Intuit QuickBooks Small Business Index, March 2026

Simple, smart accounting software - no commitment, cancel anytime

MY FIRST YEAR

Starting a business is one of life’s most exciting adventures. But it can sometimes be a lonely experience too, with no one there to help make all those big decisions.

You can probably expect to wear many hats, especially in your first year. On any given day you might be a marketer, accountant, recruiter, or IT manager. And that’s on top of the day job.

Even the most skilled multitaskers can’t do everything alone. No matter how self-confident and/or flush you might feel. Making a proper go of it requires iron-clad self-discipline and good decisions because now, you’re the boss.

While no two businesses are the same, most will tick off similar milestones in their first year. We’ve put together this timeline which you can use as a guide, or a checklist, as you navigate your first year in business.

I'm looking to start a business

What kind of business structure do you want – sole trader, private limited (LTD) or limited liability (LLC)?

Do your research on what each kind of business demands, including the legal liabilities and admin involved.

What's right for you?Given that more than 93% choose to set up as LTD, we’ll assume that’s what most of you will go for.

Some of the following won’t apply to sole traders and other corporate body types.

This is the fun bit–finding the perfect name that your business will be remembered by in the history books.

Whatever choice you make, take a moment to celebrate. This is a big step, where your dream starts to become a reality.

Your preferred name is a no-go if it’s already taken on the gov.uk registry of trademarks, Companies House, or, under certain circumstances, is not registered but is still being used elsewhere.

If you’re struggling for inspiration, we’ve got you covered.

It’s important that your company’s cash flow is managed in a business account. But this doesn’t have to be at a bank you currently hold an account with.

What suits your business best? A digital bank with a handy app, or a household name with a local branch? Compare fees with benefits before you decide.

You can find other relevant aspects to consider.

You’re going to need a marketing strategy in place so that your future customers can find you easily.

Whether that’s securing a physical premises, launching a website, or setting up an e-commerce shop with business social media accounts, you’ll want to create a large presence across the best channels for your new business.

It’s worth checking out this marketing strategy guide to make sure you don’t miss anything important.

Now that you’ve set your business up, you’re ready to launch.

Kick that genius marketing strategy into gear and begin advertising your new website, creating content to garner new followers on social media, and reaching out to potential customers.

If you’re not entirely sure how, our target audience guide might help. Intuit Mailchimp provides email marketing campaigns to support your business as you grow. You can even integrate with your site to drive newsletter sign ups.

You did it!

Some new business owners might expect to start receiving orders on day one. For others with a more complex or expensive product, it might take a bit longer to land your first big sales.

Regardless of when you land your first order or deal, it’s important not to get complacent. You’ll need to follow up on it in a professional way so that you attract returning customers and encourage good feedback.

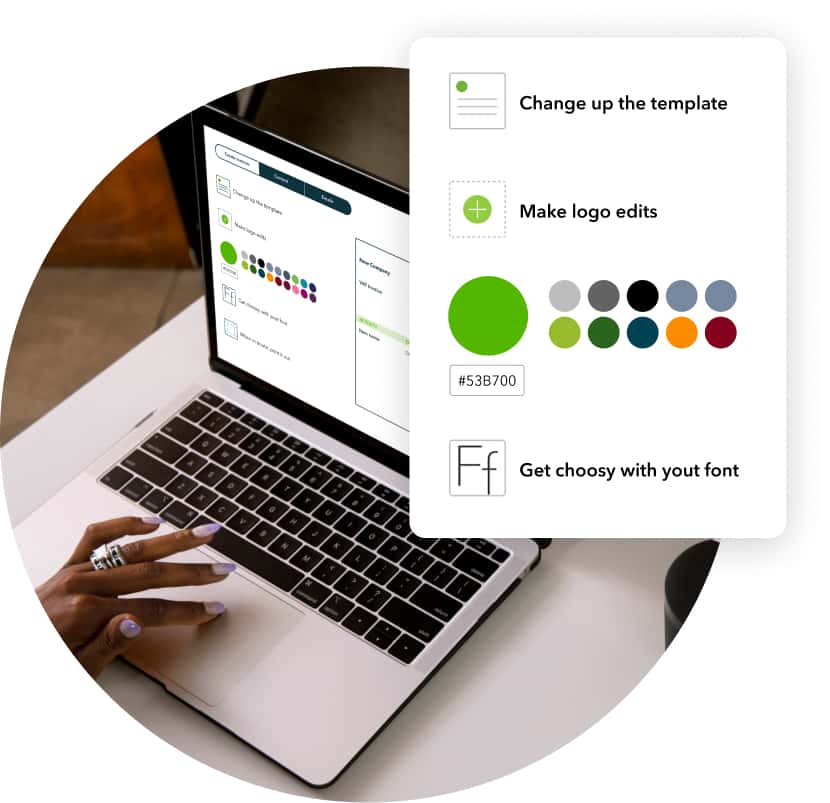

You can also add some flair to your invoice by branding it with your company information and logo, regardless of which QuickBooks package you’re using.

