One great reason to consider an inventory management system is to help your small business keep your inventory carrying costs down. But how do you know if you’re inventory management process is making your business more efficient and saving on costs over time?

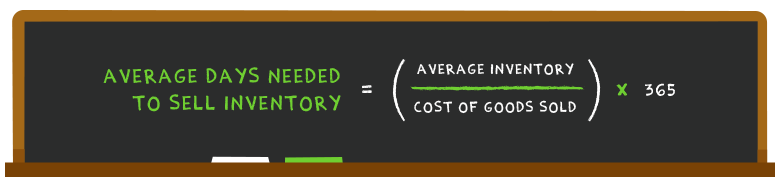

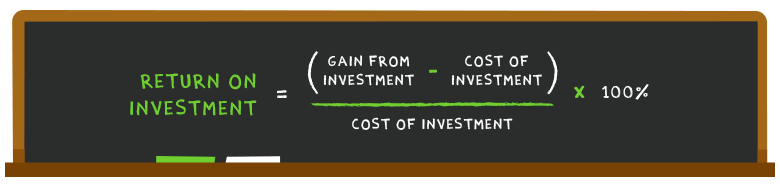

We’ve put together a list of four crucial metrics that you should keep a close eye on over the course of the year: inventory turnover, average days to sell, return on investment, and inventory carrying costs. Tracking metrics can help you make decisions about scaling your business, forecasting sales, and identifying opportunities to hone your supply chain operations.