Making Tax Digital

Guide to Making Tax Digital for Income Tax (MTD for IT) software

Simple, smart accounting software - no commitment, cancel anytime

CLOUD ACCOUNTING

Accounting is entering its most significant technological shift in decades. What began as a manual, paper-based process has become an intelligent, connected profession. First came automation, which made repetitive work faster. Then artificial intelligence, which added insight and foresight. Now, agentic AI introduces a new kind of partnership, where systems can coordinate tasks and work alongside you.

These three layers – automation, AI and agentic AI – represent distinct stages of maturity in the intelligence stack. Each builds on the last, offering increasing capability and value. Automation follows rules. AI interprets data. Agentic AI acts on insight, then checks in. Understanding how they differ helps accountants make informed decisions about adoption, trust and strategy.

Automation handles repetitive, rule-based tasks such as recurring invoices, bank feeds and scheduled payments. It is fast, consistent and reliable, but it cannot adapt when exceptions arise. Think of it as the dependable hands of the practice, always working and never questioning. It reconciles, schedules and reminds, reducing repetition and the risk of error.

AI goes further. It learns from data, spots anomalies and forecasts trends. It can categorise expenses, flag unusual transactions and predict cash flow. Yet it still requires human review. The accountant remains in control, interpreting what the system suggests. Think of it as the sharp eyes that transform raw data into foresight so you can act sooner.

Agentic AI represents the next leap forward. An agent is AI that is goal-directed and capable of taking action within guardrails. It goes beyond prediction to plan and act. It connects tasks, context and outcomes across systems, applying reasoning to decide the next best step and then requesting approval where needed.

In practice, that means your agent doesn’t just spot patterns — it learns, recommends and collaborates within your defined boundaries:

Suggests expense or transaction categories based on past behaviour, learning from your corrections.

Surfaces anomalies in context, highlighting what needs review.

Connects data and processes across systems to deliver outcomes, not just insights.

Unlike fixed workflows, which follow a static sequence of rules, agentic AI adapts in real time and learns from every correction, keeping you firmly in control. Think of it as a proactive teammate that coordinates tasks, drafts actions and waits for your sign-off, turning insight into results.

Think of it as the initiative layer: a proactive virtual teammate that perceives problems, plans solutions, and checks in with humans where necessary. This is not about handing control to machines. It is about creating reliable virtual teammates that take on time-consuming work and present everything for you to review.

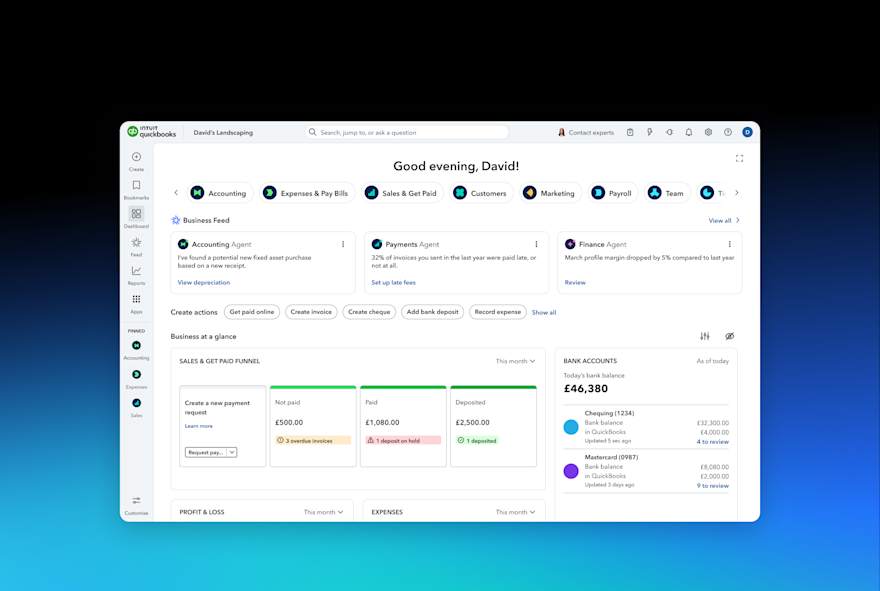

QuickBooks unites these layers through one connected intelligence stack, all visible in a new Business Feed. Together, they give accountants and bookkeepers greater capacity, visibility and confidence while ensuring they stay fully in control.

