For accounting professionals. Not an accountant?

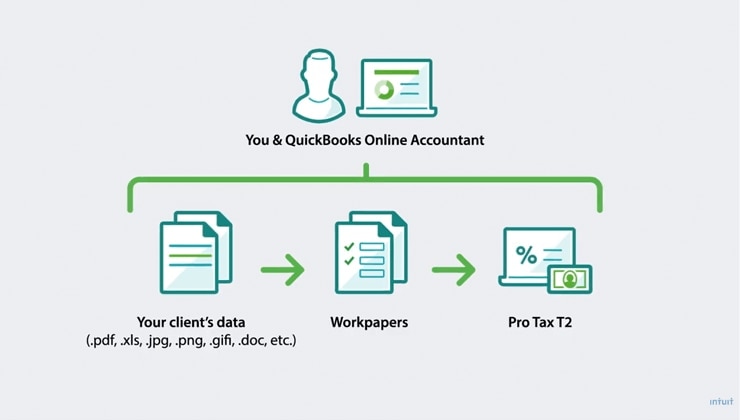

Simplify your year-end workflow

Efficient workflow. Accurate data.

With client data already in QuickBooks, you can get started on year-end preparation faster. Plus, a single source of data means there’s less room for error.

The link between books and tax

Make adjustments, add attachments, notes, gifi mappings, and create custom financial statements in Workpapers. Get easy access to the tools you need for your engagements.

File faster online

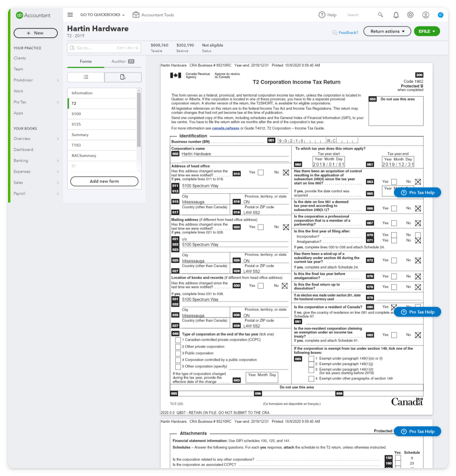

Transition seamlessly from Workpapers into Pro Tax where you can EFILE T1 and T2 tax returns. It’s built right into QuickBooks Online Accountant.

See how it works

You have one source of truth for your bookkeeping, tax, and year end. It makes everything so much easier

All the nuts and bolts

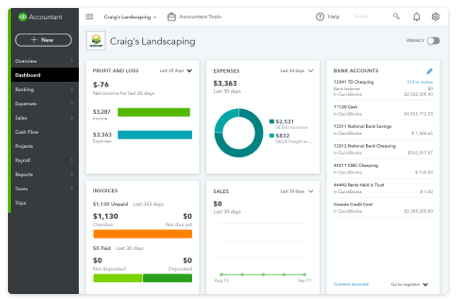

Accounting software designed to make your work easier

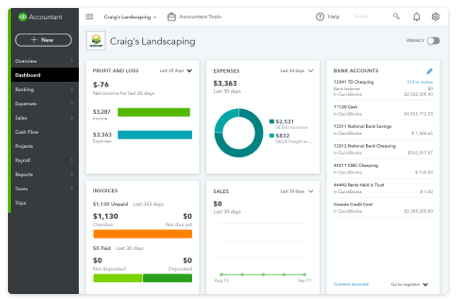

Manage your clients’ books in QuickBooks Online Accountant. Connect bank feeds, attach receipts to transactions, and set rules to automatically categorize business expenses. Use the month-end review feature to ensure nothing gets missed throughout the year.

QuickBooks Online Accountant makes it easy to keep the books clean year-round, so you have accurate data moving into tax.

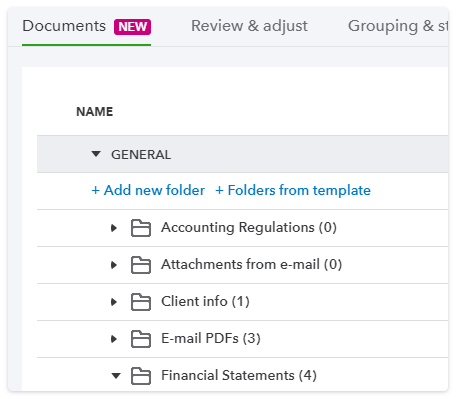

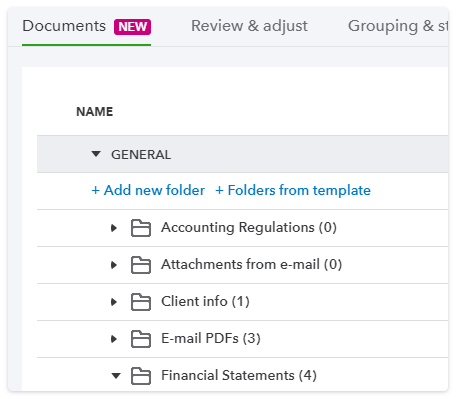

Everything from files, to cloud links in one place

The Document Manager in Workpapers is the single place to attach, collect, and organize all of the documents associated with a client engagement. No more transferring files back-and-forth between various computers, drives, or other software.

