Hello @asma-vectorhealt ,

Keep in mind that you have four years to claim your ITC's so the maximum number of months you can spread your ITC's over on this purchase will be 48, although you can do it in fewer months if you want to.

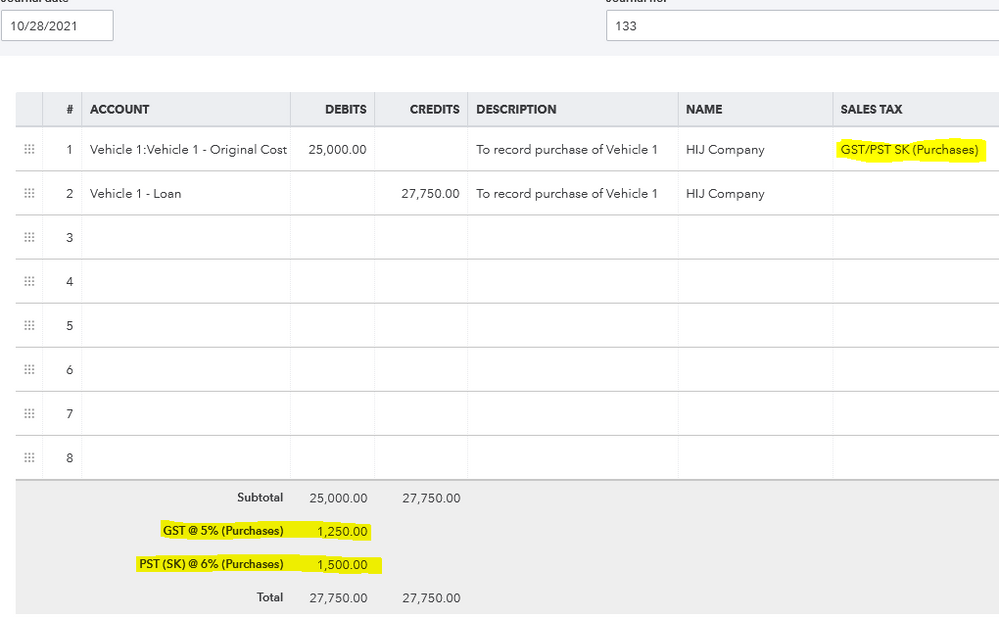

To record the purchase of the vehicle, the first thing is to make a JE that records the Asset, the Liability and the taxes, both PST and GST. We will make adjustments to the GST in another entry to accomplish your goal of claiming ITC's monthly instead of all at once in the period in which the purchase occurred.

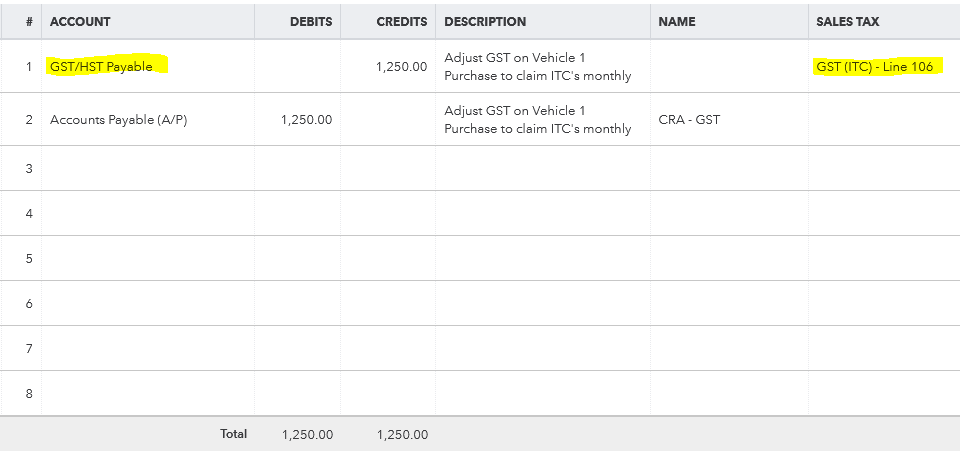

Now you will make a JE to remove the ITC from the GST/HST Payable account, and place into an Accounts Payable account, as a negative balance. You must have a Vendor Name in the Name field on the same line as you post to Accounts Payable. Note that you will enter the actual GST/HST Payable account from your chart of accounts; just make sure to tab over to the Sales Tax field and choose the GST (ITC) tax item. This is the only way this entry will show up on your GST liability reports.

