The correct way to handle a sales tax refund from the Canada Revenue Agency (CRA) is to use the Record a Refund feature, Navpreet.

As a new business, it's common to have a sales tax refund from the government if you've paid more sales tax to your vendors than you've collected from your customers. Using the Record refund feature will properly deposit the funds into your bank account and reduce your sales tax liability in QBO, keeping your records tidy and correct.

Here's how:

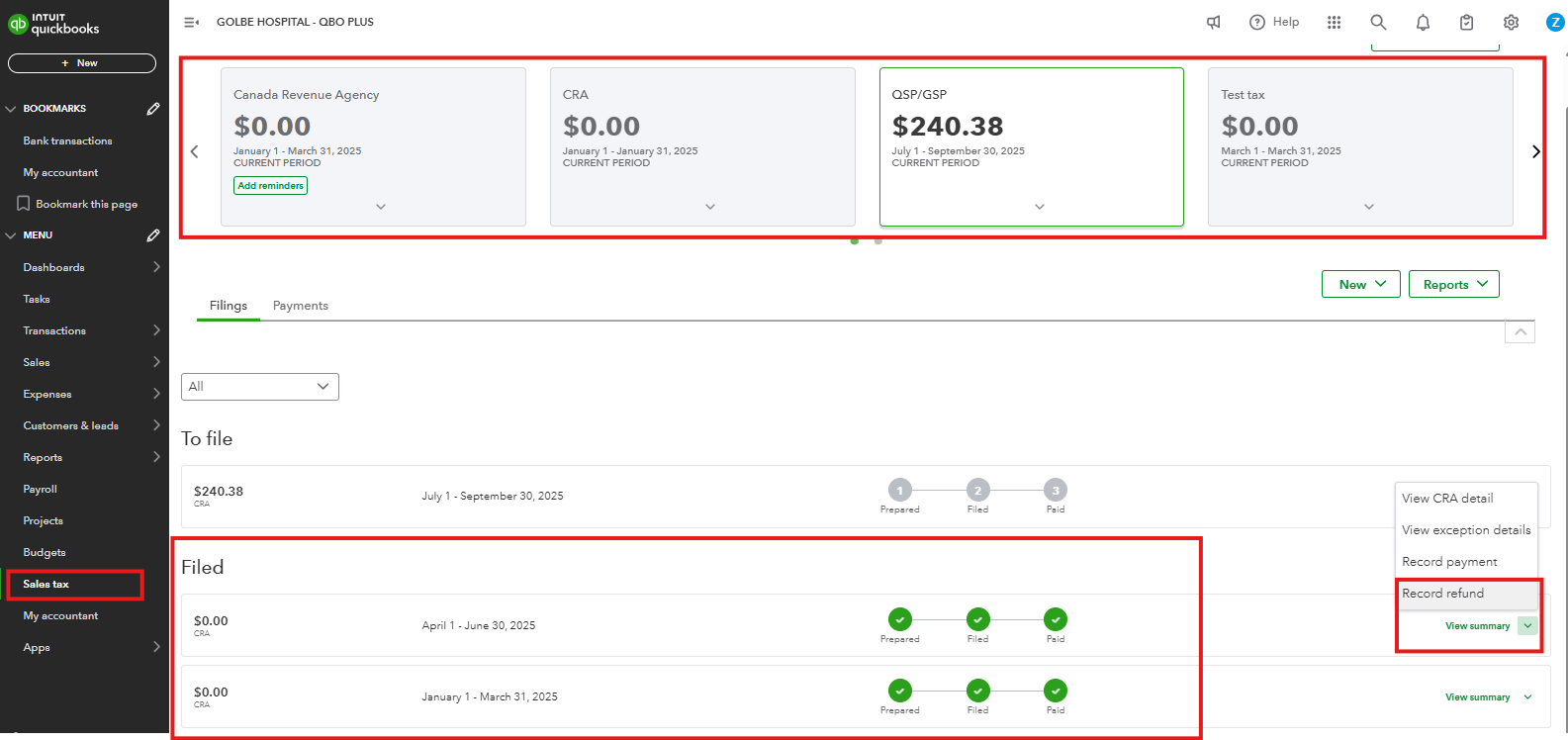

- Go to Sales tax, then go to the Filings tab.

- From the dropdown arrow, select Record refund.

