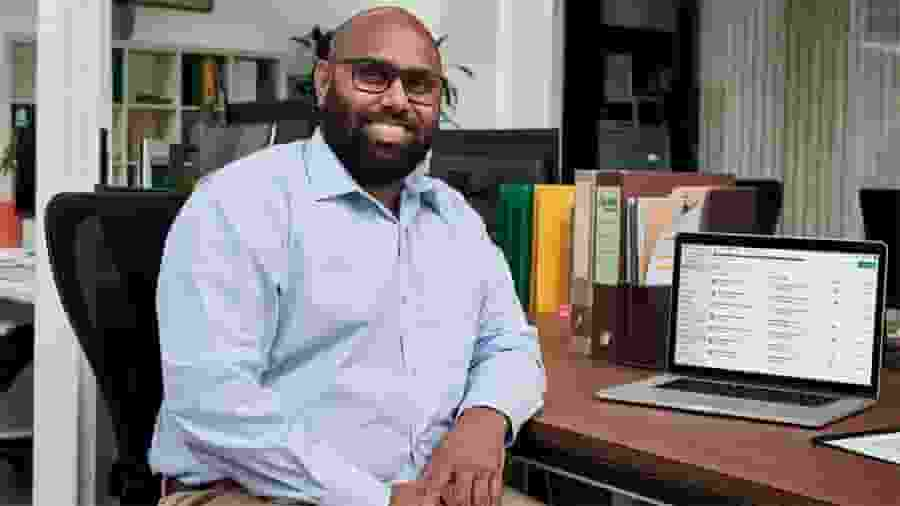

We are happy to announce that Shaye Thyer, Head of Accounting at Intuit Australia, has been nominated for the Thought Leader of the Year category of the 2022 Australian Accounting Awards.

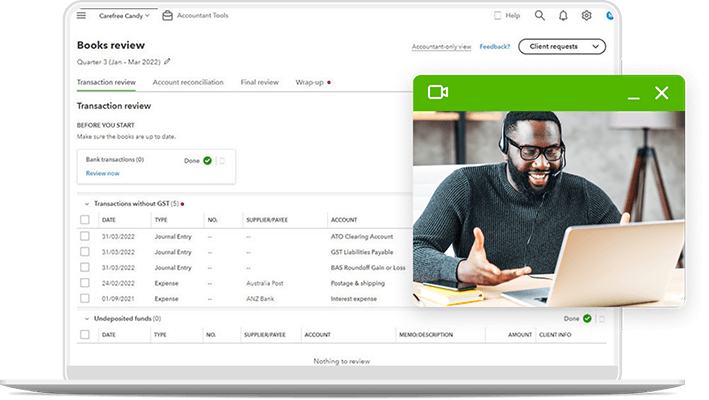

A passionate and driven disruptor in the accounting industry, Thyer leads the team responsible for supporting the success of accounting and bookkeeping partners, through cloud accounting solutions and modern practice digitalisation.

Having started her career as an accountant herself, Thyer uses her experience working in various accounting firms, to make sure that Intuit authentically aligns with what advisors need in their growth mission.

The shift to digitalisation

It was only in 2014 that everything changed when Thyer came across cloud accounting.

“I was a late adopter of cloud accounting. The accounting firms that I worked at previously were very traditional and had no exposure to modern and digital ways of delivering client service. It was very manual, lots of binders and paperwork,” she says.

“But as soon as I was there, I was there in a massive way. Moving to the cloud made such a difference to my career and made such an impact on the way that I could engage with my clients. I wanted to help to make sure that everybody knew about cloud accounting, and that no one else was a late adopter like I was,” Thyer says.

Prior to Intuit, Thyer worked at BDO for over four years.

“Typically, what we see is that these large firms are slow on the digital uptake. So, over the course of 18 months, I delivered the partnerships and frameworks to allow the teams to move about 5,000 clients to the cloud.

“Across BDO’s many geographically dispersed offices at the time, it was my job to make sure that everyone who was client-facing, had the right support to move their clients to the cloud. I always think about that as a huge impact,” Thyer says.

Amongst those 5,000 small businesses, many had exponentially more time to focus on other areas of their business as a result of moving to the cloud.

Shortly after the completion of this project, Thyer was recognised as a Fellow with Chartered Accountants Australia and New Zealand (FCA) for her outstanding career achievements and contributions to the accounting industry.

Now at Intuit, Thyer says her role is to ensure customer obsession with advisors is on point for meaningful impact and influence within the accounting industry.

“Accountants are a proud profession with a delicate eye for credibility, so having a FCA within the Intuit business is very helpful for this purpose.

“The accounting function is such a critical function in the way that our economy operates – particularly in its support of small businesses. This is why the introduction of cloud accounting was a huge enabler of so many things that I could do in my role. Technology is the amazing enabler of scale of impact,” Thyer says.

This included the ability to reach more clients and help them achieve scale commercially.

Thyer says that cloud accounting encouraged her to find her voice in the industry.

“I pushed into a place that was very outside the box for me. It was very scary, but in doing that, a lot of people came along on that journey, because they resonated with me and where I was at.”

Today, Thyer is using her cloud accounting experience to educate businesses about its importance and how they can improve their systems and implement a more efficient practice management process.

“I firmly believe that shifting to cloud accounting will have a positive impact on not only business operations, but also for the quality of life of the advisor and their clients.”

.jpg)