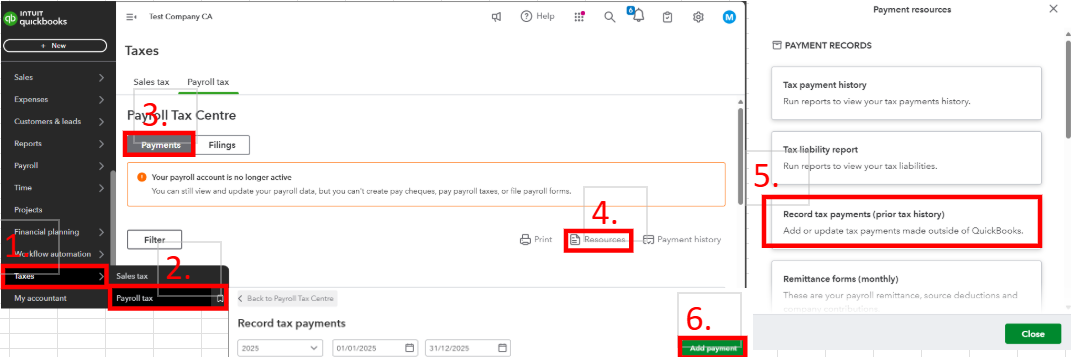

You can log past tax payment processes outside the system using the Taxes tab in your QuickBooks Online (QBO), @settlementbookke. I'll guide you step-by-step and include visual references or seamless navigation.

Tracking prior payments made outside the program is crucial, as it can affect recordings you have in the company file. These are the steps:

- Access your QuickBooks Online company.

- On the left navigational bar, click the Taxes tab.

- Select Payroll tax and then click the Payments section.

- Click Resources beside the payment history.

- Choose Record tax payments (prior tax history).

- Select the Add payment button.

- Complete the information in each field inside the Payment Details.

- Once done, click the Submit payment button.

For visual reference, see the image below.

If you're referring to the pay history in QBO, refer to this article for further guidance: Add pay history to QuickBooks Online Payroll.

Moreover, you can run the Payroll Tax Payments report to keep track of your recordings in the program. these are the steps:

- Access your QuickBooks Online company.

- On the left navigational bar, click the Reports tab.

- In the search bar, enter Payroll Tax Payments and then click on the result.

- You can filter the date if you want to review certain period recordings. In case you want to secure a copy of the report outside the program, click the Export and select Export to Excel or Print or save PDF.

I've added a screenshot below for seamless navigation.

I've enjoyed our interaction today and encourage you to use the comment section below if you have further questions about the program. I can assist in handling tax payments in QuickBooks if needed. Rest assured, I'll always be around to respond promptly. Stay safe.