Hi @ 9130 3484 4851 2586 , thanks for reaching out to the community. I understand how important it is to use the right accounts for accuracy and transparency.

I'd be glad to show you the way on how to properly handle prepayments.

First, we are going to create an Accounts Payable account for the transaction. Then, create a journal entry, and input the total amount of the payment. After that, make another journal entry transaction to post the advance payment. When the time comes for your monthly payment, you can also create a journal entry for it. That way, you can track the balance you've owed to your supplier. Please refer to the detailed steps below.

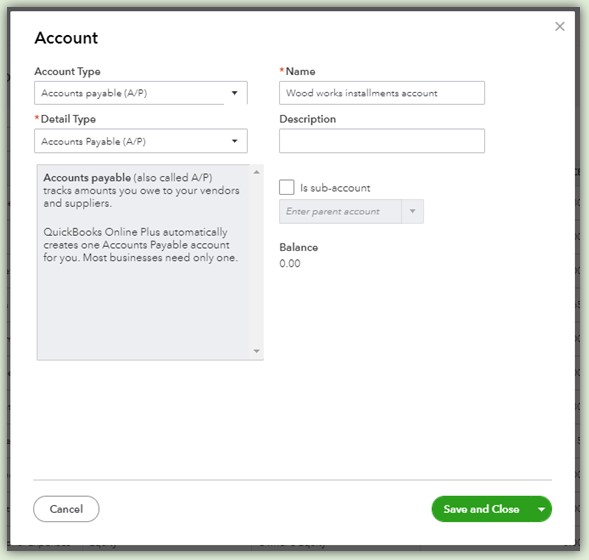

Step 1: Create an Accounts Payable account.

- Go to the Settings or Gear icon and select Chart of Accounts.

- Click the New button.

- On the Accounts type field, choose Accounts Payable.

- Enter a descriptive name of the account to easily identify it.

- Once done, select Save and close. You can check out the screenshot for additional reference.

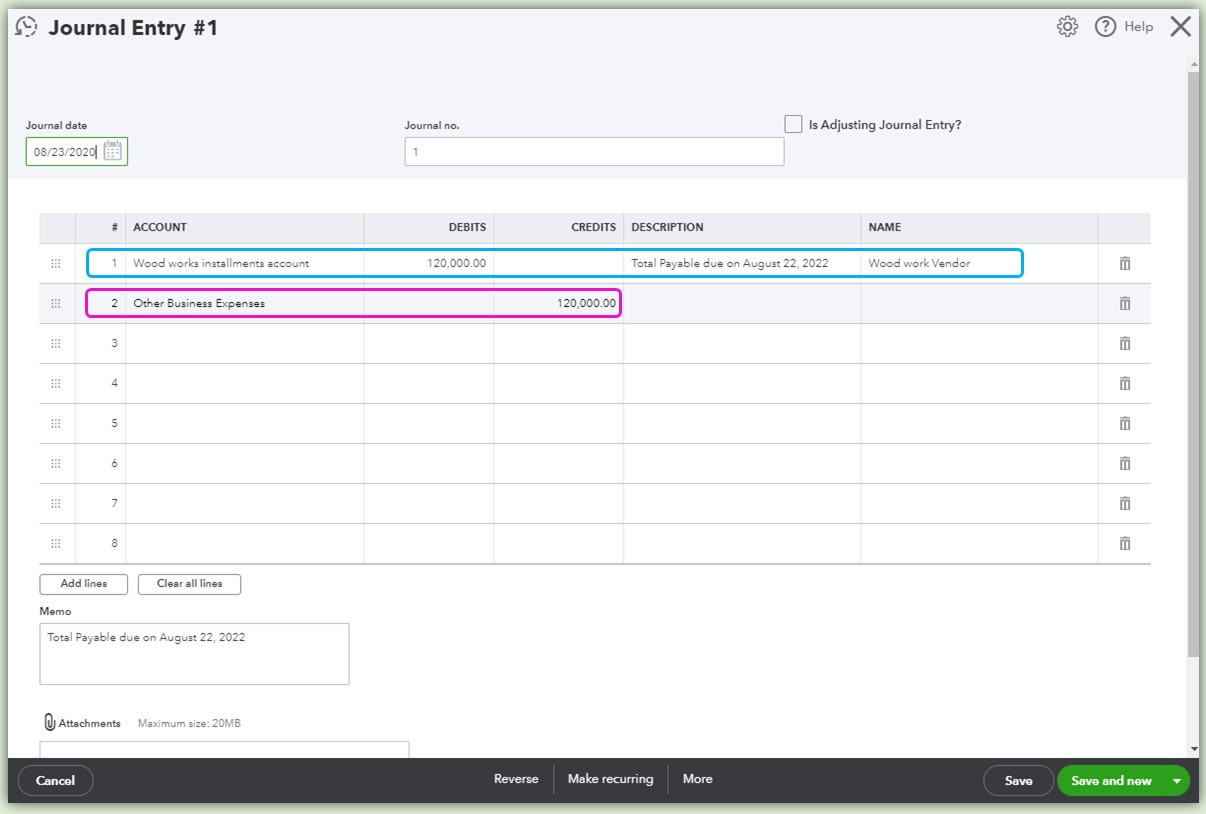

Step 2: Post the total payable amount in the account you've just made.

- Go to the + New button and choose Journal entry.

- On the first line, enter the Accounts Payable you've created, then debit the total amount you've owed.

- Enter the name of your supplier under the Name column.

- On the second line, choose an expense account and credit the total amount.

- Select Save and new. I've also added a sample screenshot to see how it looks like.

