Monday - Friday, 9 AM to 6:30 PM ET

-

DAYS

-

HOURS

-

MINS

-

SECS

Celebrating Canadian businesses.

75% OFF QuickBooks for 6 months*

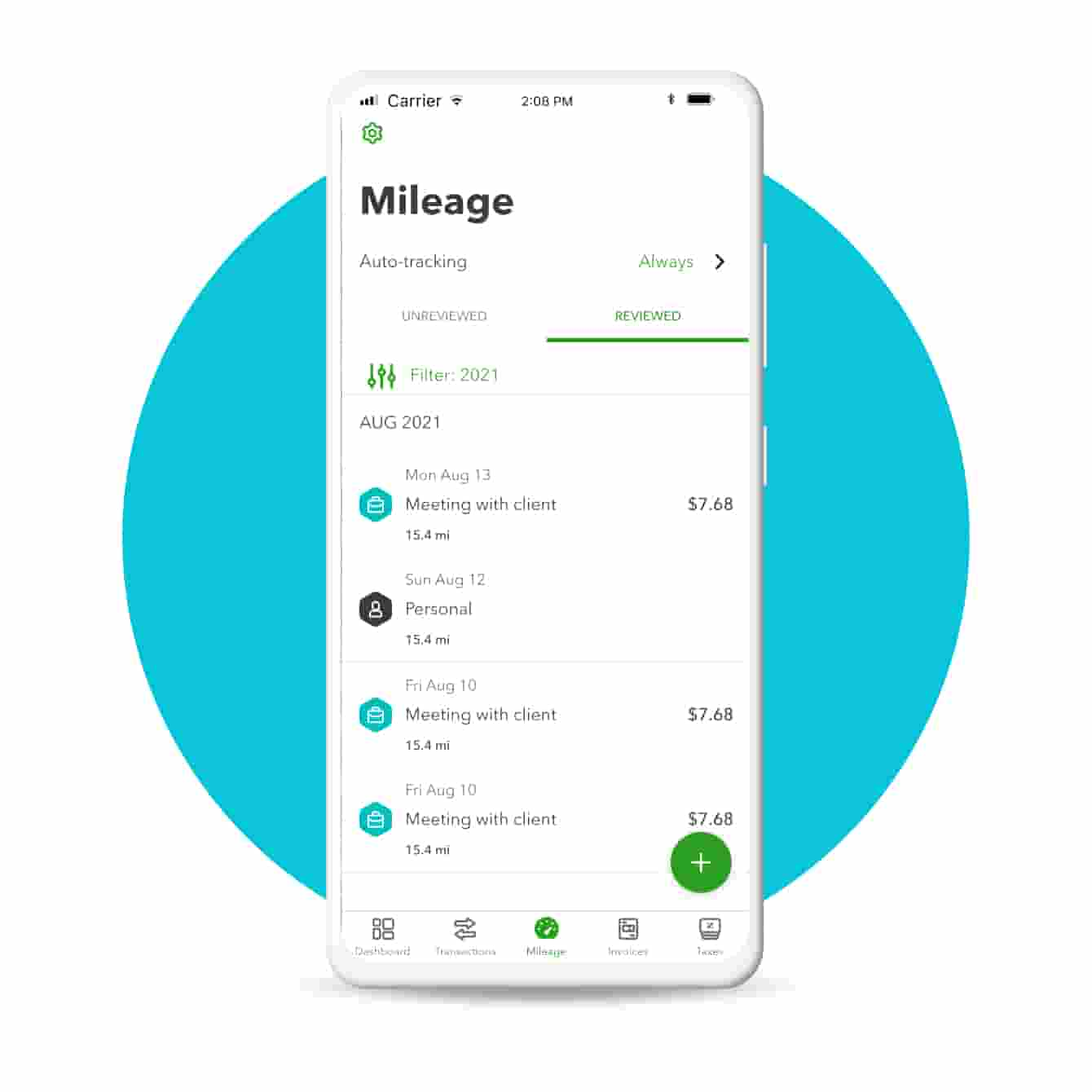

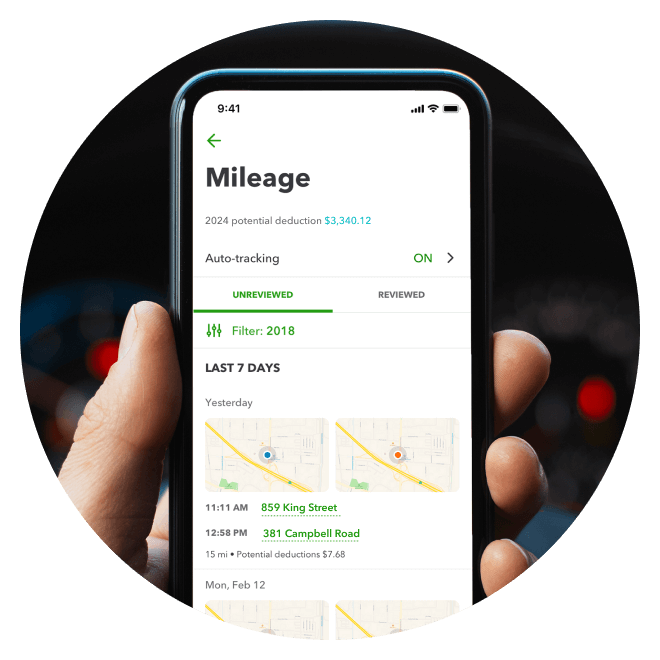

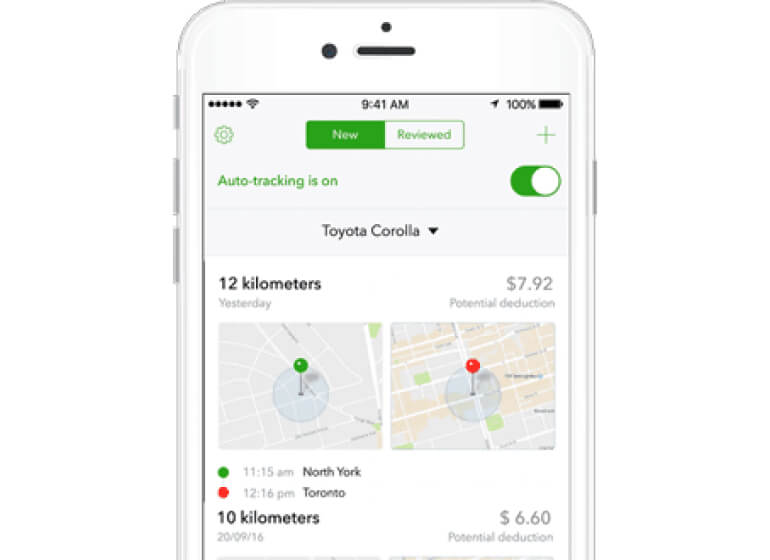

MILEAGE TRACKER

Drive up deductions with mileage tracking

Automatically track all your kilometres and maximize potential deductions at tax time.

Make every kilometre count

With automatic mileage tracking and easy categorization, you can effortlessly turn your business trips into deductions.

Automatically record every drive when you turn on the mileage tracker in your QuickBooks app. Or, add a trip manually.

Swipe left for business trips and right for personal trips to quickly categorize trips within your mileage tracker app.

Our easy to share mileage reports give you a detailed breakdown of your business miles and potential deductions.

Get going for free

Download the QuickBooks app free with your QuickBooks Online subscription.*

Find a plan that’s right for you

Frequently asked questions

More ways to learn about mileage tracking

Find more of what you need with these tools, resources, and solutions

ARTICLE

Mileage tracker—CRA mileage log made easy

If you use your vehicle to earn income, you can claim a business tax deduction based on your mileage. Learn how to keep a mileage log with a mileage tracker app and what kinds of mileage you can deduct.

ARTICLE

How to write off vehicle expenses

Whether you’re self-employed or a commission-based salaried employee, the advice in this article can help you keep your hard-earned money by taking advantage of tax time deductions.

ARTICLE

How to expense mileage,entertainment, and meals

Learn how to make the most of your tax deductions by understanding what you can claim and how to keep accurate records of everything you need to back up your deductions.