For accounting professionals. Not an accountant?

- ProductsProducts

- Software for accounting professionalsSoftware for accounting professionals

- Features of QuickBooks Online AccountantFeatures of QuickBooks Online Accountant

- Software for your clients

- Pricing

- Learn & SupportLearn & Support

- Grow your firmGrow your firm

- Contact us

- FR

- Sign in

Free for you, hassle-free for your clients

What’s included

QuickBooks Online Accountant is free for your firm.* Just pay to add clients.

Tax and accounting add-ons

Add QuickBooks Pro Tax or Ledger to your account and simplify your year-end.

QuickBooks Ledger

Designed exclusively for accounting professionals, QuickBooks Ledger is ideal for tax-only, or multi-company clients with non-operating entities. Only $8/month.**

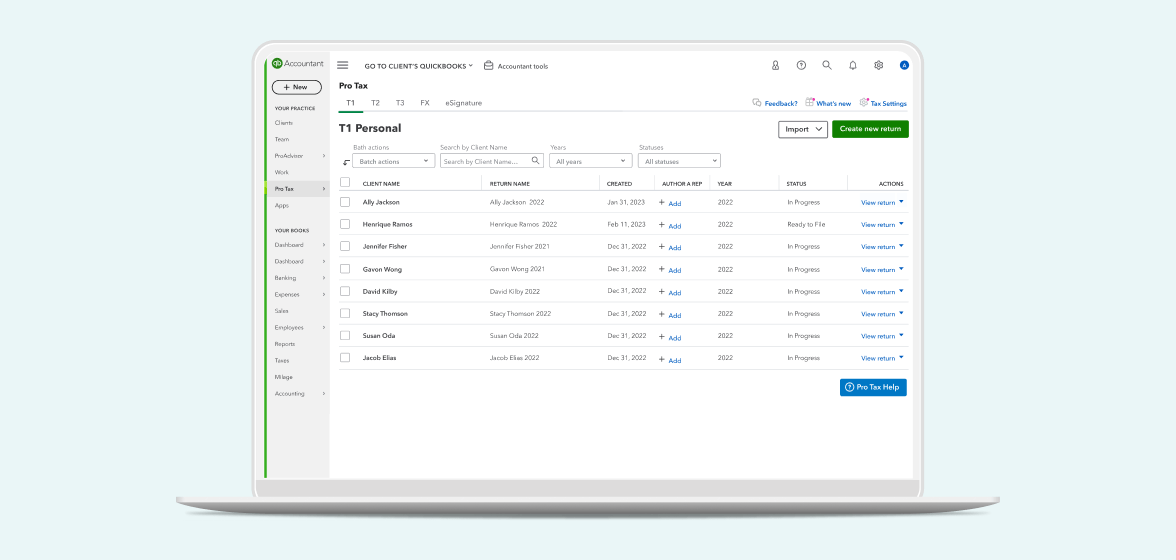

Pro Tax

Move from managing clients' books to filing tax returns with Pro Tax built right into QuickBooks Online Accountant. Supports T1, T2, T3, and Forms Expert filings.**

Find your clients’ perfect plan

Frequently asked questions

When you sign up for QuickBooks Online Accountant, you get access to practice management tools, real-time access to your clients’ books, and free subscriptions to QuickBooks Online Advanced and QuickBooks Payroll—our most robust solutions to help run your practice.

You also unlock other benefits like training modules, exclusive discounts for your clients, premium support, and networking opportunities with local accountants and bookkeepers.

There are no hidden fees. QuickBooks Online Accountant is free for accountants and bookkeepers. You only pay if you decide to pay for your clients’ QuickBooks Online subscriptions and bill them directly. Or if you decide to purchase add-on products, like QuickBooks Pro Tax or QuickBooks Payroll.

Your clients can either pay for their own QuickBooks subscriptions directly, and receive up to a 50% discount for their first year. Or, your practice can pay and add the cost to your billing, and receive an ongoing 50% discount.

QuickBooks Pro Tax is a tool that enables the preparation and filing of unlimited tax returns, with full form sets (T1s, T2s, and T3s), a built-in auditor, and digital signatures. Combining Pro Tax with QuickBooks Online makes it simple to go from books to tax all in the same place.

QuickBooks Ledger is a QuickBooks Online plan designed exclusively for accounting professionals. Use Ledger to manage your year-end, tax-only, and low-transaction clients.

*Offers

Free QuickBooks Online Accountant subscription: Free subscription to QuickBooks Online Accountant is available for a limited time only. To be eligible for this offer you must be an active, licensed public accountant. Intuit reserves the right to cancel at any time any and all licenses that are not compliant with Intuit eligibility requirements. Terms, conditions, availability, pricing, features, service and support options are subject to change without notice.

50% discount for your clients when you pay for their QuickBooks Online subscriptions: You can give your clients 50% off the then-current MSRP pricing of QuickBooks Online (includes Essentials and Plus) for the life of their subscription when you sign up for wholesale discount (firm is billed) within your QuickBooks Online Accountant account. The MSRP price is subject to change at any time in Intuit’s sole discretion.

*QuickBooks Payroll Core: Get 80% off for 8 months with QuickBooks Payroll Core (with direct billing only)..

**Features & Product Information

QuickBooks Ledger: Subscription is only available through the Accountant channel and requires an active subscription to QuickBooks Online Accountant. Your account will automatically be charged monthly until you cancel. Sales tax may be applied where applicable. To cancel your subscription at any time, go to Account & Settings and select “Cancel.” Your cancellation becomes effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Online Accountant Pro Tax: The annual subscription price excludes HST/GST. Offer valid for a limited time only. You must select the Subscribe button within the QuickBooks Online for Accountant Pro Tax tab to subscribe. Upon expiration of your annual subscription term, your account on file will be automatically charged on an annual basis at the then-current fee for the service(s) you’ve selected, until you cancel.

