QuickBooks Time is the No. 1 time tracking software and has over 75,000 five-star reviews.1, 2 With automatic time tracking, real-time reporting, and direct integrations, QuickBooks Time pays off long after payday.

Simpler payroll is just the start

Spot every second

Track hours from any device to manage employees with ease and eliminate time theft.

Plan for profits

Show your clients which projects take the most time, so they pick the most profitable jobs.

Find time to grow

Ditch the busy work and save hours on payroll for clients—so you can add a few more.

Discover all the ways QuickBooks Time puts time on your side

Time tracking

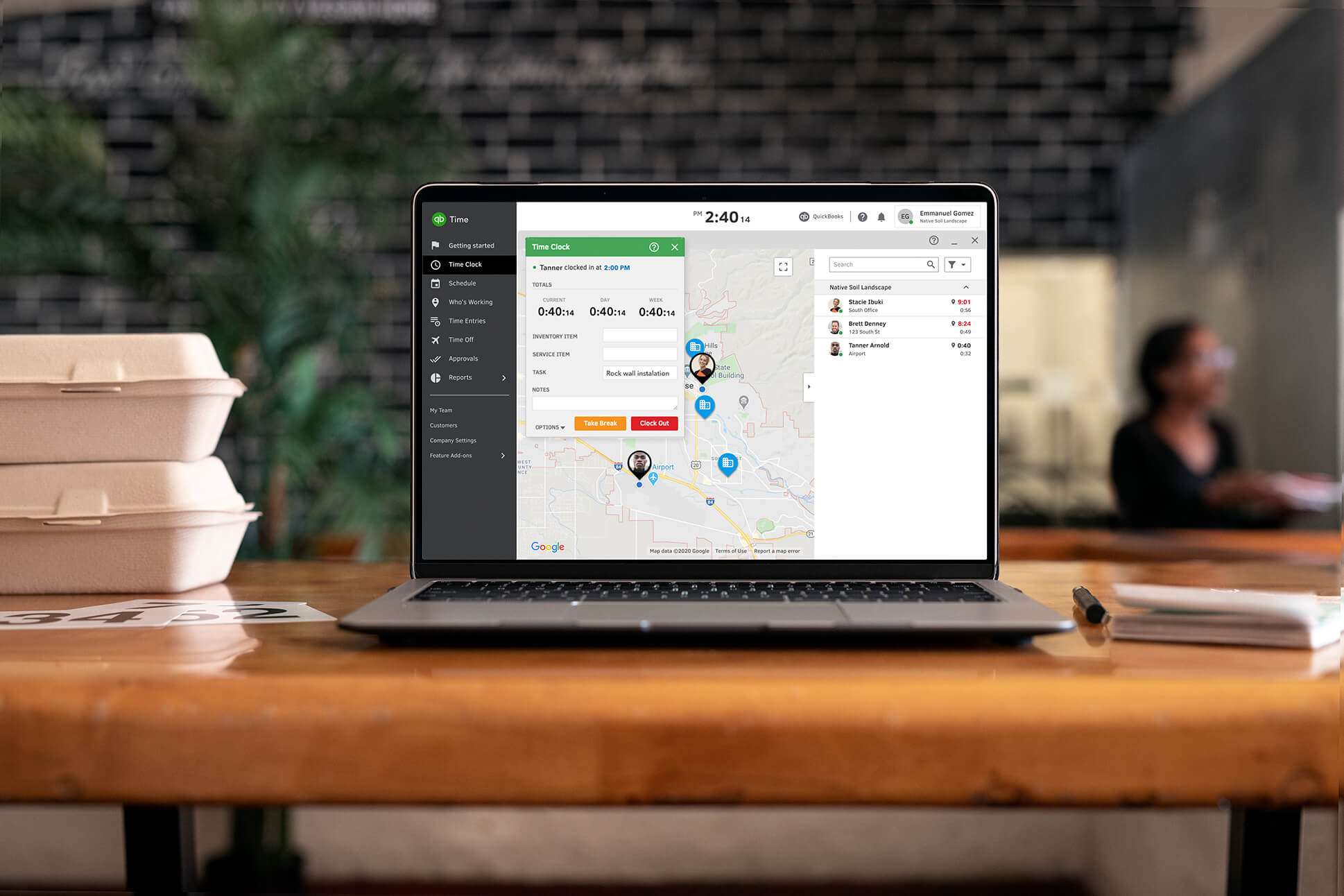

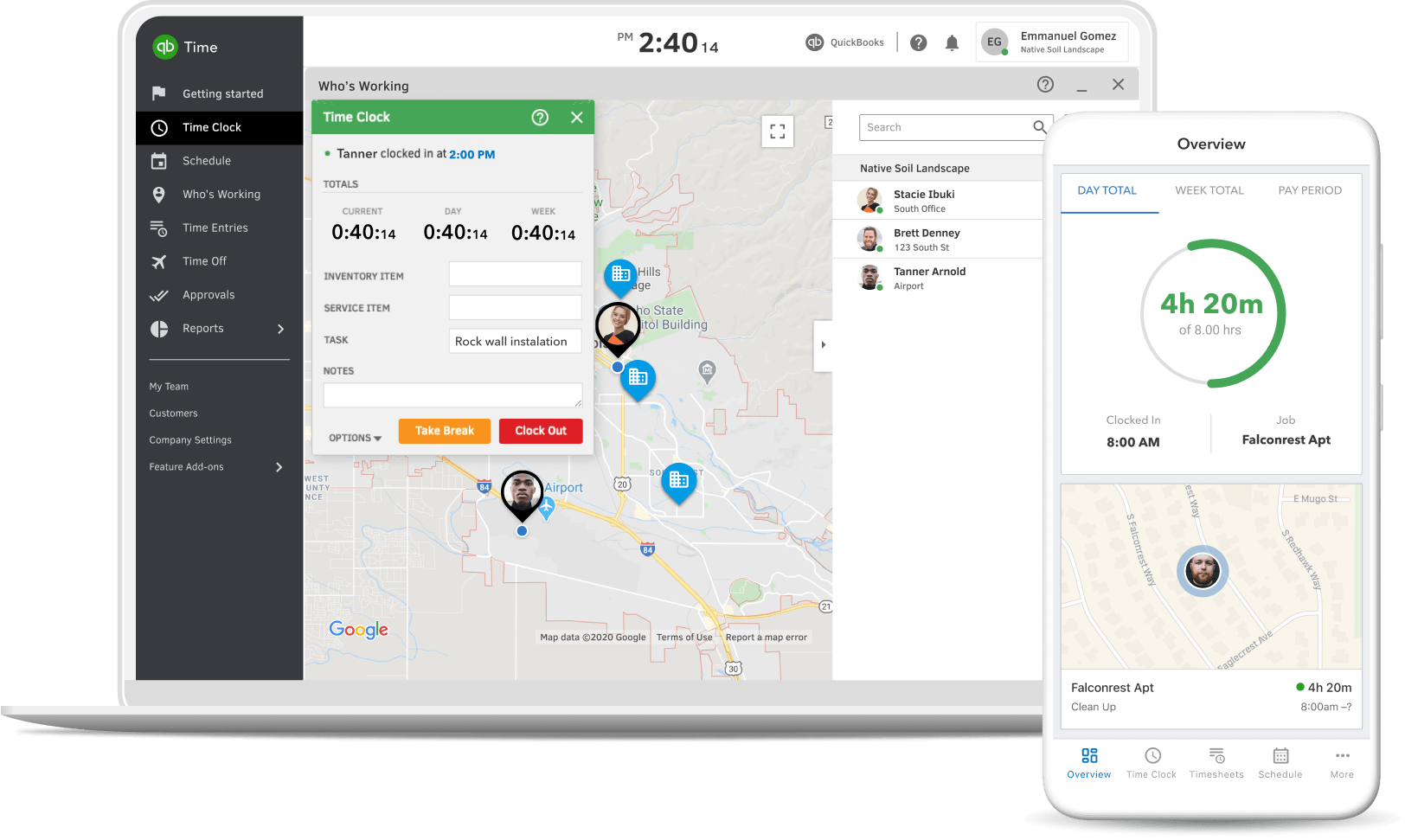

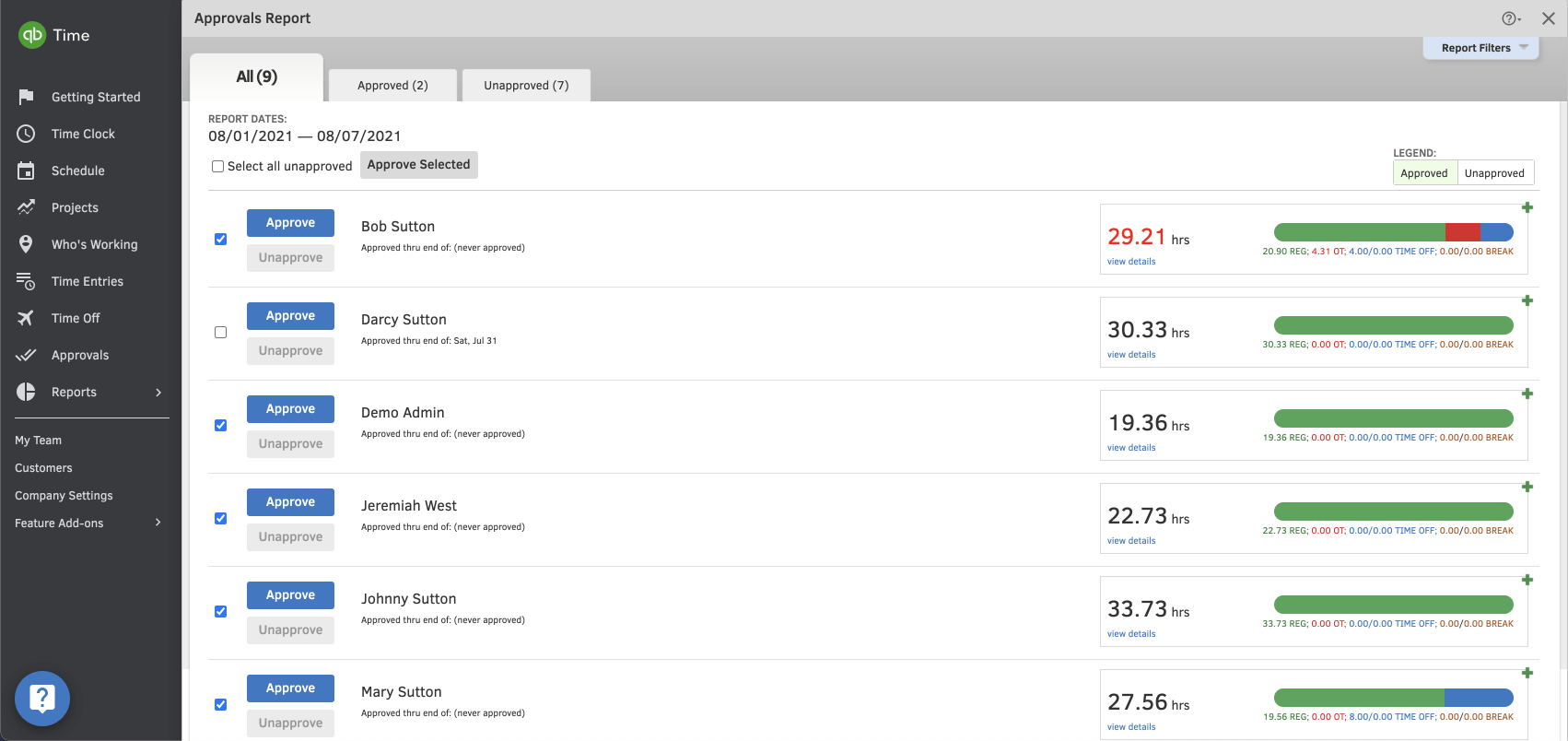

Always know who’s working

No more paper time cards and bloated spreadsheets. Employees clock in and out from any device, and you and your clients can see and approve their hours anytime, anywhere.

- GPS tracking for mobile employees

- Down-to-the-second time stamping

- Alerts for employee breaks and overtime

- Payroll approval reminders

- Flexible scheduling by job or shift

QuickBooks Time customers save 11 hours each month managing employee time, on average.3.

