Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

To set an employee as inactive, we just need to update their status, Sheila.

Here's how:

If you have any further questions, don't hesitate to reach out.

I thought I was being charged for the employees we are actually doing payroll for. Unfortunately we've been getting billed for months by not noticing it said (4) when we only have (2) employees! I just assumed Intuit raised their prices then I noticed the (4) on the invoice. I have since made the two employees inactive.

Is there any chance Intuit will reimburse us? It would seem QB would only charge for an employee that had recorded paycheck data that I used with the QB payroll program?

So for example, if an employer hires employees on a part-time basis, they have to move them month by month from active to inactive so they don't get charged for payroll when they only pay them 5-6 times a year?

Lynn

Thank you for reaching out and sharing your concerns regarding the billing for your QuickBooks Payroll service, @lg59. I completely understand how receiving invoices that don’t seem to align with your actual payroll activity can be challenging. It’s always important to ensure that you’re only being charged for the services and employees that reflect your real business needs, so your attention to this detail is well warranted.

To clarify, QuickBooks does not issue refunds for charges related to active employees. It’s important to understand how the billing system works. QuickBooks Payroll charges are based on the number of employees marked as “active” in your payroll account during the billing cycle, regardless of whether you actually ran payroll for all of them that month. If an employee is listed as active, the system assumes you intend to maintain them on payroll and, therefore, bills you accordingly.

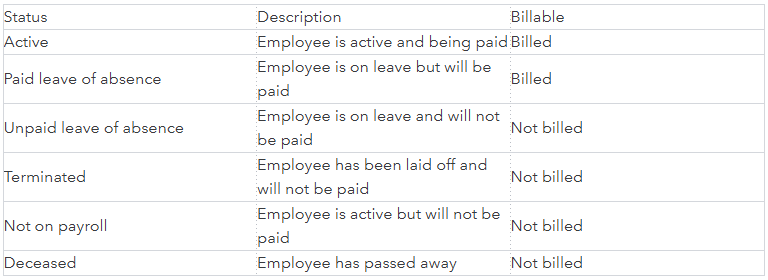

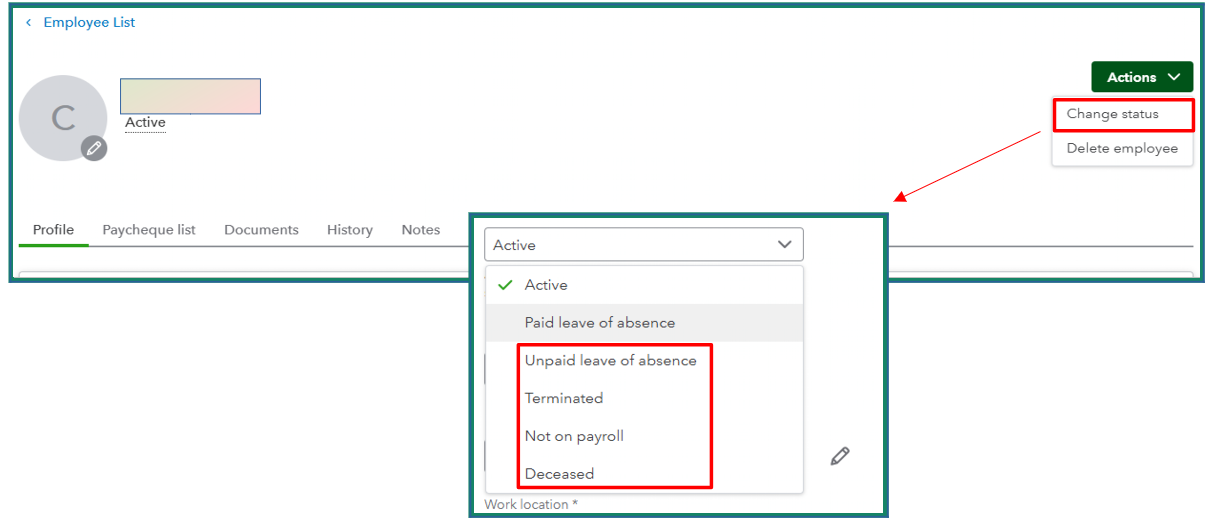

Moving forward, be sure to update the status of any employee you do not want to be billed for by marking them as Terminated, Unpaid leave of absence, Not on payroll, or Deceased. Please refer to the attached screenshot for detailed information on the different employee statuses and which ones incur billing charges.

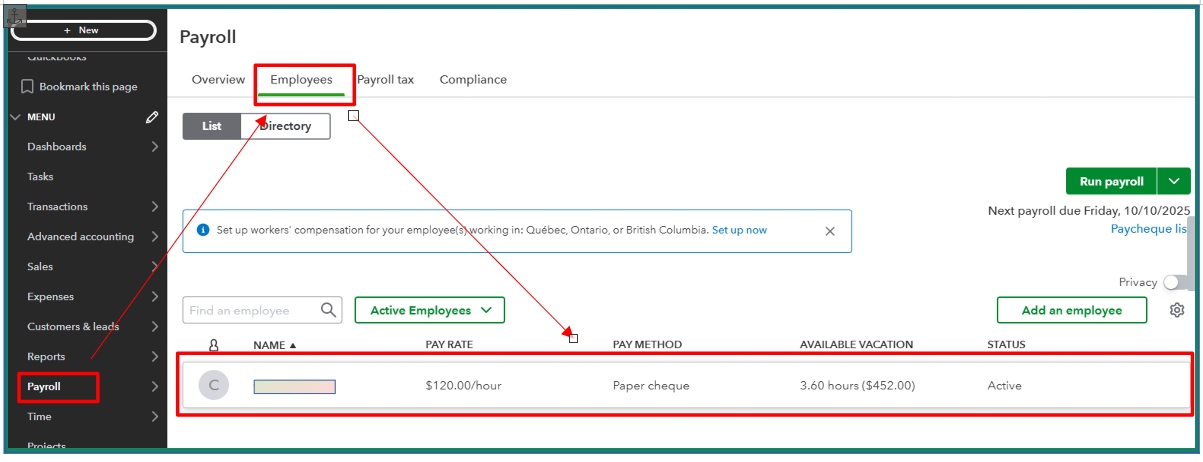

To update the employee's status, you can follow these steps:

I hope this explanation helps clarify how QuickBooks Payroll billing works and why managing employee statuses is so important to avoid unexpected charges. Thank you again for your attention to this matter and for trusting us with your QuickBooks Payroll service. Please feel free to reach out anytime if you need further clarification or assistance. We'll be right here to help. Take care!

I only have 2 employees and QB is now charging me for 4 employees also. Would like to know how many users they are doing this to .

Let’s take a moment to review your QuickBooks Online charges to ensure accuracy and confirm there are no billing errors or unexpected charges, NBI.

Your QuickBooks subscription details are located in the Item section of your subscription invoice. I recommend carefully reviewing the list of employees or workers for whom you were billed during this billing period, which is outlined on the second page of your invoice.

It’s worth noting that QuickBooks Payroll plans follow a per-employee pricing model, which varies depending on your chosen subscription level. To confirm the charges tied to your specific subscription, follow these steps:

If you notice any unfamiliar items or charges, we encourage you to use the Look-Up Charge Tool to investigate where a particular charge originated and why it was applied.

Should you require further assistance or expert verification of your charges, our Live Support team is available to provide guidance and ensure your concerns are fully addressed.

Feel free to reach out to us with updates, or let us know how things progress on your end. We’re fully committed to ensuring everything runs smoothly for you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here