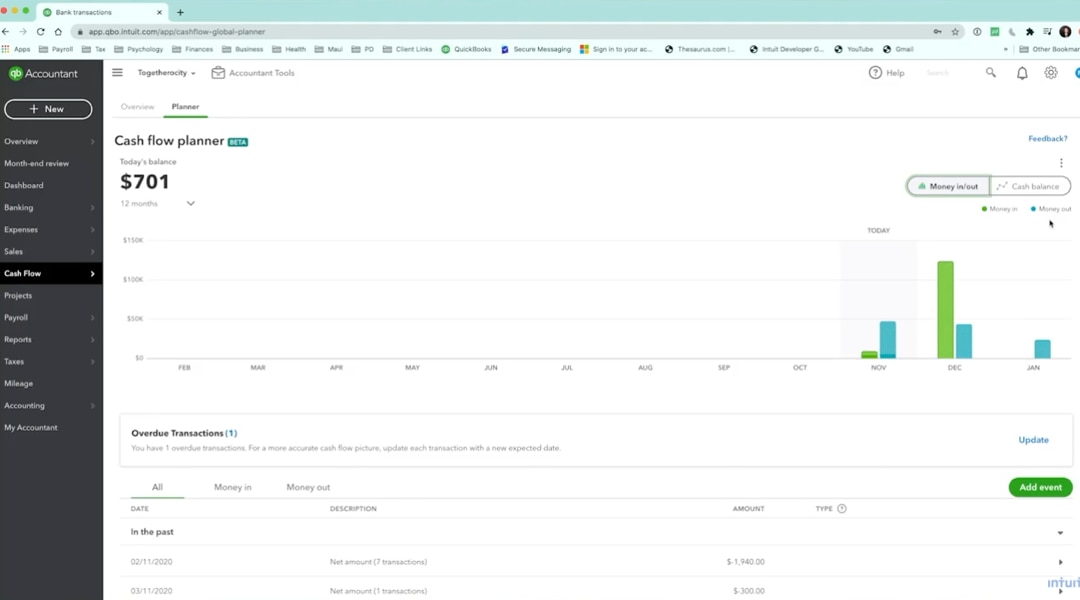

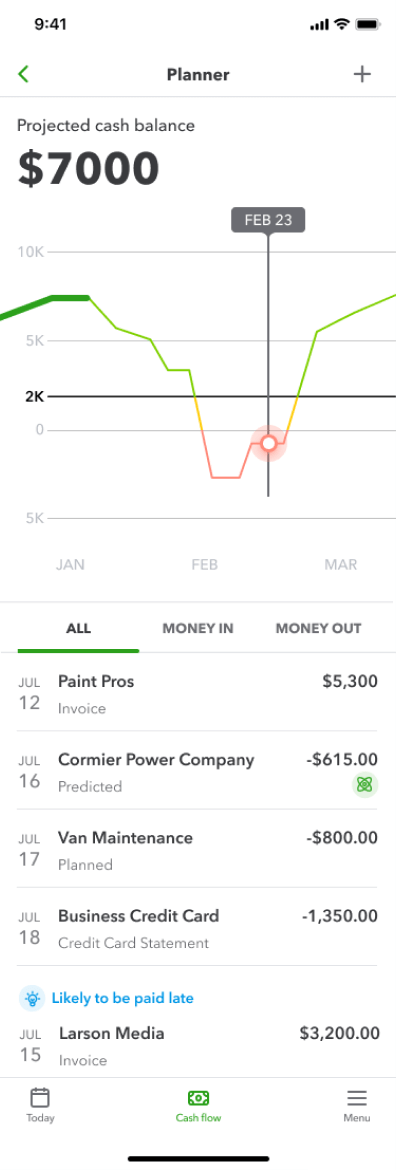

Manage your business finances, forecast your cash flow, and get actionable insights on the go with the cash flow planner in the QuickBooks mobile app. Edit events in the planner without affecting your books so you can make informed decisions about when to save, spend, borrow, and transfer money.

Traditionally all conversions from QuickBooks Desktop to QuickBooks Online have been hosted through Intuit’s Migration tool found within your Desktop product. While we continue to support migrations through this tool, we’ve added Desktop conversions to our Dataswitcher suite of services to provide additional options for our customers. While both Dataswitcher and Intuit migrations can successfully perform the task to get your data into QuickBooks Online, there are subtle differences in each program and we encourage you to review these before selecting the best option to host your migration.

To help you stay compliant with CSRS 4200, two new client letters have been released. The new Compilation Engagement Report will provide you the right verbiage in a templated form to make it easily shareable with your customers. The new Notes to the Financial Statement letter template has all required CPA Canada disclosures for the Notes to the Financial Statement, as well as optional disclosures based on the client's situation. Find both under Client Letters.

You can now create simplified financial statements by combining Workpapers with a workflow called Groupings & statements, which enables the creation of financial statements in just a few steps. There’s a new Statement of Retained Earnings tab in Groupings & statements where you can easily export a Statement of Retained Earnings financial statement.

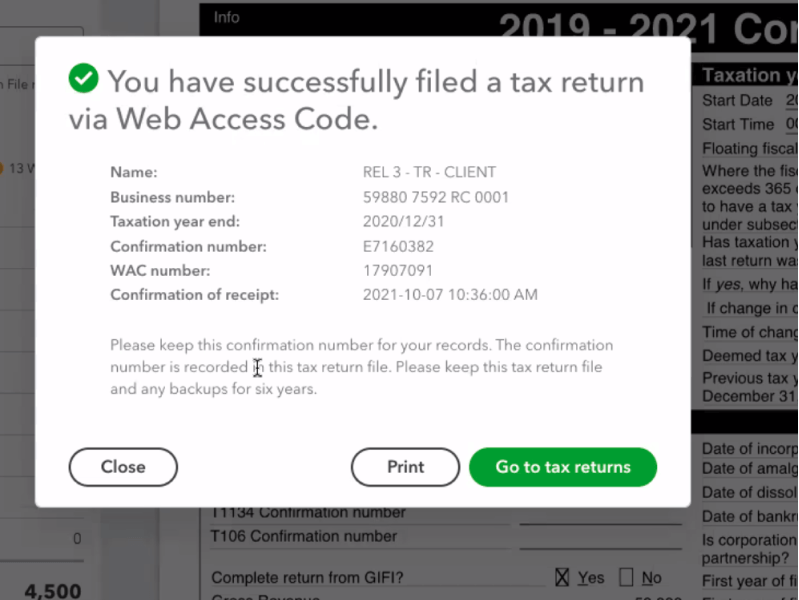

In QuickBooks Online Accountant Pro Tax, you can now file T2 returns using a Web Access Code. This comes in handy for firms that do not have an EFILE number.