Hello claudiarstead,

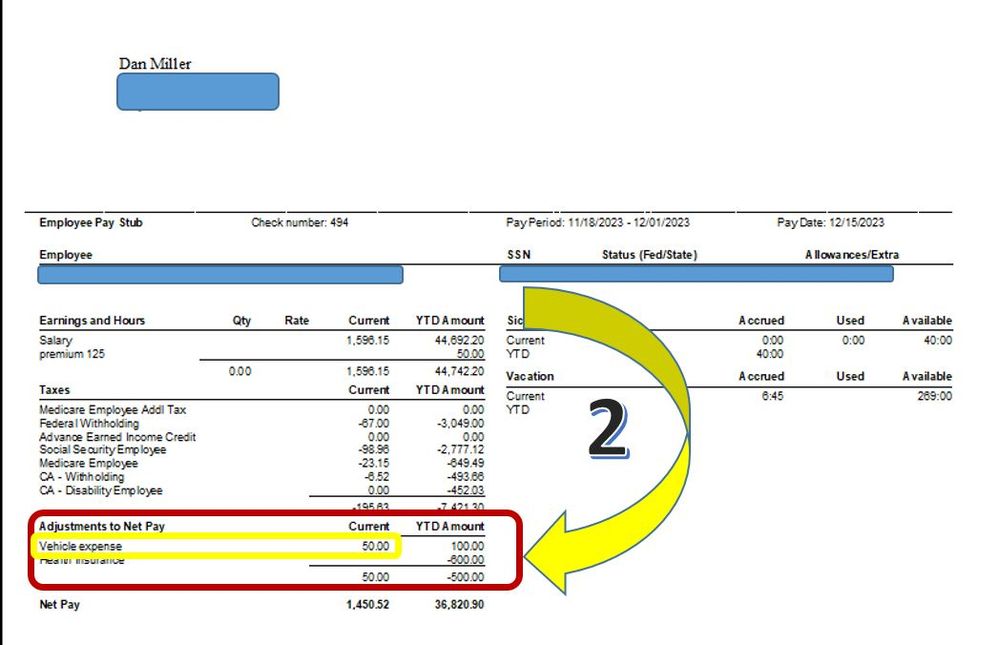

You can create an Addition payroll item for the vehicle expense. This way, the payroll item will be posted under Adjustments to Net Pay. Let me guide you through the steps.

- Click Lists, and then Payroll Item List.

- Click the Payroll Item drop-down, then click New.

- Click the Custom Setup radio-button, click Next, click Addition.

- Enter Vehicle expense on the Enter name for addition field.

- Make sure to select the correct Tax tracking type, choose None if you don't want to affect this item to your taxes or tax forms.

- Click Next, until Gross vs. net and click the net pay radio-button.

- Click Next until Finish.

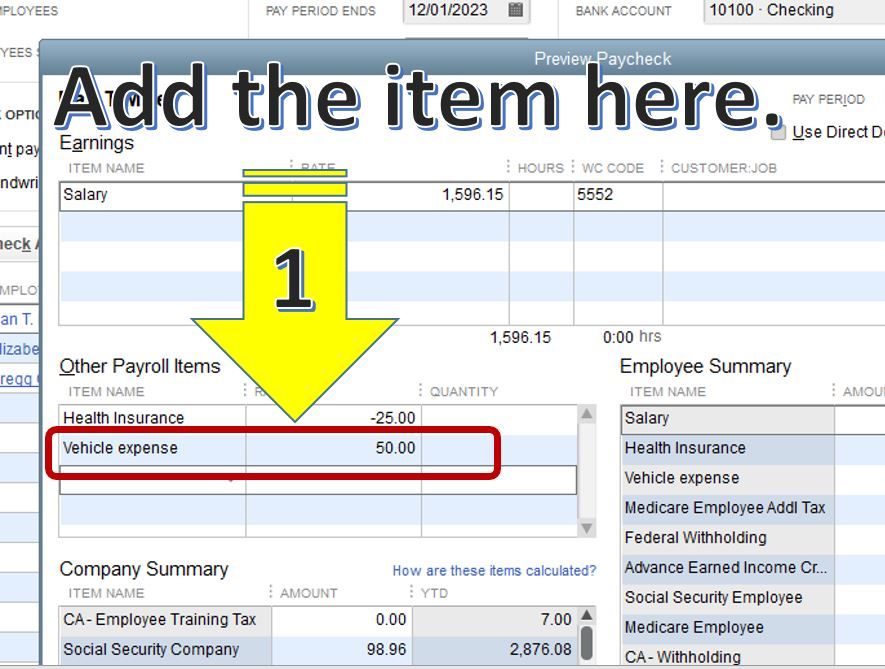

Once done, add the payroll item under Other Payroll Items when creating the paychecks.

This article is also a good future reference: Email pay stubs, T4s, and RL-1s from QuickBooks Desktop.

Please let me know if there's anything else you need. I'm always here to help.