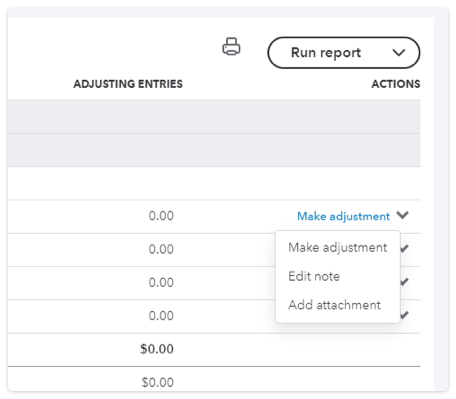

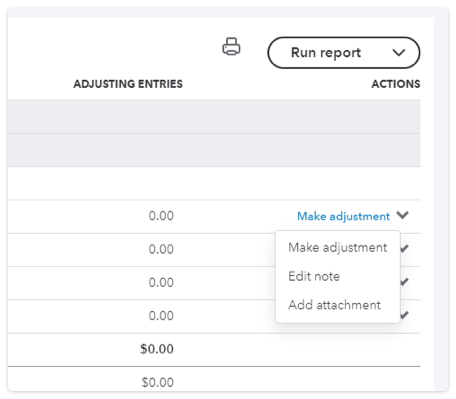

Efficient year-end adjustments and analysis

Eliminate the need to export data by comparing prior and current tax-year data side by side. Then record new activity in a separate Adjusting Entries field, which captures your changes directly to the books while preserving Workpapers data.

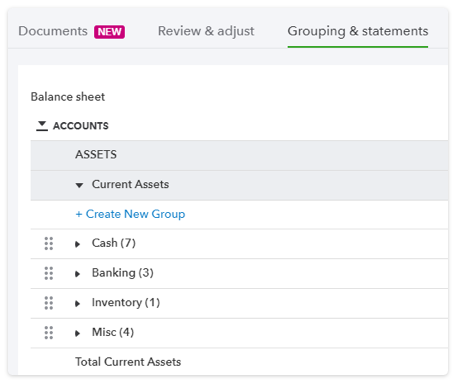

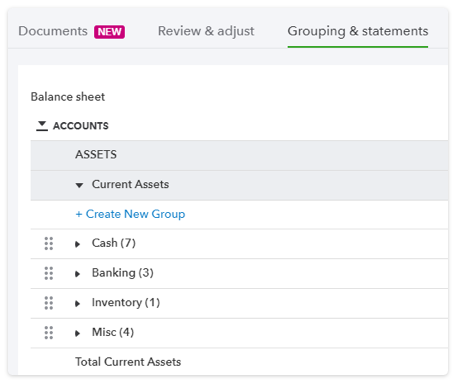

Custom reporting in just a few steps

With Groupings & Statements in Workpapers, you can group accounts using simple drag-and-drop to make your own custom reports, and attach a reference code or leadsheet to ensure a proper compliant paper trail. Plus, everything is automatically saved for you to use next year.

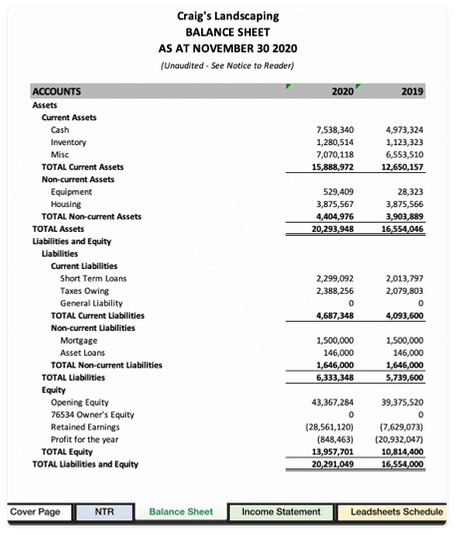

Save time, reduce errors, and optimize your year-end report process

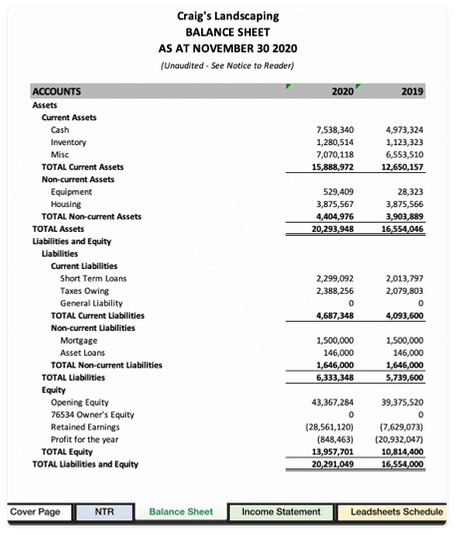

Export editable reports from Workpapers. Generate a detailed financial statement that includes the Notice to Reader (NTR), balance sheet, and an income statement based on your groupings.