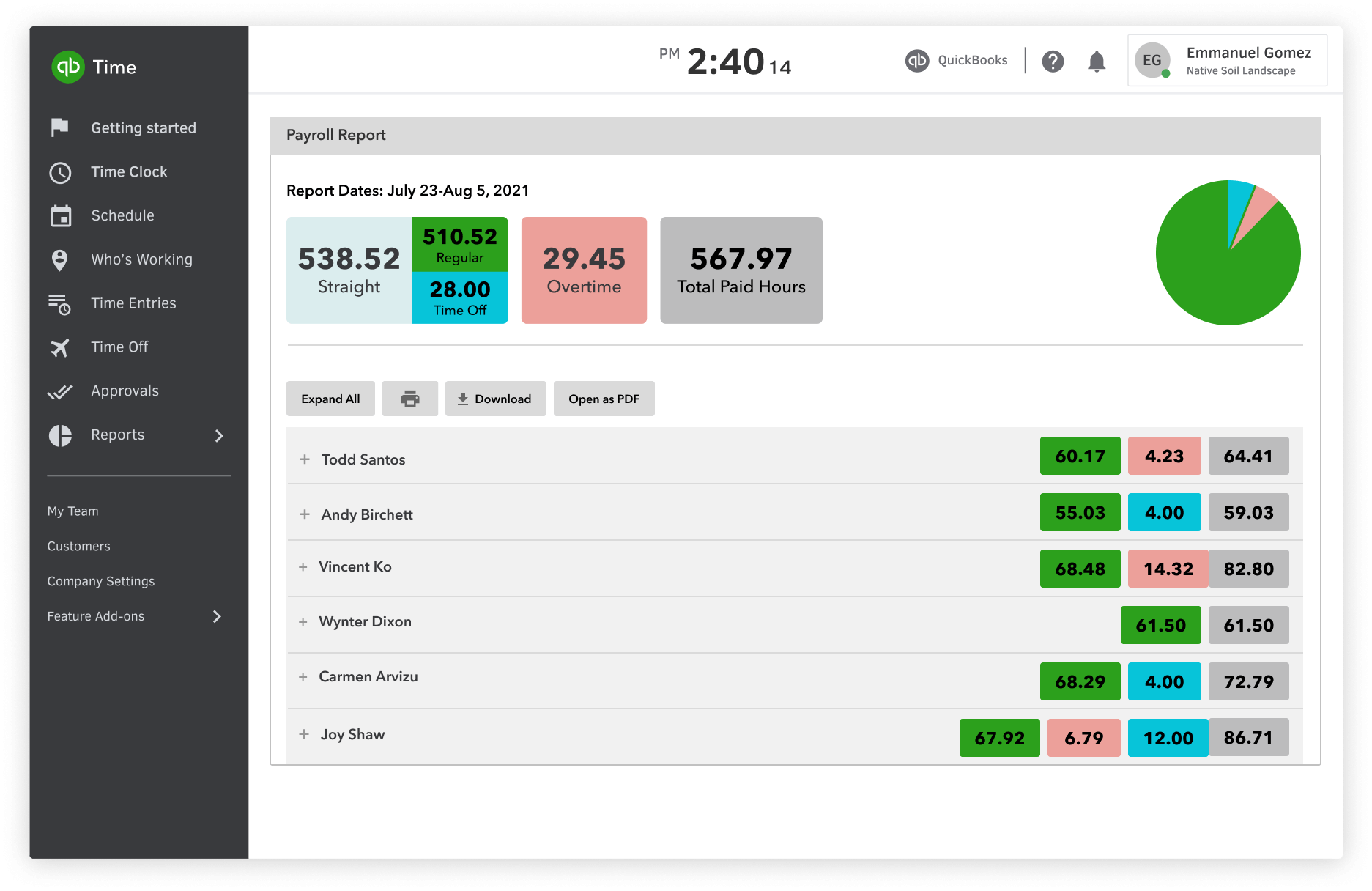

Real-time reports

Sharper details, smarter decisions

Access real-time reports to gain deep insight into project costs, so you can help clients make the most of their time.

- Spot every second employees work to uncover extra billable time clients are owed.

- Compare profit margin across jobs so clients can pick the most worthwhile projects.

- Track live changes in labor costs to prep for payroll.

Companies that use QuickBooks Time create nearly 10% more billable time, on average.4.

Integrations

Accelerate all your work

QuickBooks Time cuts out manual labor by pulling in data for you. Get tasks done in record time, and get the freedom to scale your firm.

- Faster, more accurate payroll, invoices, and more in QuickBooks Online Accountant or Desktop.

- Review, edit, and approve timesheets for your clients within QuickBooks Online.

- Track time right within payroll, whether you use QuickBooks Online or Desktop.

QuickBooks Time can save 2 hours per payroll and reduce payroll costs by 4%, on average.5

The proof is in the prosperity

QuickBooks Time is the perfect time-tracking solution for businesses of any size. Easy to use and lets managers approve time and process payroll with the click of a button.

As a QuickBooks ProAdvisor, I’m always on the lookout for tech stacks that I can recommend to my clients to save them time and money. Of all of the partner programs I have worked with, my favorite is QuickBooks Time.

QuickBooks Time gives my client a competitive edge from increased efficiency and accuracy in their time tracking.

Get QuickBooks Time at a discount for your clients

Choose your ideal billing option with the right ProAdvisor Preferred Pricing discount.

30% off base subscription

+15% off employee and contractor fees

ProAdvisor

We bill you

Discount is ongoing*

Direct

We bill your client

Discount lasts 12 months*

ProAdvisor

We bill you

Discount is ongoing*

Direct

We bill your client

Discount lasts 12 months*

Compare QuickBooks Time plans.

Includes:

Includes:

Contact 888-836-2720 to learn more about how QuickBooks Time can elevate both your firm and business clients.