You’ll want to be flexible to your customer’s needs by offering them more than one way to pay, whether that’s at the point of sale (POS), via direct debit with GoCardless, or using the ‘pay now’ option on your invoices.

This way, you’ll also boost your chances of getting paid faster. And we’ll help you chase those awkward late payments, without damaging your rapport with the client.

My business is 3 months old

Keep an eye on the numbers to avoid unpleasant surprises

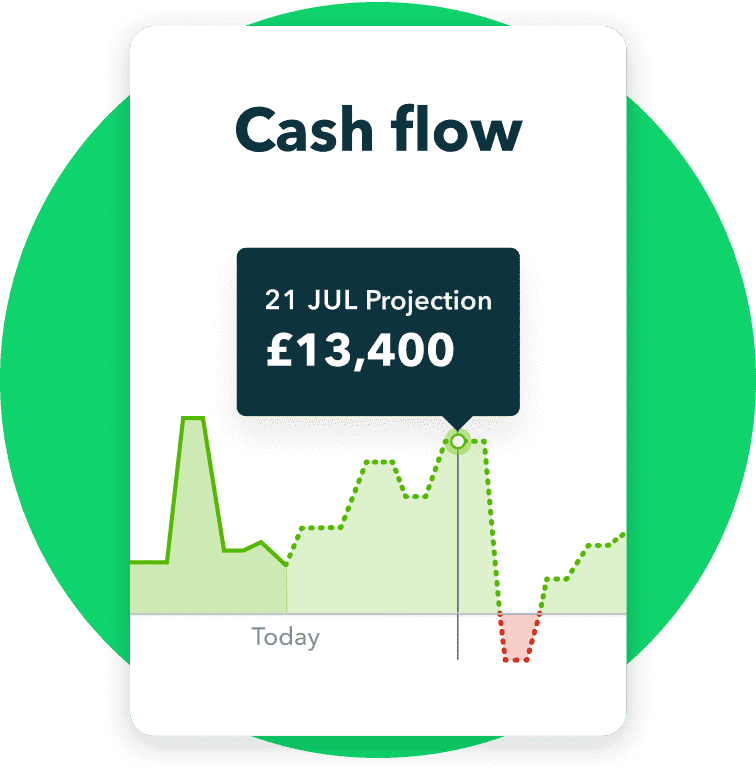

Now that you’re up and running, you’ll need to keep an eye on cash flow. Always bear in mind what you owe, and what others owe you. You don’t want to suddenly realise you can’t pay your bills.

Try not to lose touch with what’s coming in and going out of your account, especially when taxes come up at multiple points in the year.

You can check out this cash flow guide to help you out.

