Payroll management made easy

Save time, streamline your employee payroll management, and ensure ATO compliance by using QuickBooks Payroll Software powered by Employment Hero, the number one choice for Australian businesses.*

Capterra

4.3/5

GetApp

4.3/5

Join over

7 million

QuickBooks Customers Worldwide

Google Play

4.3/5

App Store

4.7/5

All-in-one payroll processing for small businesses

Streamline payroll processes and enjoy the benefits of QuickBooks cloud-based payroll software.

Save time with automatic calculations

Straightforward per-employee pricing

Employees can access self-service on the go

Fully Single Touch Payroll compliant

Straightforward pricing for small businesses

Take advantage of serious value by adding payroll software to any QuickBooks Online plan.

- Easy $6/employee per month pricing on Standard Payroll

- Add payroll software to any QuickBooks Online plan

- No forced plan changes as your business grows

Aussie Cloud Payroll with Employee self-service

- Staff can provide tax, super, banking and personal information, directly into the platform

- Employees can manage time-sheets and review payslips on the go with the EH Work app

- Streamline leave and roster management

- Run your business from anywhere with cloud-based payment software for small business

- Get the right information and advice with small business accounting and payroll software designed and built exclusively for Australian businesses

Simplify payroll management

Enter hours and pay, and let our payroll software handle the rest.

- Say goodbye to complex payroll calculations: Save more than just time and money.

- You’ll get a notification if any actions are required from your small business

- Gain complete financial visibility with comprehensive reports from QuickBooks payroll software

- We’re here to help with readily available assistance to make tax time a breeze

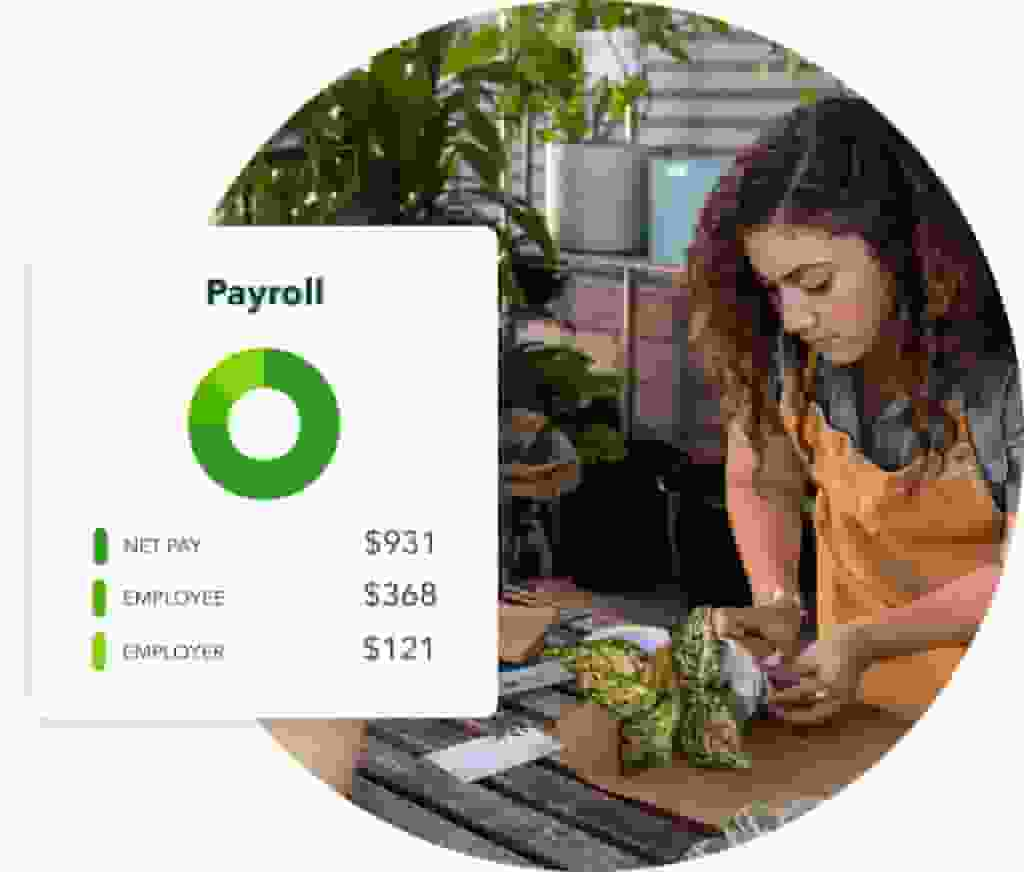

Save time with automatic payroll calculations

Say goodbye to manual data entry and complex payroll calculations. QuickBooks Payroll Software does the number crunching for you and automates the calculation of superannuation, leave, and termination payments, while also providing proactive notifications for any required actions from small businesses.

