5. Centralised, automated invoice tracking

If you choose software that supports cloud storage, then all of your invoices and estimates will be stored remotely, making it easy for you to keep records. Storing records in the cloud also frees up local memory on your own mobile device while ensuring that your information can be accessed from any of your authorised devices.

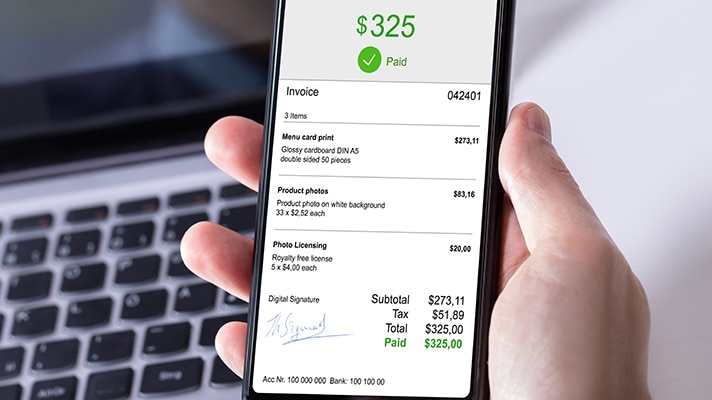

Other integrated options include adding pictures or notes to different client records, both of which can be especially helpful for tracking progress on a project or keeping track of client meetings. Additionally, programs like QuickBooks can sort your invoices into separate categories (e.g. open, paid, overdue), giving you a quick snapshot of the state of your billing, so at the end of a billing cycle, you can easily note who you need to contact in order to request payment.