Your keen attention to detail is commendable, Allseasonsyardcare2002.

QuickBooks calculates cash flow using accounts categorized as Bank or Cash and Cash Equivalents. If the sales receipts are deposited into non-cash accounts, such as Accounts Receivable, Undeposited Funds, or Other Current Assets, they will not appear in the Cash Flow.

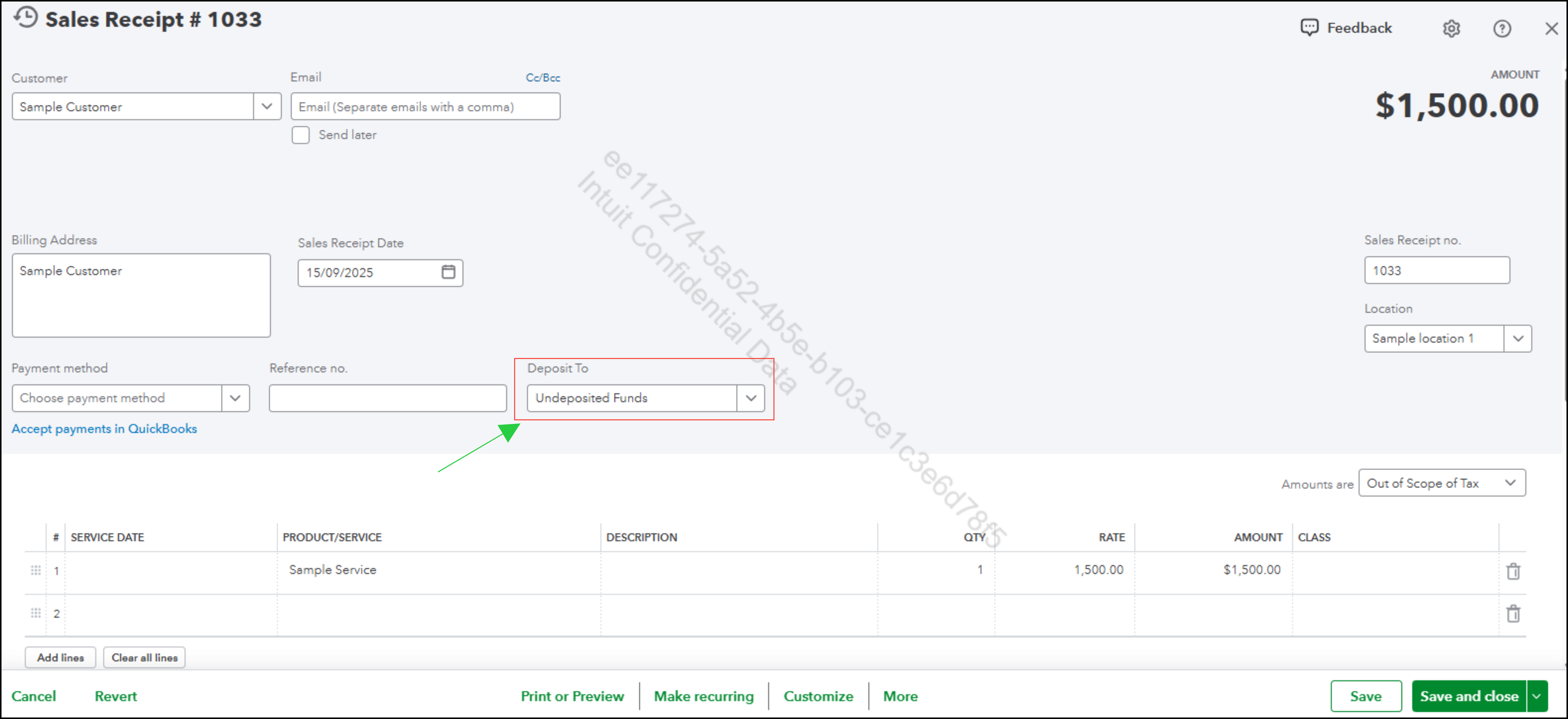

To resolve this, let's open the Sales Receipt and verify the Deposit to field. Ensure it's deposited into a Bank or Cash account.

