If you are just starting a small business, then you probably have a lot of questions about GST in Australia. In this article, we seek to answer some of them

Goods and Services Tax Australia (GST) - Guide for Beginners

What is GST?

GST stands for goods and services tax and whether you pay it or not will depend on the turnover threshold. It is levied on most goods and services sold or consumed in Australia. The general public ultimately pays this tax but the Australian Taxation Office (ATO) relies on local businesses to collect the money on its behalf.

The current GST rate is 10%. Therefore, if your products and services cost $200, and you charge GST, then your customer would pay $220. The $20 should be paid to the Australian Taxation Office. So, though you charge your customers goods and services tax, you're not the one keeping that extra money.

When you purchase supplies, you will be charged GST, but you can claim these GST credits for your business.

Why You Need To Register For GST

If your business has an annual turnover of at least $75,000 or more (or if you expect it to be), you need to apply for GST registration. If your annual turnover is below the $75,000 threshold, you can get your business registered for GST, but this is optional.

The benefit to registering for GST, even if you fall below the threshold, is the ability to claim the GST credits you spend on supplies. If you have started a new business, you may want to register for goods and services tax, if you expect your annual turnover to exceed the threshold. However, you do not need to register until you reach the threshold.

Start-ups and enterprises not registered for GST should assess sales figures regularly, as once your revenue breaches the annual turnover threshold, you will only have 21 days to register your business to avoid penalties and interest.

The GST registration threshold for businesses is $75,000, as of writing in March 2023. However, not-for-profit organisations are not required to register until they exceed a turnover of $150,000. By contrast, limousine, ride-sharing and taxi drivers have to register regardless of their turnover.

Start-ups and enterprises not registered for GST should assess sales figures regularly, as once your revenue breaches the annual turnover threshold, you will only have 21 days to register your business to avoid penalties and interest.

Certain types of services and products are exempt from goods and services tax.

- Staple foods are exempt from GST, this includes fruits, vegetables, sauces, spices, meat, and most dairy.

- Some education resources and courses.

- Certain healthcare and medical services and products.

- Some telecommunications supplies

Where To Register Online

You can register online for GST via the ATO's Business Portal or on the Australian Business Register's website. If you are registering for GST, you can also get an Australian Business Number or Tax File Number, register your business name, and apply for PAYG withholding.

How To Report GST

The GST period is usually quarterly but can be monthly in certain circumstances. Account for how much goods and services tax you have collected on your sales minus what you paid on your purchases. The difference is what you owe to the ATO or what you are owed if you have credits. This is done by completing a Business Activity Statement (BAS), and your GST should then be paid to the ATO.

When lodging a BAS, it should list periodic business tax entitlements, obligations and GST reporting charged on sales. Businesses with an annual turnover that exceeds $10m must file a BAS monthly. Other businesses can opt for monthly filings, but they only need to do so quarterly. There are cash flow benefits to doing so monthly. Monthly business activity statements should be lodged within 21 days of the month's end. Quarterly business activity statements should be filed at the end of a financial quarter by the 28th day of the following month.

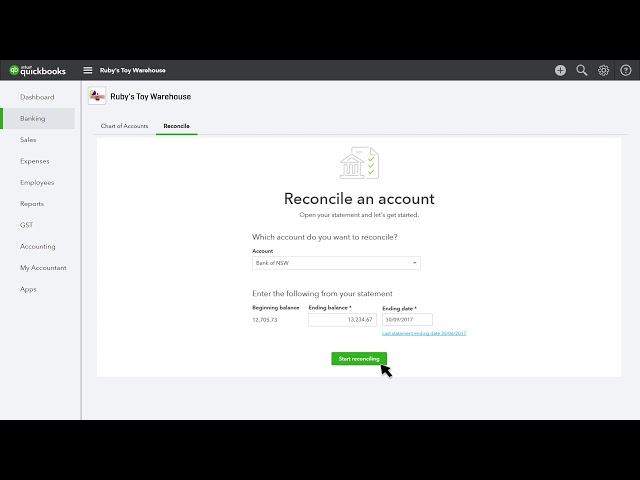

Watch our guide on how to prepare and lodge BAS on QuickBooks on how to report GST.

Accounting For GST

When you complete a sale over $82.50, including GST, your GST registered customers should be issued with a tax invoice. This allows them to claim credits under the GST rules. If you have not given your customer a tax invoice your customer can make a request for a tax invoice. You then have 28 days to produce a tax invoice for their purchase.

If the sale is over $1,000, then there are certain specifics you need to include on the invoice. The invoice must say tax invoice, it must include the seller's name and ABN, it must be dated, and the buyer's name and ABN should be listed. Additionally, there should be a description of the quantity, price and items sold. Finally, the GST payable and the total amount, including GST.

For invoices below the $1,000 threshold, the details you must include remain the same but without the buyer's details. You can easily create templates for those under and over the threshold to simplify life.

There are two options when accounting for GST – cash or accrual basis. If turnover is below $10m, you can opt for your preferred method. If your turnover is over $10m then you need to use an accrual basis. The accrual basis requires accounting for sales and purchases in the period they were invoiced. If you choose a cash basis, you need to account for all sales and purchases over the period in which the sales were paid. There is a strong advantage in choosing the cash basis, as it is helpful for small businesses in terms of cash flow.

GST & Income Tax Deductions

If you have purchased something for your business and it is deductible, you can claim only for the net total, excluding GST. This is because you would have presumably claimed the GST back, so you cannot receive the same tax relief twice. If you did not claim GST credit for that purchase, you can include the GST for a tax deduction on your tax returns.

Looking for something else?

TAKE A NO-COMMITMENT TEST DRIVE

Your free 30-day trial awaits

Our customers save an average of 9 hours per week with QuickBooks invoicing*

By entering your email, you are agree to our Terms and acknowledge our Privacy Statement.