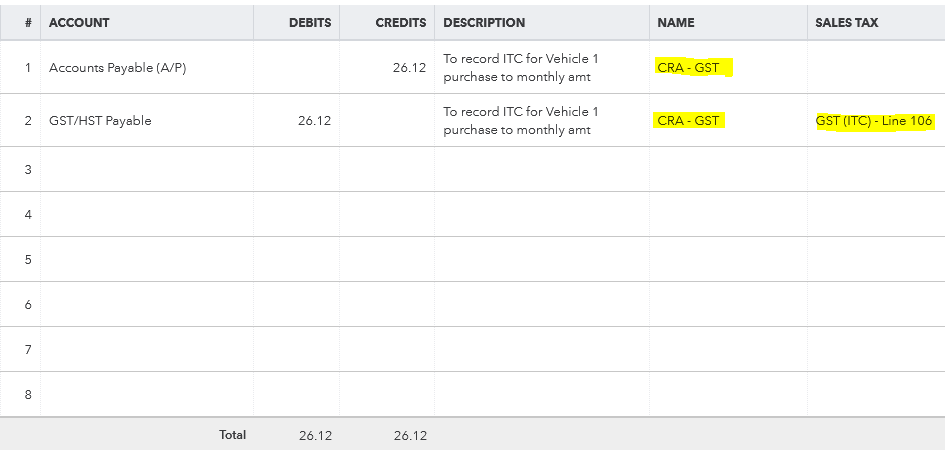

In this example, we'll assume that you're going to split the $1,250.00 in GST on this purchase into 48 months and claim the ITC monthly. The very first JE we make will be a manual JE, in the amount of $26.12. Once again, ensure to tab over to the Name field and place a vendor name in the Accounts Payable line, and tab over to Sales Tax and place the GST(ITC) item in the Sales Tax field on the GST/HST Payable line. This becomes the entry which will place $26.12 as an ITC on your GST tax reports.