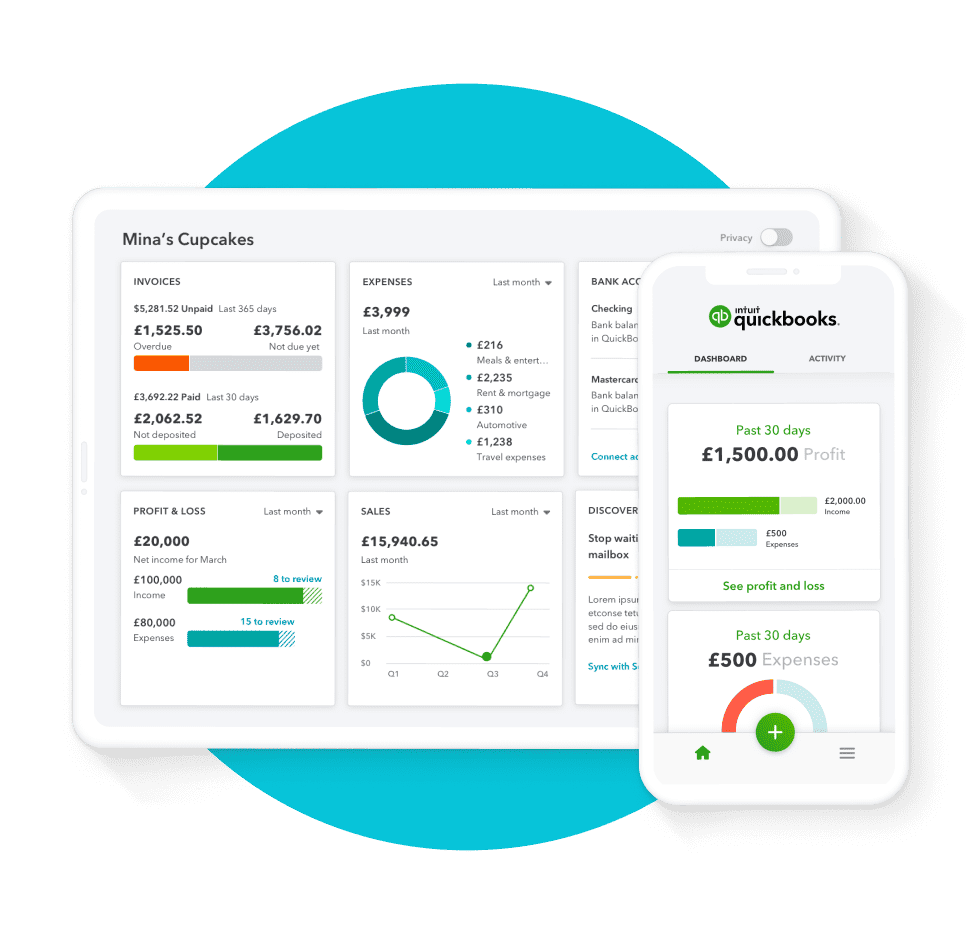

Connect your business bank account to QuickBooks, and we’ll download your transaction history for you. Monitor your cash flow at a glance, whether you’re at your desk or on the go. We’ll keep you up to speed.

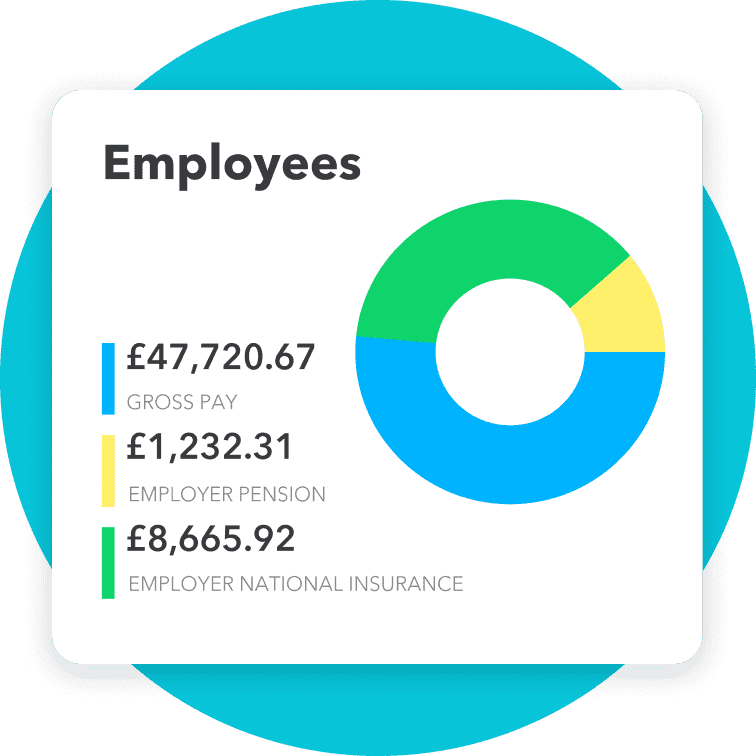

Make payday as seamless as it is rewarding

If you’re going to pay yourself a salary through the business, you’ll need to pay tax and National Insurance through PAYE.

That means filing the correct amount, and on time. You’ll also need to keep up to speed with the latest tax code changes from HMRC. All this takes you away from running your business.

If you’re hiring other members of staff beyond a certain age and salary, you’ll want to set up a workplace pension to keep employees going beyond retirement.

That’s where QuickBooks Core Payroll can help. Whether you’re running payroll for one employee or 20, you can relax knowing that details are being tracked accurately and kept up to date.