Streamline super contributions

We’ve teamed up with Beam, a game-changing super fund clearing house, to change the way you pay your staff’s super. It’s fast, automated, and you can manage everything right from QuickBooks Payroll.

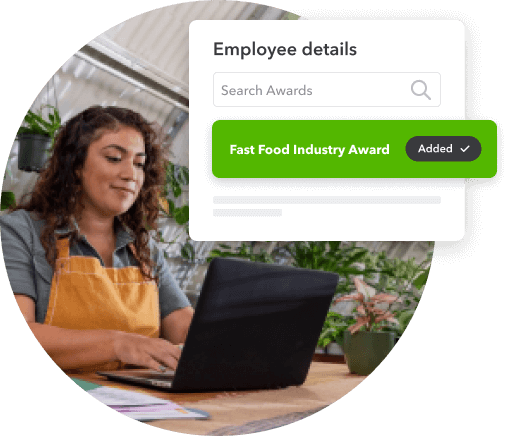

Single Touch Payroll (STP) is sorted

The QuickBooks Single Touch Payroll solution powered by Employment Hero includes integrated STP compliance.

- Inbuilt Single Touch Payroll

- ATO approved

- Pre-built Awards for peace of mind (Advanced payroll option)

- Eliminate manual data entry by automatically sending payroll information with each pay run.

- Save time by sending a report to the ATO with every pay run.

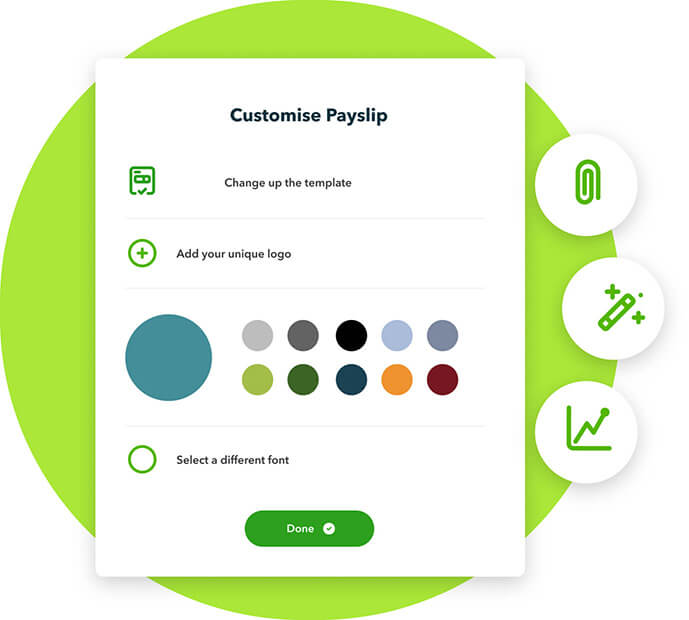

Send customised payslips

Create fully customisable and compliant payslip templates with QuickBooks payroll software. Your business matters to us so we made sure you can reinforce your business brand.

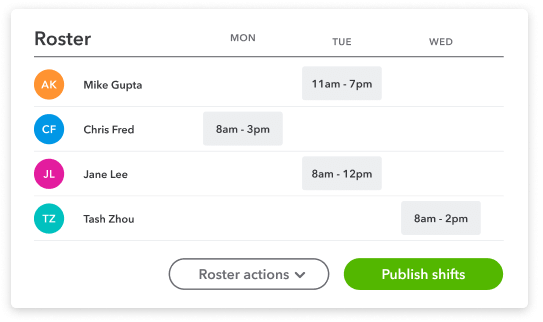

Employee rostering and wage overviews

Our Advanced Payroll software option provides employee rostering and wage overviews.

- Easily access rosters and manage shifts

- See projected wage costs at any time

- Set budgets for each shift or location

- Easy-to-use roster templates and shift swapping

QuickBooks payroll software

Frequently asked questions

Call sales for further assistance 1800 917 771

* Employment Hero was voted the leading payroll solution for SMBs <50 employees (Australian Payroll Association 2021 Payroll Benchmarking Study)

* Free onboarding: Not available for the QuickBooks Self-Employed product or trials.