Hey All,

Do we have instructions for setting up severance payments in QuickBooks Desktop? I’ve been unable to configure it correctly.

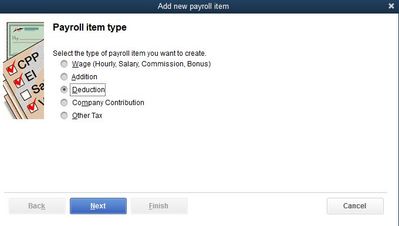

When I try to set up severance pay, the system only gives me options to add wages, additions, deductions, company contributions, and other taxes. From my understanding, severance should not be reported on Box 14—only on Box 66 or 67. It should also be exempt from CPP and EI contributions, with only federal and provincial taxes applied.

Additionally, since the severance will be paid as a lump sum along with wages and termination pay, the taxes should be calculated accordingly. How can I confirm if the taxes are being applied correctly in this scenario?

Thanks in advance!