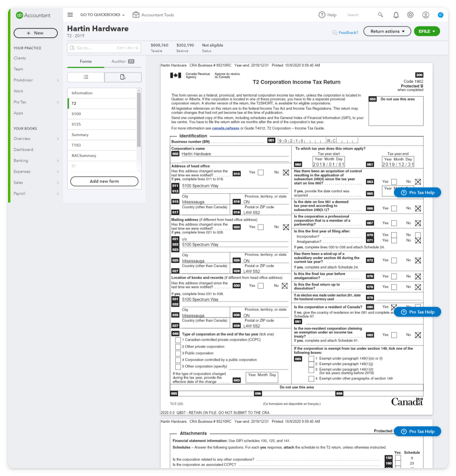

No need to export data

Once your books are ready, your data moves seamlessly into Pro Tax where you can EFILE T1 and T2 returns. Pro Tax is powered by the same technology as Intuit's desktop professional tax software, but it's built right into QuickBooks Online Accountant to give you a more streamlined year-end.

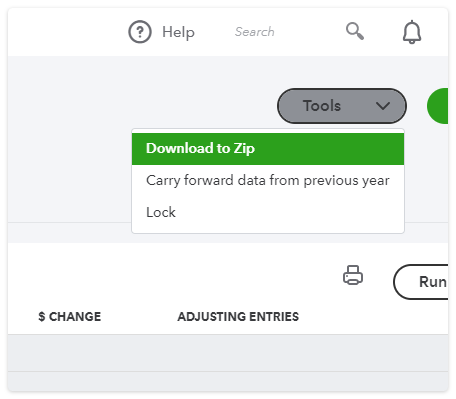

An easy backup of all your work

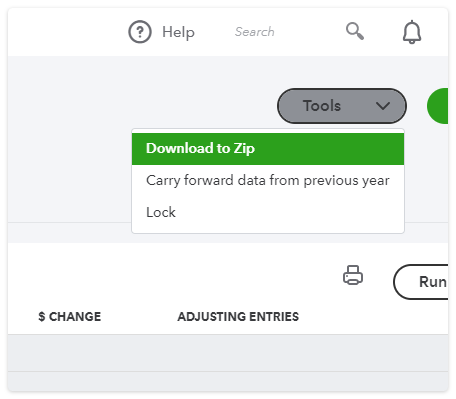

With the Workpapers’ Download to Zip feature, one click allows you to download attachments, notes, reports, PDFs, tax mapping and links associated with your client’s file. It's a simple way to backup your work and great for showing your paper trail during practice audits.

Accounting software designed to make your work easier

Manage your clients’ books in QuickBooks Online Accountant. Connect bank feeds, attach receipts to transactions, and set rules to automatically categorize business expenses. Use the month-end review feature to ensure nothing gets missed throughout the year.

QuickBooks Online Accountant makes it easy to keep the books clean year-round, so you have accurate data moving into tax.

Everything from files, to cloud links in one place

The Document Manager in Workpapers is the single place to attach, collect, and organize all of the documents associated with a client engagement. No more transferring files back-and-forth between various computers, drives, or other software.

Efficient year-end adjustments and analysis

Eliminate the need to export data by comparing prior and current tax-year data side by side. Then record new activity in a separate Adjusting Entries field, which captures your changes directly to the books while preserving Workpapers data.

Custom reporting in just a few steps

With Groupings & Statements in Workpapers, you can group accounts using simple drag-and-drop to make your own custom reports, and attach a reference code or leadsheet to ensure a proper compliant paper trail. Plus, everything is automatically saved for you to use next year.

Save time, reduce errors, and optimize your year-end report process

Export editable reports from Workpapers. Generate a detailed financial statement that includes the Notice to Reader (NTR), balance sheet, and an income statement based on your groupings.

No need to export data

Once your books are ready, your data moves seamlessly into Pro Tax where you can EFILE T1 and T2 returns. Pro Tax is powered by the same technology as Intuit's desktop professional tax software, but it's built right into QuickBooks Online Accountant to give you a more streamlined year-end.

An easy backup of all your work

With the Workpapers’ Download to Zip feature, one click allows you to download attachments, notes, reports, PDFs, tax mapping and links associated with your client’s file. It's a simple way to backup your work and great for showing your paper trail during practice audits.

Make year-end more efficient, start today

Using Workpapers and Pro Tax requires QuickBooks Online Accountant

Already using QuickBooks Online Accountant?

Sign in to try Workpapers and Pro Tax for free1.

New to QuickBooks Online Accountant?

Sign up to get started2.

Get the support you need

Learn

Get the tools and information you need to run your firm.

QuickBooks Online Accountant Training

Pro Tax Training Resources (Youtube)

Join the community

Stay on top of the latest product updates, connect with product managers, and network with your peers.