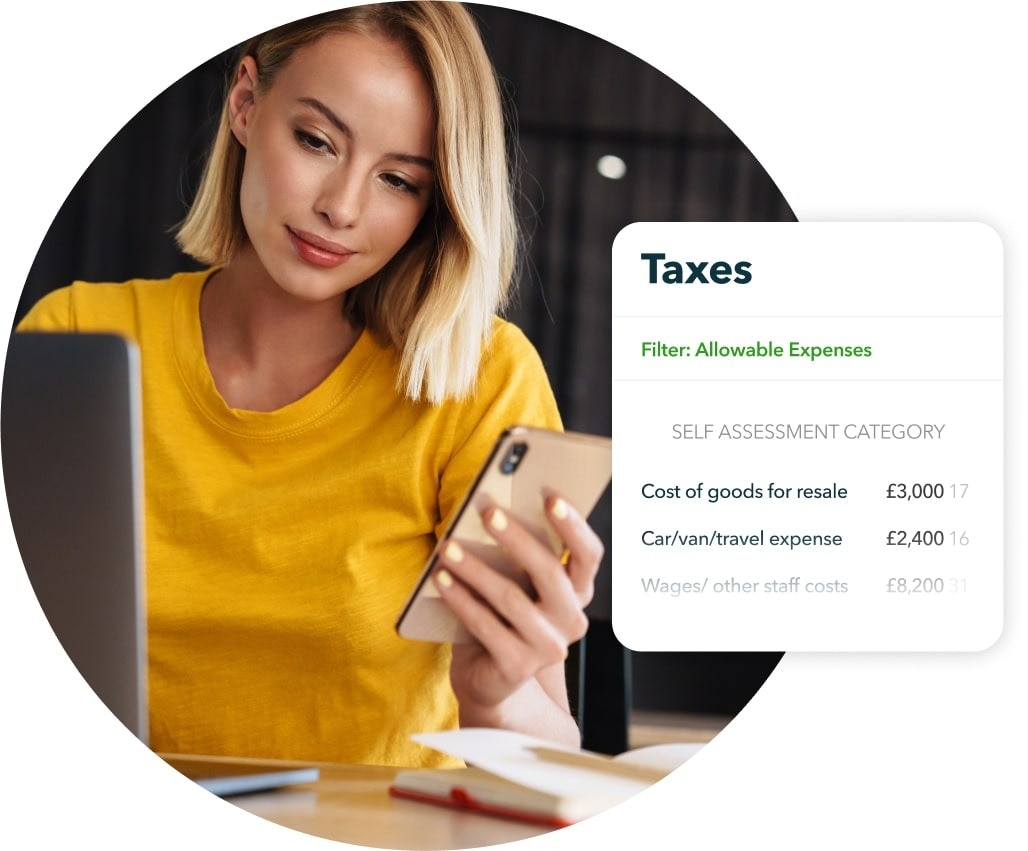

Claim every allowable expense available for self-employed individuals – all deductions are worked out for you. You'll be ready to submit your tax return to HMRC with accurate figures.

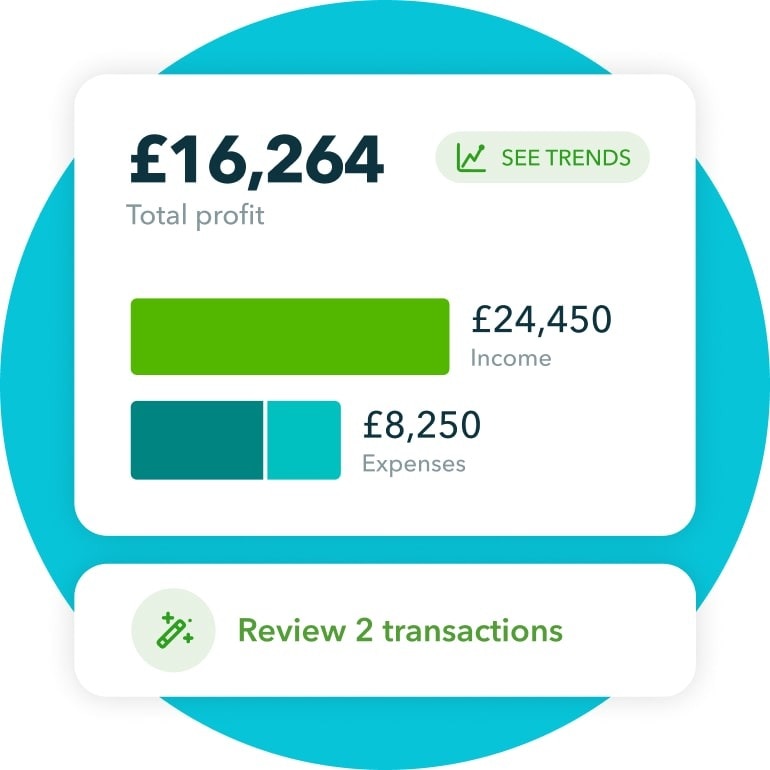

*We'll calculate your income and expenses to estimate how much tax you owe