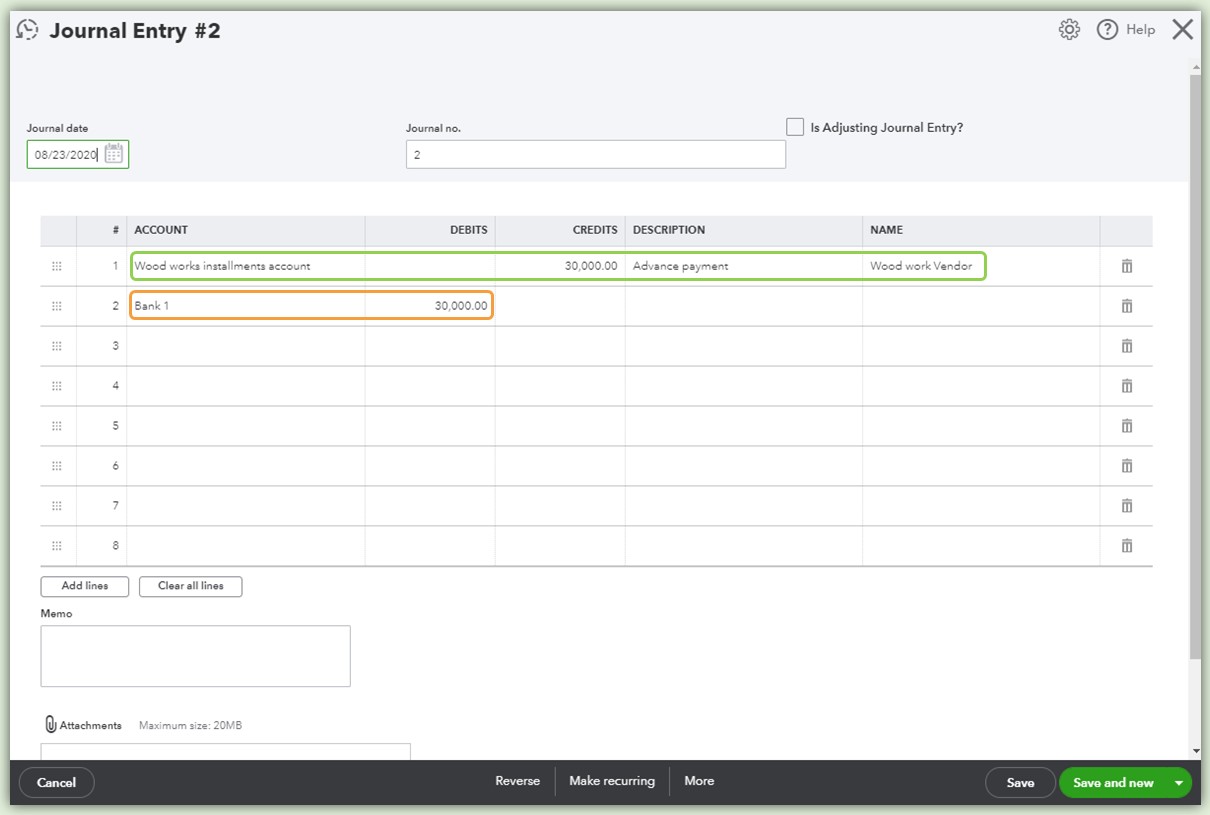

Step 3: Record the Advance payment on the Accounts payable.

- In the Journal entry page, credit the advance payment on the specific Accounts payable of your supplier.

- Enter the name of your supplier under the Name column.

- On the second line, debit the amount to the Bank you've used to pay.

- Once done, select Save and close. Here's a sample screenshot for this step.

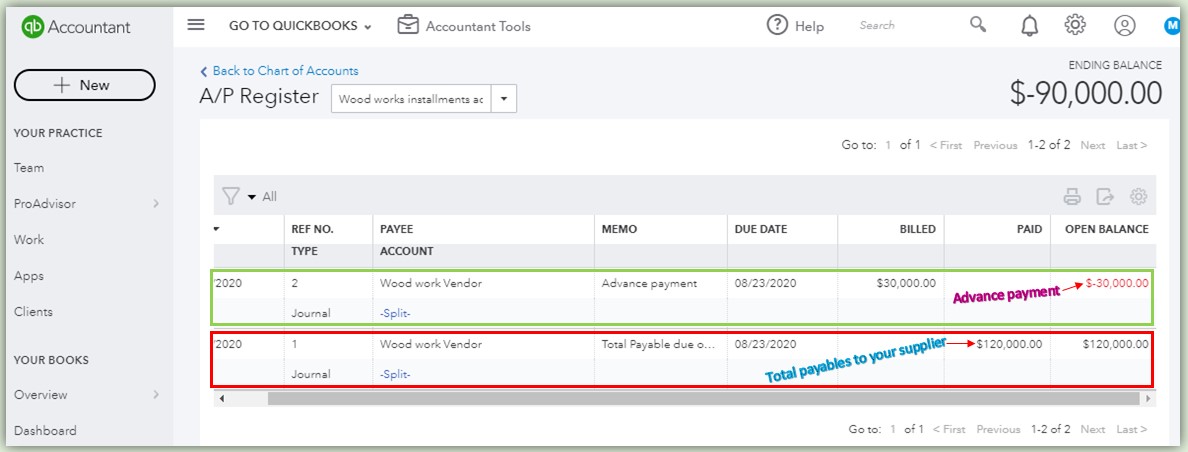

After those steps, you can check out the register of the Accounts payable you've created to track the payment. This is how it looks like:

For the monthly payment, you can follow Step 3 when recording. To learn more on how to enter details in Journal entry, you can check out this article: Create a journal entry in QuickBooks Online.

Hopes this helps. Have an amazing weekend!