Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi, I have been using QBO payroll function to run semi-monthly payroll for two companies since April 2022. I always check payroll deduction (CPP, EI, Tax) amount with the payroll deduction online calculator (PDOC) of CRA website. For April month, the tax deduction on QBO is same as on PDOC.

But when I do the May1-15 period payroll, I find that the tax deduction on QBO is different from PDOC, QBO deduct more CPP and Less tax than PDOC. This make a big difference in net pay amount. I checked all the possible factors such as pay period frequency, Federal and provincial amount, Max CPP reached etc. Everything is right, so I couldn't find the cause... I can only manually correct all employee's CPP and tax amount on the payroll of May 15th based on PDOC's calculation, this took me a lot of time

Also, I haven't changed any payroll settings since April, so I wonder why the April payroll deduction on QBO is correct and May's are not. And the two companies have same the issue... It seems a bug of QBO payroll tax table.....

Anyone have the some issue in May when running payroll? Any solution except manual correction?

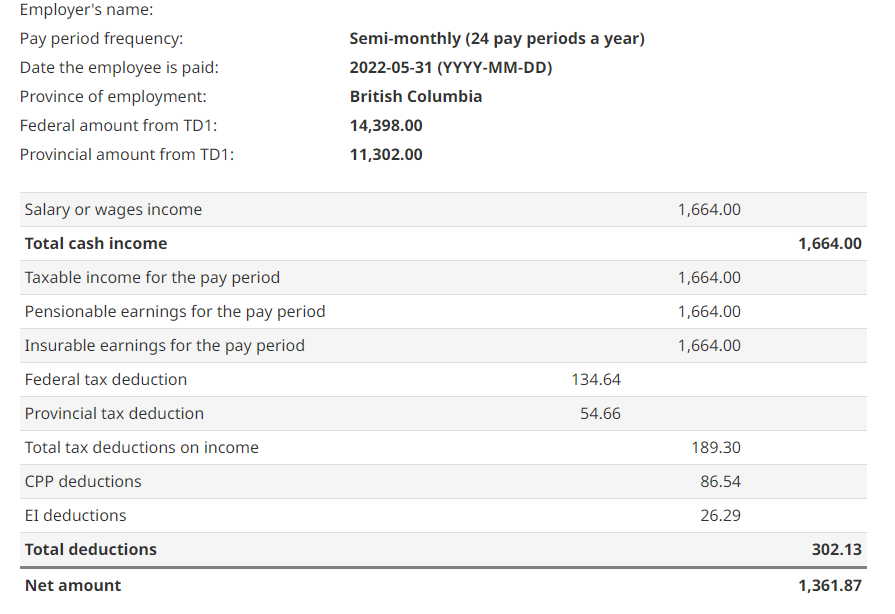

Below is an example, QBO and PDOC screenshot for an BC employee, Semi-monthly, gross pay $1664

QBO PDOC

Gross pay $ 1664 Gross pay $1664

Income tax $ 179.30 Income tax $189.30

EI $26.29 EI $26.29

CPP $136.40 CPP $86.54

Net pay$1322.01 Net Pay $1361.87

Thanks

Hello JANECCC1,

It's important you're able to get the resolution you need with this in a timely manner. I'll be glad to point you in the right direction so you're on the right track with your work.

Based on what you've described, I see you benefiting more by contacting our support team outside of the Community. This ensures that your account info remains private and secure. A specialist will be able to share your screen and have a visual reference of what you're seeing on your end. Here are our contact details:

Feel free to keep me posted on how you make out. I'll be one message away in case you need anything else.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here