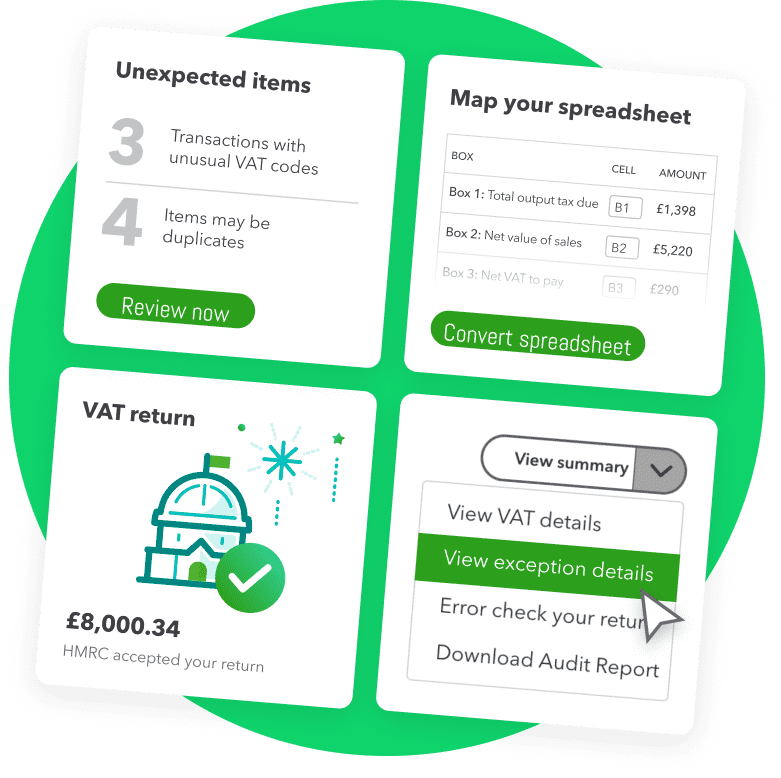

Registering for VAT might not sound like the most exciting part of running your new business. But if you anticipate reaching £85,000 in taxable turnover per year, you’ll need to be on top of this. Even if you don’t see yourself earning that much for a while, it’s still worth doing.

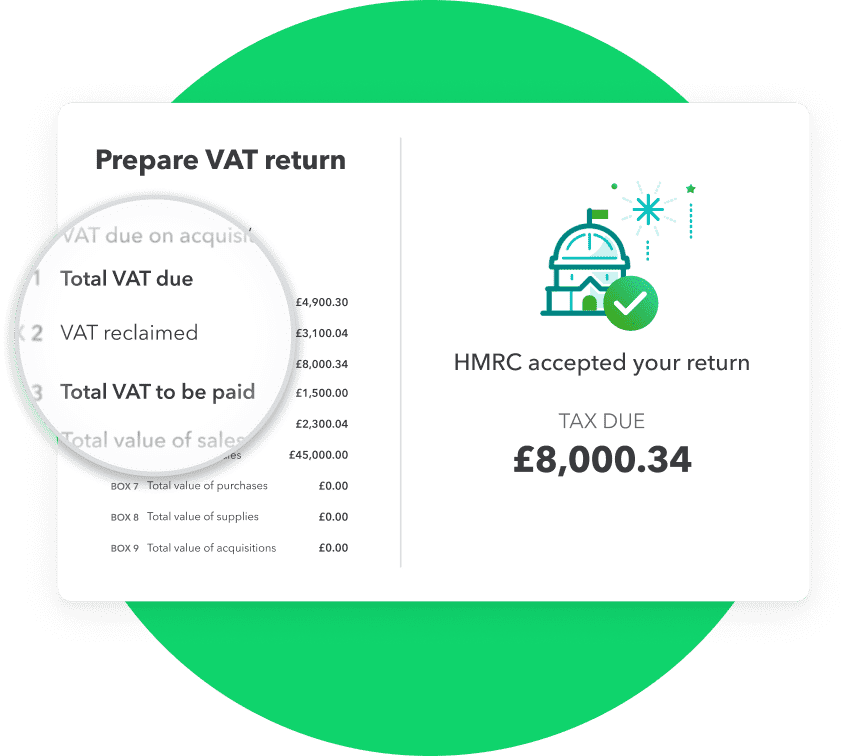

You’ll have to charge VAT on customer invoices and file a return every quarter. But the good news is that you’ll be able to claim back the VAT that others charge to your business.

Here’s a breakdown of the VAT basics to get you started.

VAT returns are due every three months. Mark your diary.

Filing a VAT return tells the government how much tax you’ve charged and how much you’ve paid to other businesses. Returns usually need to be filed quarterly in what’s known as your accounting period. The deadline for submitting your return online is usually one calendar month and seven days after the end of an accounting period.