If you’re not satisfied with Pro Tax for any reason, you can cancel your subscription within the product if you purchased your subscription directly from Intuit. To cancel, navigate to your account page from the gear menu in QuickBooks Online Accountant and click on the Billing details tab. View and manage your active Pro Tax subscriptions using the action button on the right.If you’re not satisfied with Pro Tax within fourteen (14) days from your purchase and have not efiled, you are eligible to receive a purchase refund. No product refunds are available after fourteen (14) days from purchase (Learn more, here)

You can cancel your subscription at any time within the product if you purchased your subscription directly from Intuit. When you cancel your subscription, you terminate automatic renewal only. You will continue to have access to your account (including efile) through the end of your current billing period. In order to continue to efile after your current billing period, you will need to resubscribe at the then-current full annual pricing. Terms, conditions, features, pricing, service, and support options are subject to change without notice.

Attention: Current T1, T2, T3 and/or FX subscribers may purchase bundles and/or suites, however, system limitations at this time require you to cancel your T1, T2, T3, and/or FX subscription(s), and wait until the end of your current billing period for each of those subscriptions to expire before re-subscribing to the bundle or suite. These actions are to minimize any potential billing issues or complications. Please refer to the FAQs for more information.

Unlimited tech support:Intuit offers priority phone support to Platinum and Elite ProAdvisor Program members by directly routing to a team of QuickBooks Online experts to deal with advanced product queries. The team is on hand to help 9am-8pm EST Monday to Friday and 9AM-6PM EST on Saturdays (excluding holidays).

Auto Payroll:Available if setup for the company is complete. At least one employee has completed setup and has consistent payroll that qualifies for automation (i.e. salaried or hourly with default). Company must complete bank verification if the employee has direct deposit as the payment method, and the first payroll must run successfully. The account must not have a hold.

Year-end forms: Automated tax forms are available for reporting payroll taxes to the CRA and Revenu Québec. Customer must still proactively file and pay such payroll taxes.

QuickBooks Workforce mobile app: The QuickBooks Workforce mobile companion app work with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Workforce mobile access is included with your QuickBooks Time subscription at no additional cost . Product available in English only. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Free guided setup: The free 60-min QuickBooks Payroll guided expert setup is a one-time virtual session with a QuickBooks Payroll expert. It’s available to new QuickBooks Online Payroll Core, Premium and Elite monthly subscribers and trialers who are within the first 30 days. The guided setup is available from 7 AM - 4 PM PT. Service includes: reviewing key business information, adding first employee, setting up payroll taxes, connecting bank accounts and automating payroll taxes. Guided setup does not include desktop migration.

Fast payroll direct deposit: Available to QuickBooks Online Payroll Premium and Elite users only. Payroll submitted before 5 PM PT will be processed the same business day (excluding weekends and holidays) and deposited into the recipient’s bank account next day, or in 2-business days depending on the recipient’s bank (i.e. a small percentage of bank branches require 2-business days for direct deposit). Requires setup of direct deposit and bank verification. May be subject to eligibility criteria. Deposit delays may vary because of third party delays, risk reviews, or issues beyond Intuit’s control. Available only for employees, not available for contractors or tax payments.

Prioritized support: Included with your paid subscription to QuickBooks Online Payroll. Chat and phone support in English available Monday through Friday from 8 AM - 9:00 PM ET and Saturday 9 AM to 6 PM ET. Chat and phone support in French is available Monday through Friday 9 AM to 6 PM ET. Your subscription must be current. Get more information on how to contact support. Intuit reserves the right to limit the length of the call. Terms, conditions, features, pricing, service and support are subject to change without notice.

Time tracking: Time tracking included in the QuickBooks Online Payroll Premium and Elite subscription services. Features vary and may be available in English only.

Mobile app: The QuickBooks Workforce mobile companion apps work with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Workforce mobile access is included with your QuickBooks Time subscription at no additional cost . Product available in English only. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Geofencing technology: QuickBooks Workforce mobile app allows users to share their location data while they are on the clock. Cell service required for GPS points accuracy. QuickBooks Time does not save GPS points for users when they are off the clock. Account admins may require users to set their location settings to “Always” in order to clock-in and track time using the QuickBooks Workforce mobile app.

Track sales & sales tax: Additional terms & fees may apply for third party apps. Third party app integrations and Québec sales tax support are not available in QuickBooks Self-Employed.

Run powerful reports: Some reports are not available in QuickBooks Self-Employed.

Invoice & accept payments: Additional terms & fees required. Only credit card payments in Canadian dollars can be accepted.

Maximize tax deductions: Connectivity with your accountant requires your accountant to subscribe to QuickBooks Online Accountant, sold separately. Alternatively, with QuickBooks Online Essentials or Plus you can designate your accountant as one of your users.

Enter time: QuickBooks Time integrates with QuickBooks Online, QuickBooks Online Payroll, and QuickBooks Desktop. Additional terms, conditions, and fees may apply.

Track inventory:Additional terms & fees may apply for third party apps.

Spreadsheet Sync:Automatic refresh requires setup and will update workbooks or individual sheets every time you open the workbook or login to Spreadsheet Sync.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Call Sales: 1 855-348-9670

© 2026 Intuit, Inc. All rights reserved

Intuit, QuickBooks, QB, TurboTax, Profile, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice.

By accessing and using this page you agree to the Terms and Conditions.