The Business Feed acts as your central command centre, showing everything AI and automation have completed and what needs review. Every recommendation includes an explanation, and every action requires approval. It is intelligence designed for transparency and accountability.

At its core:

Automation handles regular tasks such as reconciliations and reminders.

Intelligent tools analyse data, highlight issues, and suggest priorities.

Agents coordinate these actions, learning from feedback and prompting next steps while always waiting for approval.

“Generic AI isn’t helpful. Our agents are trained to be very good at specific things. Intuit Assist is the foundational tech, and the agents are highly specialised — designed to cut tedious tasks, flag risks and help you stay compliant.” — Hamilton Jones, Staff Product Manager, Intuit QuickBooks

Intuit's AI agents leverage event-driven architectures to manage multiple tasks concurrently, and can ensure high responsiveness and efficient task handling across various business processes. They are part of a coordinated system that understands context, shares information across functions and acts to complete work on your behalf while keeping you in control.

The power of this approach lies in its focus and integration. Each agent is a specialist in a core business function, yet they are all connected on a single platform, sharing data and context to provide a unified view of your business.

Each QuickBooks agent is designed to perform a specialised role – or “hero job” – within your practice. Together, they form an intelligent virtual team that supports accountants while maintaining transparency and control through the Business Feed.

QuickBooks users across SimpleStart, Essentials, Plus and Advanced plans can already access these agents, with availability and functionality varying by plan.

Accounting Agent: Automates bookkeeping and categorisation to help keep accounts clean and accurate. It identifies anomalies early for your review, whilst facilitating seamless collaboration with your accountant.

Customer Agent: Finds leads directly from your inbox, prioritises high-value opportunities, drafts personalised responses, books meetings, and tracks customer opportunities across the full sales cycle.

Finance Agent: Delivers comprehensive financial summaries, including profit and loss, cash flow and balance sheets. Identifying trends based on actuals vs forecasts, whilst simultaneously flagging discrepancies in accounts and budgets for your review.

VAT AI Agent (BETA): Helps customers stay compliant by flagging for review differences between income on the Profit and Loss statement, and net sales amounts on the VAT return. It also suggests likely causes for these differences, and recommends how to address them.

Project Management Agent: Accelerates setup by auto-filling key details for draft projects for the business to review, reducing t

These agents are powered by Intuit GenOS, the proprietary AI operating system that connects data, models and workflows across QuickBooks, TurboTax and Mailchimp. Each operates within Intuit’s Responsible AI Framework, ensuring transparency, accountability and human oversight.

Every task completed by an agent appears in the Business Feed, allowing you to review, adjust and approve before anything is finalised.

Automation saves time.

AI improves accuracy and insight.

Agentic AI amplifies impact by connecting both — turning knowledge into action, safely and transparently.

Fewer bottlenecks: Automated categorisation, reconciliations, and approvals free up valuable hours.

Faster decisions: Real-time insights highlight where to act.

More time advising and less time correcting.

Stronger client relationships and time to work on growing your business.

QuickBooks brings these layers together in one connected platform where people and technology work side by side. The system is designed to be transparent and explainable, ensuring accuracy, consistency, and trust at every stage.

Instead of managing multiple disconnected tools, businesses gain a virtual team that operates as one. Automation provides the foundation, intelligence brings foresight, and agents turn that foresight into progress.

This is how modern businesses stay resilient, agile and ready to grow.

Discover how a connected platform of AI agents can help your business run as one — saving time, improving visibility, and accelerating growth with confidence.

Disclaimer: "Functionality will vary depending on plans. AI Agents (excl. VAT AI Agent): While available in all QuickBooks supported languages, the AI agent's output are currently in English-only. We recommend you review all outputs carefully. Finance Agent: Not available to customers with multi-currency enabled.

This information is intended to outline our general product direction, but represents no obligation and should not be relied on in making a purchasing decision. Additional terms, conditions and fees may apply with certain features and functionality. Eligibility criteria may apply. Product offers, features, and functionality are subject to change without notice.

Subscribe to get our latest insights, promotions, and product releases straight to your inbox.

9.00am - 5.30pm Monday - Thursday

9.00am - 4.30pm Friday