I'd be happy to assist you today, jaimewood08.

You've got me here today to help share the steps in posting a credit using personal funds via QuickBooks Online.

To post a business expense paid for by personal funds, you have to first record the expense, and then you must record the partner or owner's reimbursement for that expenditure.

Here's how:

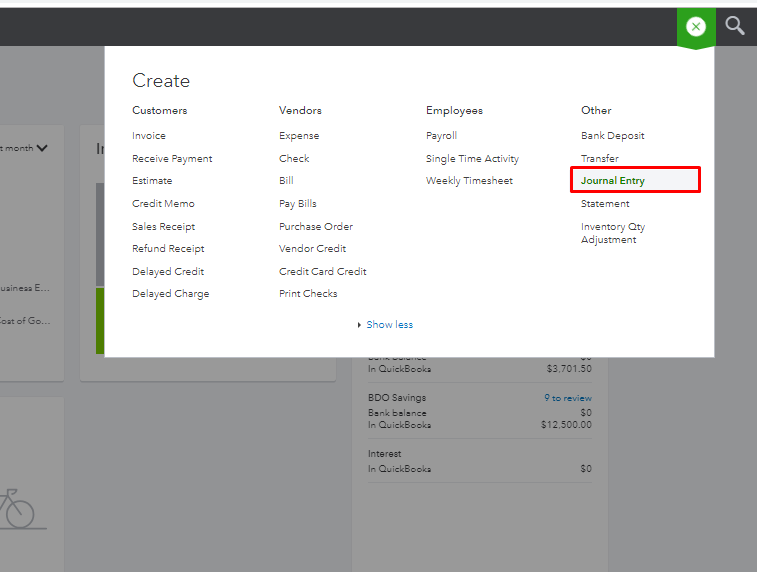

- Select the Plus icon (+) on the Toolbar.

- Under Other, select Journal Entry.

- On the first line, specify the appropriate expense Account for the purchase.

- Enter the amount of the purchase in the Debit column.

- (Optional) Enter a customer Name to associate the expense with a customer.

- On the second line, in the Account column, enter the Owner's equity or Partner equity.

- In the Credit column, enter the amount of the purchase.

- (Optional) In the Memo field, add Reimbursable to help you identify the transaction later.

- Select Save and close.

However, the assistance of an accountant is a must to help and guide on which account to debit and credit. Your accountant can provide more expert ways of dealing with this situation.

You can get more details in this article: How to pay for business expenses with personal funds.

I'm always around here in the Community if you ever need more help in posting personal funds in QuickBooks Online. Have a nice day.