Almost all VAT-registered companies must now comply with Making Tax Digital, so it’s best to start keeping digital records from day one.

If you’re ready to register for VAT online, this guide will make the process far easier.

Don’t panic or procrastinate when it comes to VAT. Instead, use QuickBooks to prepare, track and file VAT in an easy and compliant way.

My business is 6 months old

You will naturally care more about your business than anyone else. So it’s natural to want to have oversight across everything. But even the most talented multitaskers run out of time. So delegation is one of the best things to learn early on.

If there are important tasks you lack the time or skills for, it’s okay to ask for help. Knowing when to bring others on board is one of the most crucial decisions you’ll have to make.

QuickBooks takes care of repetitive financial admin, freeing up your schedule to spend time on running your business. Or just grabbing cups of coffee for the team.

If you keep growing, sooner or later, you’ll likely need help on a permanent basis. After all, you’re a boss now. Hiring your first employee is par for the course.

There are plenty of walkthroughs for hiring employees online, but we think this is a particularly helpful one.

If you haven’t yet set up payroll to pay yourself or another director, now’s the time to get it up and running.

For each new employee you’ll need to account for tax and National Insurance through PAYE. And don’t forget to add them into the pension scheme you created earlier, so long as they’re eligible – find out more.

QuickBooks Core Payroll is there to take care of the admin and help you ensure you stay on the right side of the taxman.

Repeat custom is the best custom

As you’ve noticed by now, creating a business requires a lot of decision-making.

One such decision is whether to chase new customers or focus on the ones you have. Thankfully, this is one of the easier decisions to make. Winning business from someone who’s bought from you before is much easier than convincing someone new.

Learn more about marketing to existing customers.

Find new ways to market to your existing customers when you use Intuit Mailchimp for customer relationship management (CRM).

My business is 9 months or older

You will need:

The balance sheet is especially important as it shows how much equity (or net assets) your company has.

Your director’s report is a summary of your company’s performance over the year, including its profits and losses.

And your footnotes are additional notes and explanations about your accounts which can add more context for understanding your financial position.

You’ll want to submit an iXBRL to HMRC and Companies House, along with the corporation tax return linked to your annual accounts. And if you’re VAT registered, you’ll also need to submit these to HMRC’s VAT division.

It’s worth reading HMRC’s XBRL guide for businesses if you’re not familiar with them.

As you approach your first business birthday, look at what has worked in year one, and see if there’s anything to be learned from what didn’t go as planned.

To get ready for year two and beyond, you need to know what went well, what your customers want and expect, and where you need to focus attention.

With QuickBooks, the at-a-glance dashboard makes it easy to find insights from your finances. So, you can identify opportunities and risks for the future.

One place to focus your attention could be these top tips for business success.

ITSA time management thing

Remember, if you own a limited company, your personal finances are separate from the business account. Any director of a private limited company must return an Income Tax Self Assessment (ITSA), in addition to submitting the company’s taxes. Be sure to look at this guide to make sure you’re not making any errors.

From 2026, you’ll need to use compliant software to keep digital records, and file updates to HMRC at least every quarter under the new ‘Making Tax Digital’ initiative.

Using software like QuickBooks from the outset is the easiest, safest way to work out your Self Assessment. We can help auto-calculate your figures and sort your expenses into categories, so you don’t have to.

And if you haven’t paid yourself via payroll, don’t worry. We’ll help you track your Income Tax and National Insurance in real-time throughout the year, to avoid any unwanted surprises when the deadline rolls around.

QuickBooks also helps you digitally keep track of expenses, instead of via that pile on your desk.

Making a statement has never been so simple

So, you filed your Self Assessment. Now you need to do the same for the business in your annual statement. You’ll need to include things like turnover, profits, and tax reliefs.

There’s a lot to consider here, so having a guide to financial statements is always helpful.

QuickBooks keeps accurate financial records to make filing your company tax return as easy as possible.

Your business is one year old!

Mark this milestone, because as exciting as the next few years may be, you’ll never experience your first year again.

There are plenty more choices to make over the course of your business’s lifetime but feel proud that you did your best to help it thrive from day one.

You’re no longer an amateur, but don’t get too comfortable. As you grow, complexity is inevitable. Make sure to follow all the steps on corporation tax, and remember, you can always ask QuickBooks for help.

Make your business dreams a reality with our simple, smart accounting software for startup businesses.

Subscribe to get our latest insights, promotions, and product releases straight to your inbox.

9.00am - 5.30pm Monday - Thursday

9.00am - 4.30pm Friday