Recording sales tax payments will affect certain accounts in QuickBooks Online, especially the sales tax liability account, Akshata.

When recording sales tax payments in QuickBooks Online (QBO), they reduce the balance in the Sales Tax Liability account. Make sure to record payments only when there is an outstanding sales tax liability for the period. Check the Taxable Sales Summary report to see the sales tax collected during that period and ensure the correct amount is due before filing or recording payments.

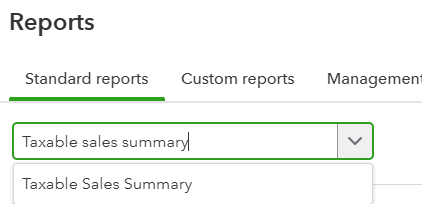

Here's how to run a Taxable sales summary report:

- Choose Reports from the left menu and select Standard reports.

- Enter Taxable sales summary in the search box.

- Run the report and check if there is an amount due.

If there is, follow the steps below to record sales tax payment:

- Find the return you have filed, then select Record payment.

- Choose the bank account from the Payment From ▼ dropdown.

- Hit Payment Date.

- Enter the amount in the Payment Amount field.

- To include any interest or penalties, click on Add Interest/Penalty. Complete the required fields in the interest/penalty form, and then click Save.

- After adding the information, select Record payment.

If no liability appears in the report, consult an accountant to figure out how to record the sales tax payments for closed financial periods.

If you have any additional questions about recording sales tax payments in QuickBooks Online, don't hesitate to comment below.