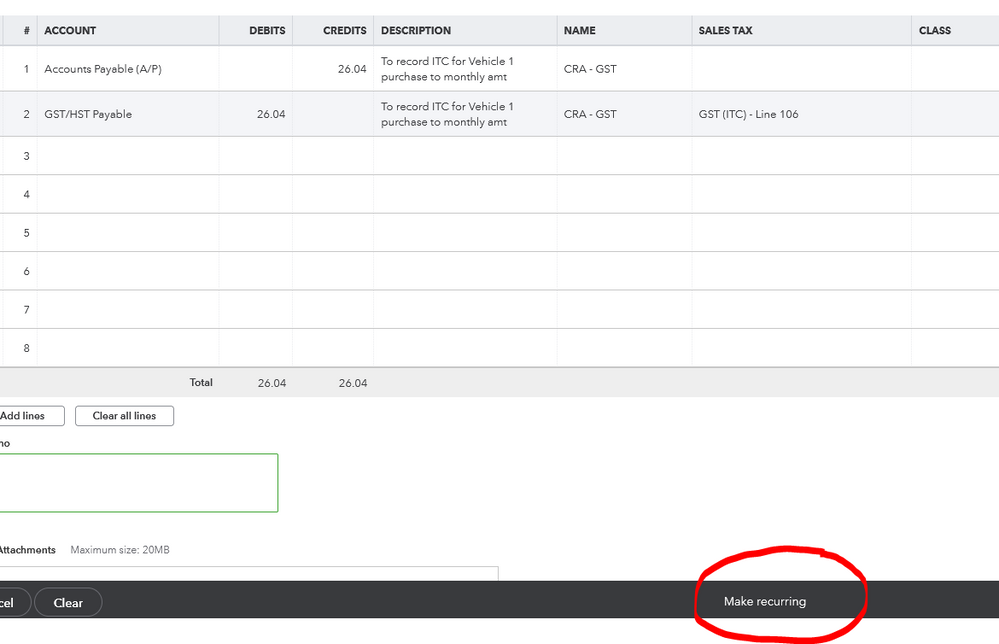

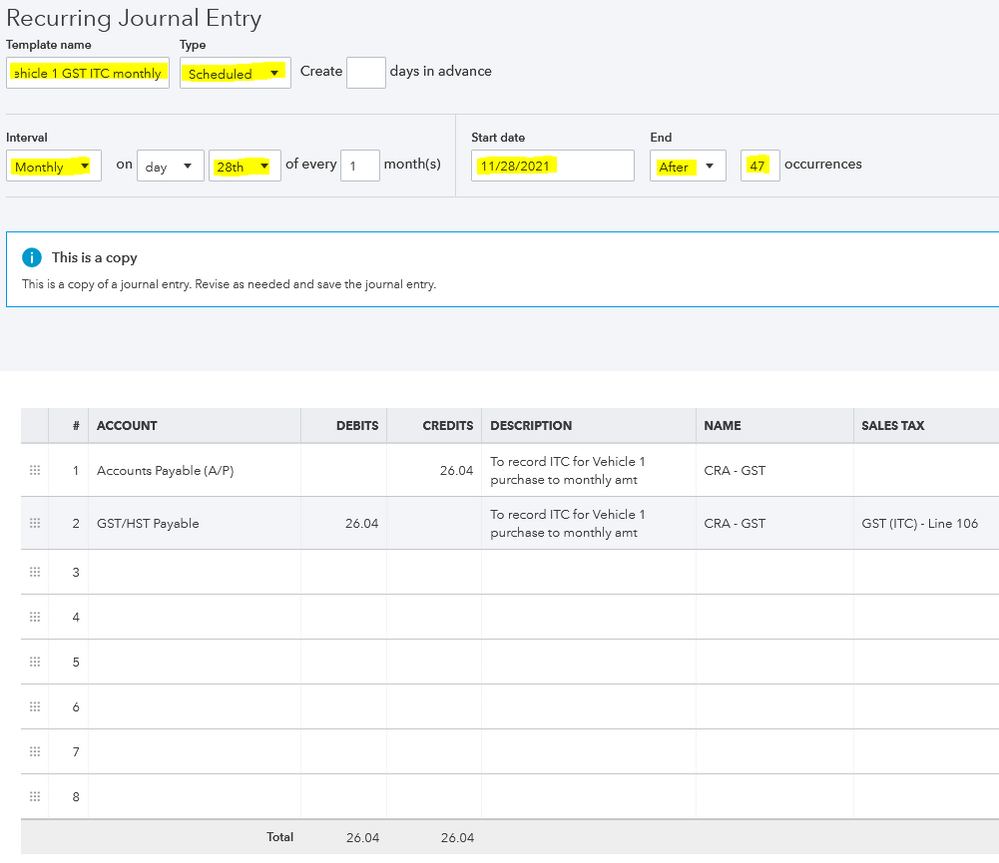

Now you will create another JE exactly the same as above, except in the amount of $26.04. You will make this a recurring JE for 47 months, so you don't have to go in and make one each month.

The recurring entry will be set up like this:

Don't forget to save the template.

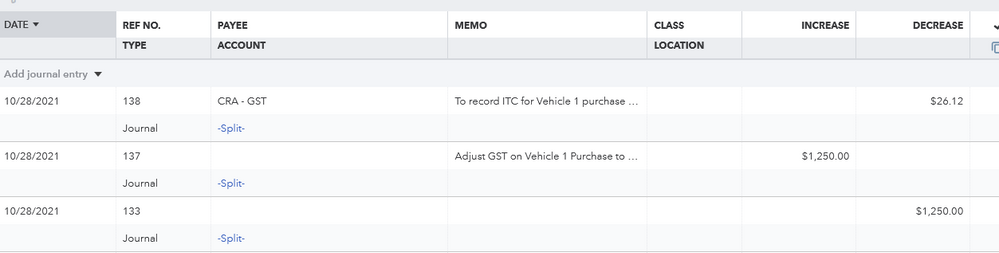

If we go to look at our GST/HST payable account in the Chart of Accounts, you can see how your entries have affected it:

Hope that helps! Cheers :)