If you're referring to setting a fiscal year that ends on June 30, you'll have to set the first month of your fiscal year to be July, Tomas. I'll provide a thorough explanation below.

A fiscal year is a 12-month period that organizations use for accounting and financial reporting. By setting July as the first month of your fiscal year, your year-end will be automatically set to June.

Before making any changes, it's essential to consult with an accountant. They can help you understand how this decision will impact your business, including any tax implications and reporting requirements. Your accountant can also provide guidance on adjusting your budget accordingly.

To change the first month of your fiscal year, follow these steps:

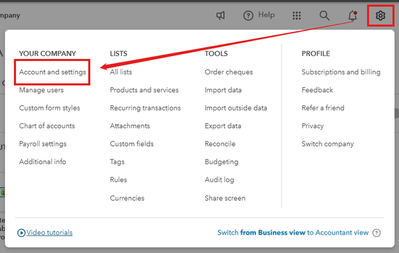

1. Navigate to the Gear icon.

2. Click on Accounts and settings.

3. Select the Advanced tab.

4. Click the Pencil icon in the Accounting section.

5. Set the First month of fiscal year to July.

If you’re referring to setting a closing date for your books, you'll need to select June 30 as your closing date. Setting it is essential for maintaining accuracy and preventing unauthorized changes that could affect your financial reports. Follow the steps outlined in this article to close your books: Close your books in QuickBooks Online.

At the end of each fiscal year, QuickBooks Online automatically transfers money to your Retained Earnings account through an electronic swap. To understand the composition of your Retained Earnings, you can generate a Profit and Loss report and examine the Net Income (Loss) section for details.

Let me know if you have additional inquiries about setting the year-end for your account or any QuickBooks-related concerns. I got you always. Have a good one.