If sales receipts are currently going to Undeposited Funds, we can manually record a deposit to transfer the funds into the correct Bank or Cash account.

Here's how:

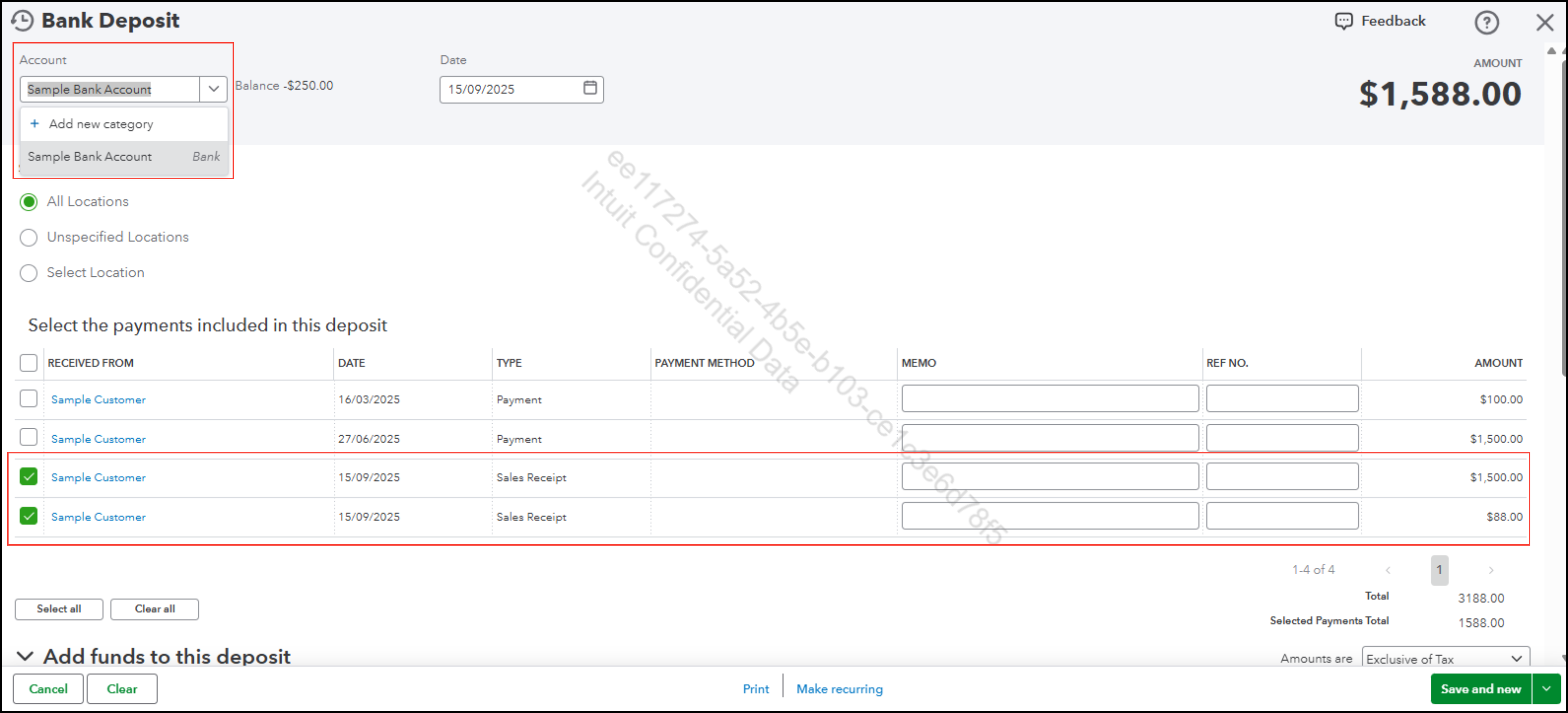

- Go to + New menu.

- Under Other, select Bank Deposit.

- On the Bank Deposit screen, you'll see a list of payments in the Select the payments included in this deposit section. Check the box next to the sales receipts you want to deposit.

- Deposit the selected payments into the appropriate Bank or Cash account.

If you have any further questions or require additional assistance, please add a comment below. We are here to help.