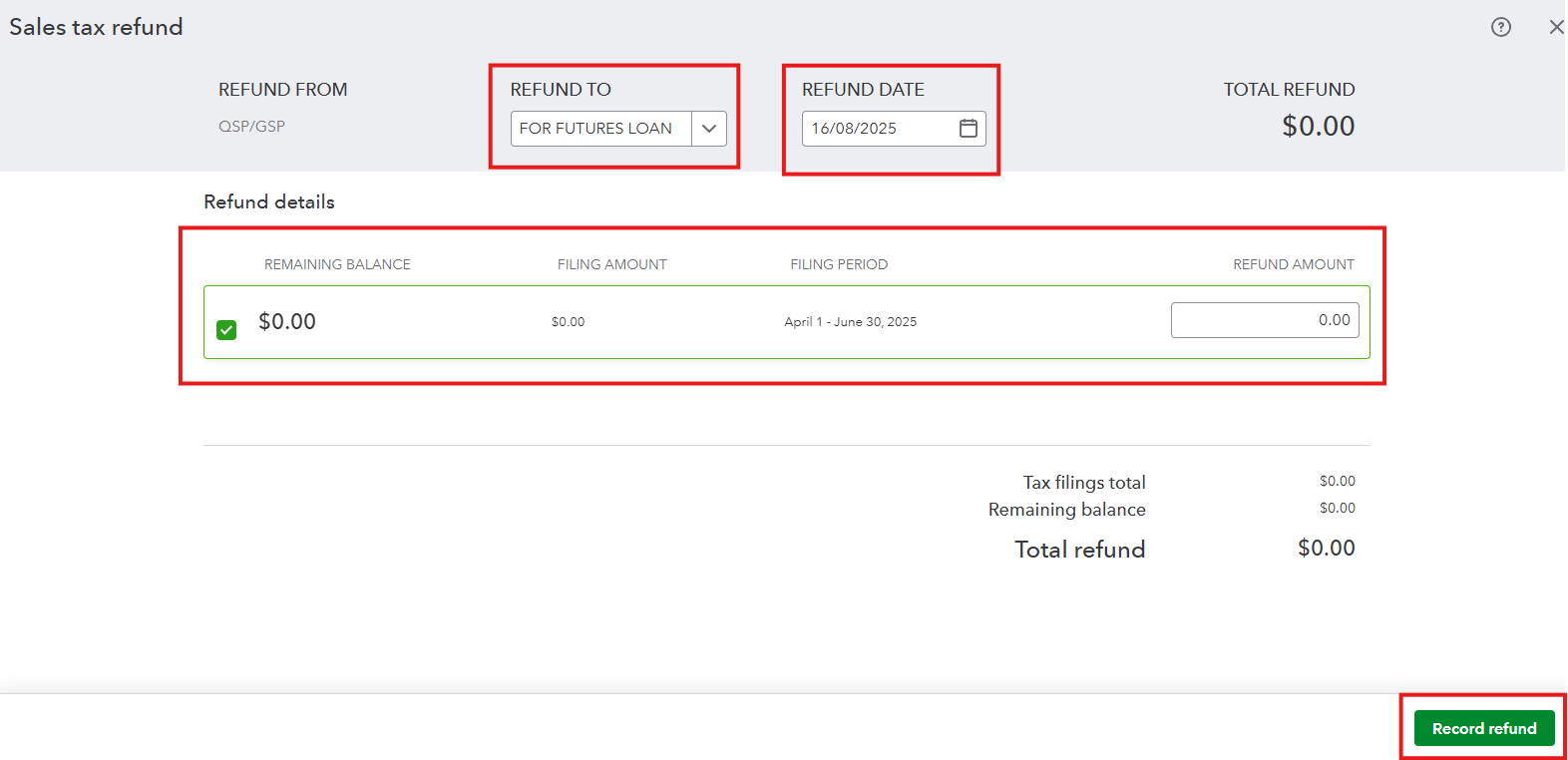

- Select the bank where you want to record the refund.

- Enter the Refund date and Refund amount.

- Once done, click Record refund.

It's also important to note that QBO is for recording transactions, not for making payments directly to the CRA. Any payments or refunds you receive are handled outside of QBO through the CRA's official channels.

For a comprehensive overview, I recommend reviewing the File sales tax in QuickBooks Online.

Come back to this post if you have other questions or concerns.