In the 2022 Small Business Insights Survey by QuickBooks, 99% of small business owners cited inflation as a concern for their business in April, an increase from 96% in September 2021 and 97% in December 2021, respectively.

The concern from the small business community is completely warranted. Inflation disproportionately affects small businesses in a multitude of ways – and more rising costs appear to be on the horizon. However, it’s possible to often leverage these challenges into growth opportunities.

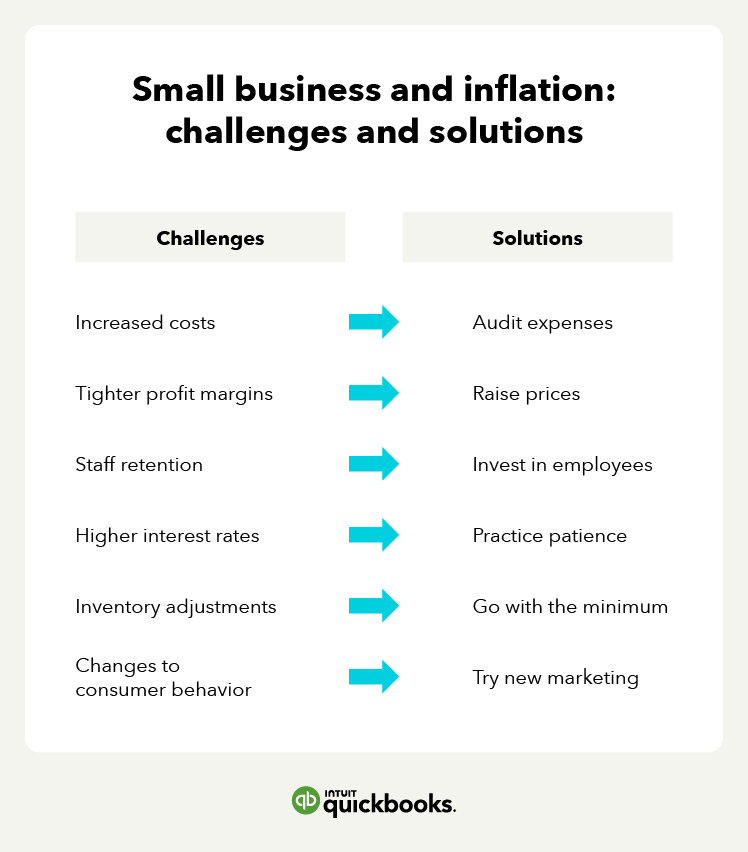

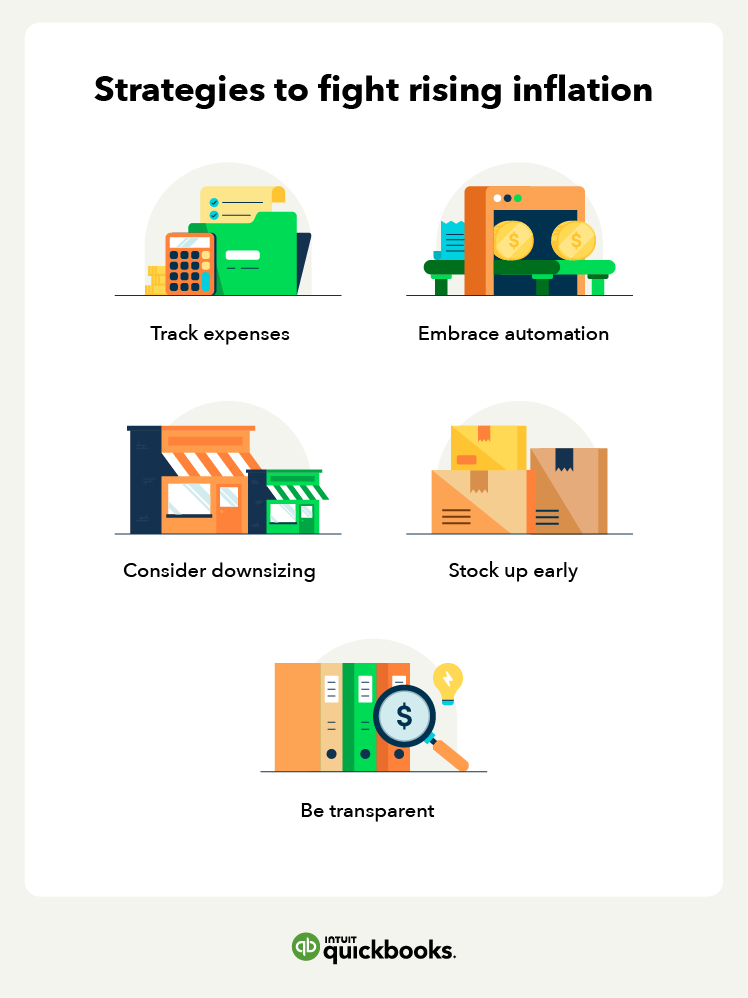

In this article, we’ll break down common challenges that inflation presents for small businesses and offer some solutions that can help them stay competitive during difficult times.