Hi, Weikcon. If you want to change the payment schedule on either your Federal or Provincial remittance, you can go to the Payroll settings to do this.

To change the Federal remittance, follow these steps:

- Select the Settings icon, then Payroll settings.

- Select the Edit icon for Federal tax info.

- Select Edit again at the bottom of the Federal tax info page.

- Select the PD7A form, how often you file and pay your taxes, and the effective date by using the drop-down menus.

- Select Save.

To change the Provincial remittance, follow these instructions:

- Select the Settings icon, then Payroll settings.

- Select the Edit icon for your province's tax withholdings.

- Select how often you need to complete your remittance.

- Select Save.

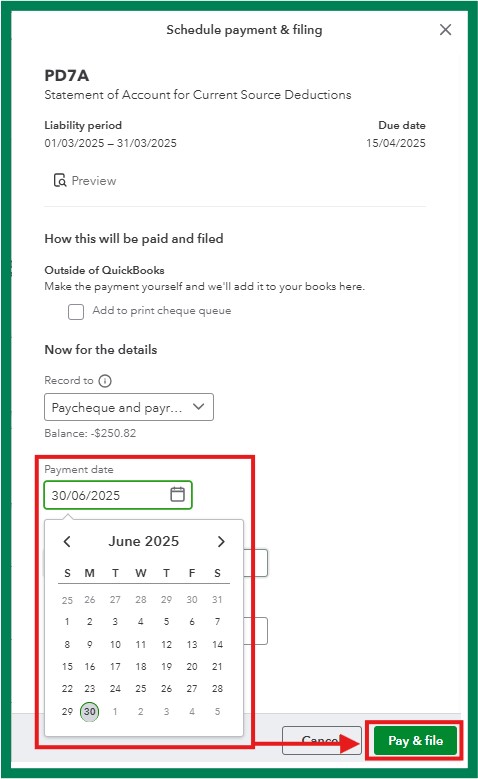

On the other hand, if you meant changing the payment date of your manually filed tax payment, you'll have to delete that previous payment and start again. Upon filing it again in QuickBooks, you can filter it to the desired Payment date before clicking Pay & File.

You can utilize these helpful resources for more information on the topic:

For generating a report that shows the total taxes and wages by employee, you can use this article as a future guide: Create a payroll summary report in QuickBooks.

We'll be active in the thread if you have more questions or need additional assistance. Please don't hesitate to post your replies.