Owning vs. Leasing Your Vehicle

Are you driving a passenger vehicle you own or lease? You may have limits on the deductions you can take for interest, leasing costs, and depreciation, known officially as a capital cost allowance (CCA) . If someone else owns or leases a passenger vehicle with you, the interest, lease, and CCA limits still apply. The total amount you and any other joint owners can deduct can’t exceed the amount a single owner or leaseholder is entitled to deduct.

Form T777 Statement of Employment Expenses helps you calculate your CCA. To claim your deductions, fill in the appropriate amounts, and attach the form to your completed tax return.

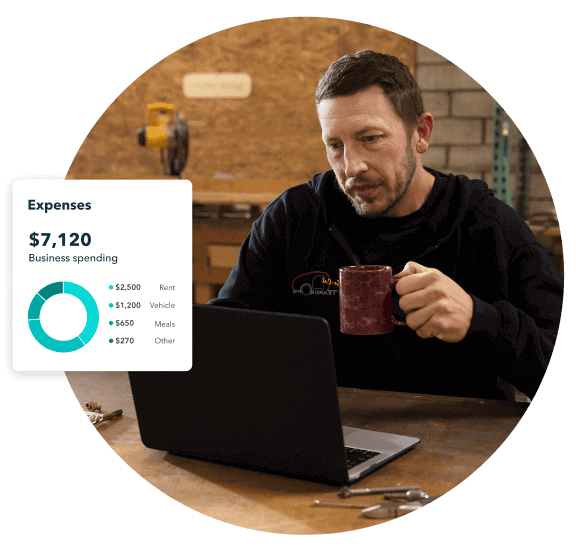

Whether you buy or lease your vehicle, the CRA allows you to take the same deductions for vehicle expenses, such as oil, gas, insurance, license and registration fees, and parking costs. Say you drove 15,000 miles for business out of 30,000 miles total for the year and had $7,000 in total car expenses. You can deduct $3,500 for your business vehicle expenses.

Your expenses for vehicle maintenance and repair expenses, loan interest for vehicle purchases, or lease costs for leased vehicles are deductible too. When the CRA conducts an audit, they ask for receipts or other documents to prove your deductions.

You qualify for certain tax deductions when you’re leasing or purchasing a vehicle. You might want to consider seeking self-employed advice about buying versus leasing before you decide which way to go.